Tariffs have been the talk of the town over recent weeks, regularly overshadowing other important developments and causing volatility spikes.

Though proposed tariffs on Mexico and Canada have been delayed for 30 days, the 10% tariffs on Chinese goods are still scheduled to take effect this week on February 4th.

The initial tariffs are a preliminary measure, with President Trump and Chinese President Xi Jinping likely to soon have discussions that shape the future path of such moves.

Still, until we know more, investor-favorite Apple AAPL has found itself in the crosshairs given the heavy iPhone manufacturing exposure. Let’s take a closer look at the development and the tech titan’s recent set of quarterly results.

Is Apple in Trouble?

Apple’s iPhone results came in a tad soft in its latest release, an interesting development given the implementation of Apple Intelligence. iPhone sales of $69.2 billion fell roughly 1% year-over-year, also marginally falling short of our consensus estimate.

Image Source: Zacks Investment Research

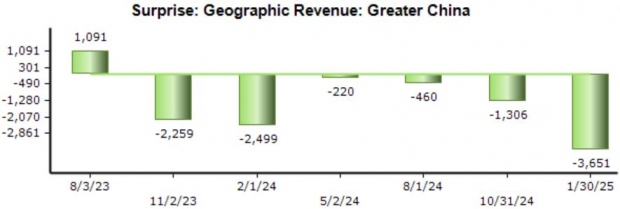

China sales have continued to decelerate amid stiffer competition, with sales of $18.5 billion in the region down notably from the $20.8 billion mark in the year-ago period. While China continues to negatively impact results, the risk and growth cooldown has been well-known here for multiple periods, not really anything ‘new’ for the market to digest.

Image Source: Zacks Investment Research

While the tariffs news is undoubtedly a tad spooky, the company has several ways to mitigate the impact, such as increasing U.S. prices. While a price increase would help absorb the impact, lower demand would certainly remain a concern.

Still, Apple has been diversifying its supply chain nicely in recent years, expanding production to countries like India and Vietnam to reduce dependence on China.

Bottom Line

While tariffs remain a concern for Apple AAPL given its heavy manufacturing exposure, the company remains flexible enough to mitigate the impact. The company could continue shifting its manufacturing to other locations, with a price increase on U.S. products also an option.

For now, the news appears to be a tad spotty, and investors should wait to see how the situation truly unfolds given the recent suspensions on tariffs from Mexico and Canada.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report