GLJ Research LLC CEO and Tesla Inc. TSLA bear Gordon Johnson on Wednesday slammed bulls for their high price targets based on the assumption that the Elon Musk-owned company is “more than a car company.”

What Happened: “2025E appears set to disappoint the Wall Street bulls taking up their price targets on the idea “$TSLA is not a car company” – i.e., despite the fact that ~88% of its revs came from selling cars in 4Q24,” Johnson said in a post on social media platform X.

While automotive revenue accounted for most of Tesla’s fourth-quarter revenue, it was only at 77%, lower than what Johnson claims in his post. The company reported a total revenue of $25.71 billion, of which automotive revenue accounted for $19.8 billion, or roughly 77%. The remaining revenue came from the company’s energy generation, storage, and service segments.

“$TSLA is a company valued for exponential growth that has not grown in its most profitable/important market (i.e., California, or 33% of $TSLA’s 2024 US sales of ~691K) five consecutive quarters,” Johnson said while adding that demand in Europe and Canada are also now in “free fall.”

The bear is referring to the recent report from the California New Car Dealers Association (CNCDA). The CNCDA said that Tesla had 203,221 vehicle registrations in California in 2024, nearly 12% lower than the year before.

Tesla’s new registrations in the state fell 7.8% in the fourth quarter and 11.6% in 2024. For the year, Tesla held a 52.5% share of the zero-emission vehicle market, down from the 60.1% share in 2023.

Johnson, in his post, pegged the decline in registrations mainly to Musk’s “political leanings” towards Republican President Donald Trump. California, on the other hand, is a Democratic stronghold.

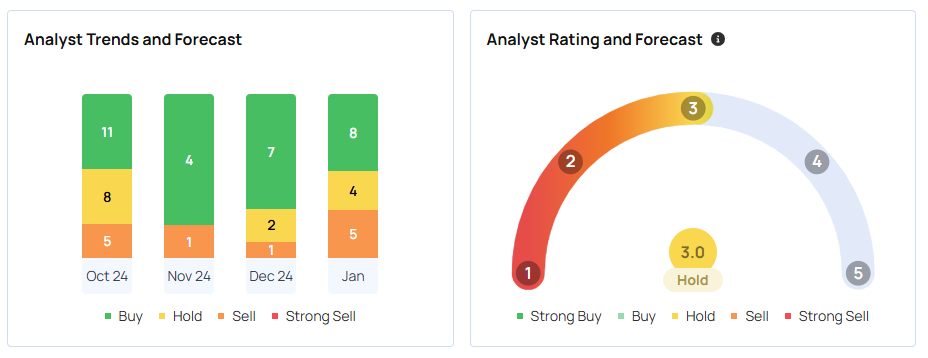

Why It Matters: Wedbush Securities analyst Dan Ives has often reiterated that Tesla is an AI and robotics company and not a car company, reflecting CEO Musk’s vision for Tesla. Wedbush has a price target of $550 on Tesla and an “outperform” rating. In comparison, GLJ research maintains a “sell” rating on the stock with a price target of $24.86. Overall, Tesla has a consensus price target of $320.75 based on the ratings of 32 analysts tracked by Benzinga.

Tesla reported a fall in vehicle deliveries for the first time in over a decade in 2024. The company reported global deliveries of 1.79 million vehicles in 2024, down from full-year deliveries of 1.81 million in 2023. The company’s revenue from its automotive segment subsequently fell 6% in 2024 to $77.07 billion while its revenue from the energy generate and storage segment rose 67% to $10.09 billion, thereby preventing a year-on-year dip in overall revenue.

The EV maker’s shares closed up 2.22% at $392.21 on Tuesday. The stock is up by nearly 117% over the past year, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs