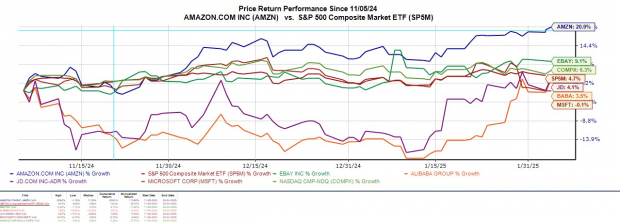

Investor sentiment has remained high for Amazon AMZN stock since the company’s announcement of a record holiday season in terms of both sales and items sold.

Amazon is still the most prosperous e-commerce enterprise with an edge over eBay EBAY and even indirect global competitors Alibaba BABA and JD.com JD. Furthermore, Amazon Web Services (AWS) remains the leading cloud provider ahead of Microsoft MSFT Azure.

Gaining momentum in recent months, let’s see if it’s time to buy Amazon stock for more upside as its Q4 results approach after-market hours on Thursday, February 6.

Image Source: Zacks Investment Research

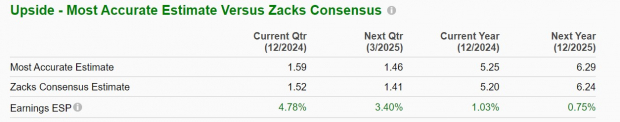

Amazon’s Q4 Expectations

Based on Zacks estimates, Amazon’s Q4 sales are thought to have increased 10% to $187.28 billion compared to $169.96 billion a year ago. Notably, AWS sales are expected to increase 19% to $28.83 billion versus $24.2 billion in the comparative quarter.

On the bottom line, Q4 EPS is projected to soar 50% to $1.52 from $1.01 a share in the prior period. More intriguing, the Zacks ESP (Expected Surprise Prediction) indicates Amazon could surpass earnings expectations with the Most Accurate Estimate having Q4 EPS at $1.59 and nearly 5% above the Zacks Consensus.

Image Source: Zacks Investment Research

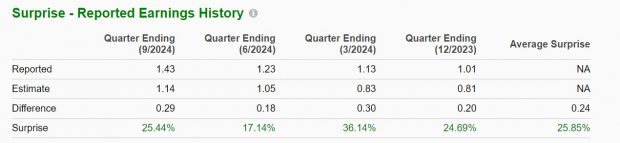

The tech giant has exceeded earnings expectations for eight consecutive quarters with a very impressive average EPS surprise of 25.85% in its last four quarterly reports.

Image Source: Zacks Investment Research

Full-Year Expectations

Amazon is slated to round out fiscal 2024 with total sales expanding 11% to $637.43 billion. Even better, annual earnings are slotted to climb 79% to $5.20 per share from EPS of $2.90 in 2023.

Tracking Amazon’s Valuation

Trading around $240, AMZN is at a 38X forward earnings multiple which isn’t an overly stretched premium to the benchmark S&P 500 and is near Microsoft’s 31.5X.

Also encouraging to long-term investors is that AMZN trades well below its five-year high of 161.3X forward earnings and offers a steep discount to the median of 66X during this period.

Image Source: Zacks Investment Research

Bottom Line

Ahead of its Q4 report, Amazon stock sports a Zacks Rank #2 (Buy). To that point, the Zacks ESP does suggest Amazon could report strong Q4 results on the heels of its record holiday shopping season.

Plus, the rally in AMZN may certainly continue if this is accompanied by favorable guidance with Zacks projections calling for another year of double-digit top and bottom line growth in FY25.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report