GitLab GTLB shares are currently overvalued, as suggested by its Value Score of F.

In terms of the forward 12-month price/sales (P/S), GTLB is trading at 15.69X, higher than its median of 10.72X and the Zacks Computer and Technology sector’s 6.48X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

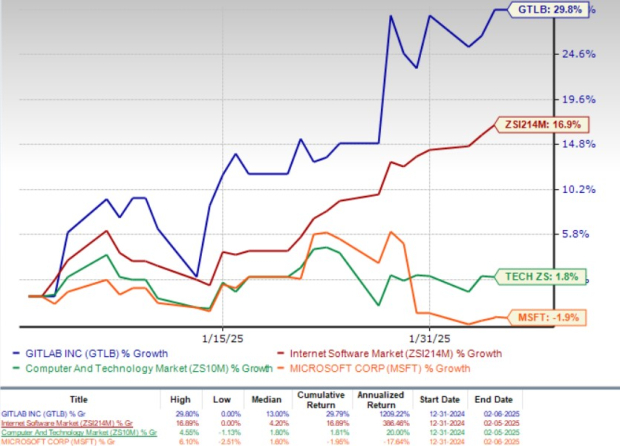

In the year-to-date period, GitLab shares have risen 29.8%, outperforming the broader sector’s appreciation of 1.8% and the Zacks Internet – Software industry’s return of 16.9%.

GTLB shares have been riding on an expanding clientele and solid adoption of its AI-powered DevSecOps platform. GitLab has also outperformed Microsoft MSFT, its competitor in the DevOps industry in the same time frame. Microsoft shares have lost 1.9% year to date.

Year-to-Date Performance

Image Source: Zacks Investment Research

GitLab is also currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

GTLB Trades Above 50-Day & 200-Day SMAs

Image Source: Zacks Investment Research

However, at such a high valuation, the question that arises is whether GTLB stock is a worthy investment. Let us dig deep to find out.

Strong DevSecOps Partnerships Aid GTLB

GitLab is benefiting from a rich partner network, which includes cloud platforms like Alphabet’s GOOGL Google Cloud and Amazon’s AMZN cloud arm, Amazon Web Services (“AWS”), which are helping it expand its footprint among large enterprise customers.

GTLB recently partnered with AWS to launch an AI-powered solution to boost software development and security. The collaboration combines GitLab Duo with Amazon Q’s autonomous agents and aims to streamline workflows, accelerate code delivery and enhance security throughout the development lifecycle.

The integration of GitLab’s DevSecOps platform with Google Cloud services is enhancing developer productivity by streamlining authentication, boosting application deployment and improving the developer experience.

GitLab’s Positive Outlook for Q4 and 2025

For the fourth quarter of fiscal 2025, GitLab expects revenues between $205 million and $206 million, indicating growth of 25-26% year over year. Non-GAAP earnings per share are expected to be between 22 cents and 23 cents.

For fiscal 2025, GitLab expects revenues between $753 million and $754 million, indicating growth of approximately 30% year over year. Non-GAAP earnings per share are expected to be between 63 cents and 64 cents.

GTLB’s Earnings Estimates Remain Steady

The Zacks Consensus Estimate for GTLB’s fourth-quarter fiscal 2025 revenues is pegged at $205.64 million, indicating year-over-year growth of 25.56%.

The consensus mark for fourth-quarter earnings is currently pegged at 23 cents per share, unchanged over the past 60 days, and indicating growth of 53.33% on a year-over-year basis.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $753.46 million, indicating year-over-year growth of 29.93%.

The consensus mark for fiscal 2025 earnings is currently pegged at 63 cents per share, unchanged over the past 60 days, and indicating growth of 215% on a year-over-year basis.

Gitlab beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 89.06%.

GitLab Inc. Price and Consensus

GitLab Inc. price-consensus-chart | GitLab Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

GTLB Faces Headwinds in AI

The rapid evolution of AI toward agentic capabilities is also presenting a challenge for GTLB to stay ahead by continuously integrating autonomous AI features across its platform. Falling behind in AI innovation can erode its competitive edge in an already crowded and intensely competitive AI market.

Adding to these challenges is the sudden rise of DeepSeek Coder, an emerging Chinese competitor to GitLab Duo, rapidly gaining traction with its innovative AI platform. DeepSeek’s momentum highlights the need for GTLB to differentiate itself to hold its market position.

GTLB Stock: Buy, Sell or Hold?

Gitlab’s strong growth, AI-powered DevSecOps platform and solid partnerships position it as a leader in the DevOps space. However, rising competition and near-term profitability pressures pose challenges.

Given the company’s modest growth prospects, we believe that its valuation is significantly stretched, making the stock a risky bet for investors.

Gitlab’s Growth Score of F makes it unattractive for growth-oriented investors.

GTLB currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise for investors to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

GitLab Inc. (GTLB) : Free Stock Analysis Report