We continue to wade through the 2024 Q4 cycle, which has been positive so far. Next week’s reporting docket is notably stacked, with major AI players Vertiv VRT and Super Micro Computer SMCI expected to report.

How do expectations stack up heading into their releases? Let’s take a closer look.

Vertiv

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services.

Earnings and sales expectations for the period to be reported haven’t budged much, with VRT forecasted to see 50% EPS growth on 15% higher sales. The company’s growth trajectory has been underpinned by red-hot demand for its services amid the AI infrastructure buildout.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Super Micro Computer

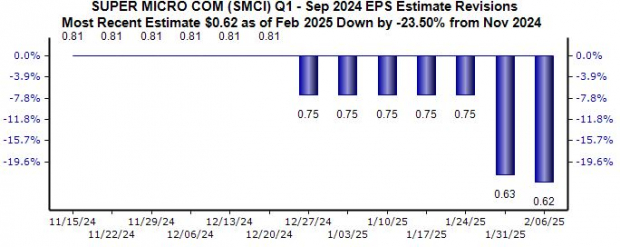

Super Micro Computer is a total IT solution Provider for AI, Cloud, Storage, and 5G/Edge services, fully explaining the buzz around the stock. EPS expectations for the upcoming release have nosedived over recent months, with the current $0.62 per share consensus estimate suggesting 10% growth.

Image Source: Zacks Investment Research

Revenue revisions have been taken lower as well, with forecasted sales of $5.8 billion down 5% over the same timeframe and suggesting 60% year-over-year growth. Like VRT, the company has seen significant top line expansion over recent periods.

Image Source: Zacks Investment Research

Bottom Line

We continue to wade through the 2024 Q4 earnings cycle, which continues to be positive. And next week, two big AI favorites – Super Micro Computer SMCI and Vertiv VRT – are on the reporting docket.

Guidance will be key for both stocks’ reactions post-earnings.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report