President Trump Wastes No Time with Tariff Plan

The difference between the 45th and 47th President of the United States is stark. The 45th President had never governed, knew few people in Washington, and lost the popular vote (but won the electoral college and, thus, the election.) Conversely, the 47th President came into office with four years of government experience, a decade of campaigning, and a deep rolodex of contacts in the nation’s capital. Of course, I am pointing out that although Donald Trump was the President in each instance, the differences are drastic.

Political analysts on each side of the aisle can pontificate about whether Trump is better prepared this time around or whether his tariff tactics are right for the country, but it’s impossible to argue with the speed at which he has executed his plan. In roughly a month, Trump has levied tariffs on US neighbors to the North and South, Colombia, and China (with threats to go after the European Union), for better or fore worse.

Tariff Policy Impact on Stock Market

As market prognosticators, our job is to stay as politically unbiased as possible and remember that politics and successful investing mix like oil and water. Whether you believe Trump’s policy will work in the long-run, in the short-run, tariff news has led to volatility. Though Trump and the US have come to temporary agreements with Mexico, Colombia, and Canada to put a hold on tariffs, a trade war with China appears to be escalating.

Today, China levied retaliatory tariffs on the US from 10% to 15% on liquified natural gas, crude oil, and farm machinery. Last week, the Trump administration hit China with an all-encompassing 10% tax on Chinese imports. Meanwhile, upon hearing the China news today, Trump vowed to strike back in what is shaping up to be a tit-for-tat trade battle among the world’s two largest economies.

Price Action Versus News

Though uncertainty around the trade war is increasing and rhetoric between China and the US is amplified, savvy investors understand the importance of analyzing price action versus news rather than listening to news in a vacuum.

A fantastic metaphor for the current market environment is the correlation between muscle soreness and working out. If you’ve ever missed a month or more of working out and then did an intense leg day, you get extremely sore, to the point where you can’t walk. Conversely, if you have been working out consistently and then hit an intense leg day, you still get a bit sore, but you are largely able to function at full capacity. Think of tariffs as working out and adverse market impact as soreness. Investors would have sold off overnight stock futures to blood red a week or so ago if they had witnessed the newest set of China tariff news. However, with each new headline, the market reacts less, signaling that it has digested the news or at least priced it in.

DeepSeek Fears are Overblown

The other significant market overhang was the news that a Chinese startup was allegedly able to nearly replicate what OpenAI’s wildly popular ChatGPT AI Chatbot could accomplish but at a mere fraction of the cost. However, several Wall Street analysts and Trump administration “Crypto Czar” David Sacks have cast doubts on these claims.

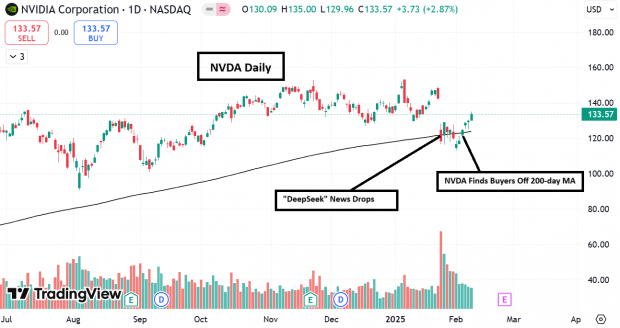

Beyond what the talking heads and analysts say, the price action in the market will always tell the true story because it’s the only indicator that shows supply and demand in real-time. Nvidia (NVDA), the leading AI stock, suffered the worst one-day market cap loss in history on January 27th (the day the DeepSeek news dropped). Nevertheless, suppose you ignore the “clickbait” headlines of the market cap drop. In that case, you will realize that NVDA simply retested its long-term 200-day moving average for the first time in two years, and has since recovered most of the DeepSeek-induced losses.

Image Source: Zacks Investment Research

Oklo (OKLO), a nuclear fission power plant provider for AI data centers, is another example of how DeepSeek fears were overblown. After plunging from $40 to $29 on the day of the DeepSeek news, OKLO has nearly doubled in just ten sessions!

Image Source: TradingView

With Market Near Highs, Sentiment is Nuetral

US stocks are within 2% of all-time highs. That said, you wouldn’t know it if you looked at various sentiment gauges. For instance, the last American Association of Individual Investors (AAII) survey found that bulls are at their lowest level since November 2023, and the bull/bear spread of -15.3% is unusually negative. Can negative sentiment and the tariff Wall of Worry drive stocks higher?

Fresh Industry Group Participation

Mega cap “Magnificent 7” stocks have dominated the US stock market and have been the tide to lift all ships. However, over the past few months, new industry groups have been cropping up, and stocks within those groups are acting well. Innovative industries like robotics and rockets are two to watch. Palladyne AI (PDYN) and Serve Robotics (SERV) jumped 8% and 20% on Monday. Meanwhile, AST SpaceMobile (ASTS) and RocketLab USA (RKLB) staged convincing breakouts on heavy turnover in the space sector.

*****************************************RKLB

Bottom Line

While President Trump’s tariff strategy has sparked volatility and uncertainty, the market’s resilience suggests investors are adapting. Though the ongoing trade battle with China remains a key concern, the price action indicates that markets may have already priced in the risk. Additionally, DeepSeek’s AI advancements appear to be overblown, as major AI and tech stocks have rebounded. With the stock market near all-time highs and fresh industry groups gaining traction, investors should focus on broader market trends rather than short-term headlines.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Serve Robotics Inc. (SERV) : Free Stock Analysis Report

AST SpaceMobile, Inc. (ASTS) : Free Stock Analysis Report

Rocket Lab USA, Inc. (RKLB) : Free Stock Analysis Report

Palladyne AI Corp. (PDYN) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report