Seagate Technology Holdings plc STX is trading comparatively cheap from a valuation standpoint. STX is currently trading at a forward 12-month price-to-sales ratio of 2.05X, a discount compared with the Zacks Computer & Technology sector’s 6.53X and the Zacks Computer – Integrated Systems industry’s 3.27X.

Image Source: Zacks Investment Research

The stock also looks attractively valued relative to other peers like International Business Machines Corporation IBM, Advanced Micro Devices, Inc. AMD and Agilysys, Inc. AGYS, with forward 12-month P/S of 3.63X, 5.54X and 7.14X, respectively.

Seagate stock has gained 14.3% in the past year compared with the industry’s decline of 2.8% and the S&P 500 Composite’s growth of 22.2%. The stock gained 1.4% yesterday and closed the session at $99.21, down 14% from its 52-week low of $115.32.

STX Stock Price Performance

Image Source: Zacks Investment Research

With the stock trading at a discount, we examine STX’s growth drivers and challenges to determine if it presents a strong investment opportunity for investors at this time.

STX’s Growth Drivers to Watch

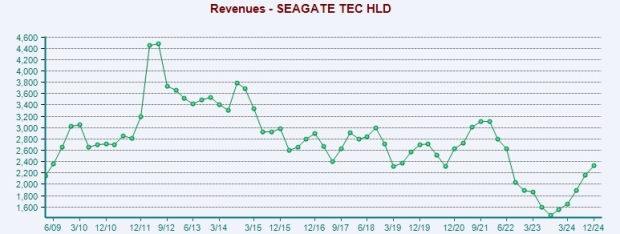

Seagate is witnessing strong mass capacity demand, especially for nearline products. In the last reported quarter, mass capacity revenues surged 79% year over year and 9% sequentially, owing to strong cloud demand. Its mass capacity exabyte shipments now represent more than 93% of HDD exabyte shipments.

Nearline revenues nearly doubled in the fiscal second quarter from the prior year, reflecting 60% growth for 2024. This surge was fueled by robust demand from both cloud service providers (CSPs) and Enterprise/OEM clients. Management noted the increased demand for nearline products aligns with approximately 50% growth in cloud capital expenditures by its customers in 2024. Furthermore, these CapEx investments are expected to keep growing steadily throughout the calendar year 2025.

Also, CSPs are focusing more on the development and deployment of AI applications while building cloud infrastructure. Seagate believes HDDs will play a key role in enabling these stages of the AI adoption curve and expects HDD demand to pick up pace going ahead.

Image Source: Zacks Investment Research

Over the long term, STX’s HAMR (heat-assisted magnetic recording) based Mozaic technology will help meet the growing exabyte demand, and offer customers a compelling total cost of ownership value proposition and boost the company’s profitability.

Seagate expects HAMR to aid in exploiting megatrends like AI and machine learning, which will drive long-term demand for cost-effective mass-capacity storage solutions. The company has significantly increased production of its 24-28 terabyte PMR drives, which now represent its top-selling product line in terms of both revenues and exabyte shipments. It has also achieved a significant milestone by sampling products with capacities as high as 36 terabytes. The company anticipates delivering capacity increases through further areal density gains for its Mozaic 4+ platform. This will lead to lower savings for its customers.

Higher adoption of AI analytics within the VIA markets is another lucrative revenue opportunity for STX amid the increasing development of smart cities and smart factories.

Seagate’s focus on cost efficiency and price adjustment has yielded consistent improvements in its gross margins. In the last reported quarter, non-GAAP gross margin increased to 35.5% from 23.6% in the prior-year quarter. Apart from price adjustment and cost discipline, a favorable product mix shift to mass-capacity products acted as another tailwind.

STX’s Robust Outlook

STX expects third-quarter fiscal 2025 revenues of $2.1 billion (+/- $150 million). Amid supply constraints in the fiscal third quarter, sustained demand for its latest near-line products, including Mozaic, presents an opportunity for sequential growth in gross margin performance.

Non-GAAP earnings are expected to be $1.7 per share (+/- 20 cents).

For the quarter, non-GAAP operating expenses are expected to be $290 million. At the midpoint of the revenue guidance, management expects the non-GAAP operating margin to grow in the low-20s percentage range of revenues.

It continues to expect fiscal 2025 capex to be at or below the low end of its long-term target range of 4-6% of revenues.

Headwinds Persist for STX

Seagate’s guidance for the March quarter reflects a seasonal decline in the VIA and legacy markets alongside supply constraints. Though it expects to meet build-to-order commitments, its capacity to handle in-quarter volume increases will be limited, with an estimated $200 million revenue impact from supply woes included in its guidance.

While Seagate has made strides in reducing its debt, the company still has a relatively high debt on its balance sheet. As of Dec. 31, 2024, cash and cash equivalents were $1.239 billion while long-term debt (including the current portion) was $5.676 billion.

Seagate faces tough competition from other players in the data storage industry, including HDD and SSD manufacturers. It also faces competition from companies engaged in offering storage subsystems, like electronic manufacturing services and contract electronic manufacturing. In addition to stiff competition, the ongoing global macroeconomic troubles and volatile supply-chain dynamics are likely to remain concerns.

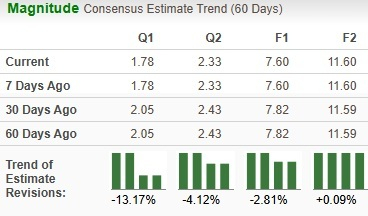

Southbound Estimate Revision Activity for STX

Analysts seem bearish about the stock, as indicated by the downward revision in earnings estimates.

In the past 60 days, analysts have decreased their earnings estimates for the current quarter and the next by 13.2% and 4.2%, respectively, to $1.78 and $2.33 per share. The earnings estimate for the current year has also been revised downward by 2.8% to $7.60 per share.

Image Source: Zacks Investment Research

How Should Investors Play STX Stock?

Seagate’s robust performance, accelerating demand for mass storage, particularly from cloud providers and enterprises, advancements in HAMR technology and appealing build-to-order strategy position it as an attractive investment opportunity. However, several bearish factors, such as supply chain constraints, high debt levels and competitive threats from other players draw our concern. Downward estimate revision activity keeps us on the sidelines.

For now, holding STX stock remains the most prudent strategy, allowing investors to benefit from its industry leadership while navigating external risks.

Currently, STX carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Agilysys, Inc. (AGYS) : Free Stock Analysis Report