Salesforce, Inc. CRM is scheduled to release fourth-quarter fiscal 2025 results on Feb. 26.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

For the fiscal fourth quarter, the company projects total revenues between $9.9 billion and $10.1 billion (midpoint $10 billion). The Zacks Consensus Estimate for revenues is pegged at $10.04 billion, which indicates an increase of 8.1% from the year-ago quarter’s reported figure.

CRM anticipates non-GAAP earnings per share in the band of $2.57-$2.62 for the fourth quarter. The consensus mark for non-GAAP earnings has been revised downward by a penny to $2.60 per share over the past 60 days, which calls for a 13.5% increase from the year-ago quarter.

Image Source: Zacks Investment Research

Salesforce’s earnings beat the Zacks Consensus Estimate thrice in the trailing four quarters while missing on one occasion, the average surprise being 3%.

Salesforce Inc. Price and EPS Surprise

Salesforce Inc. price-eps-surprise | Salesforce Inc. Quote

Earnings Whispers for Salesforce

Our proven model does not conclusively predict an earnings beat for Salesforce this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Though Salesforce carries a Zacks Rank #2, it has an Earnings ESP of -1.63%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors to Note Ahead of Salesforce’s Q4 Results

Salesforce appears well-positioned to report strong fourth-quarter results, driven by its strategic focus on digital transformation and cloud solutions. With businesses globally undergoing digital overhauls, Salesforce’s commitment to aligning its product offerings with customer needs is likely to have boosted its revenues for the quarter.

The growing demand for generative AI-enabled cloud solutions has been a major catalyst for Salesforce. By embedding generative AI tools across its products, Salesforce not only enhances customer engagement but also strengthens its competitive position in the customer relationship management space. This forward-thinking approach may have significantly contributed to its top-line growth during the quarter.

Salesforce’s ability to deepen relationships with leading brands across industries and expand its reach in key geographic markets remains a cornerstone of its growth strategy. The company’s increasing footprint in the public sector is likely to have provided a further boost, unlocking new growth opportunities during the fourth quarter.

The acquisitions of Spiff, Own and Zoomin have been pivotal in enhancing Salesforce’s capabilities and diversifying its revenue base. These additions are likely to have played a role in driving higher subscription revenues, particularly across its core cloud services. Salesforce’s key cloud offerings, including Sales, Service, Platform & Other, Marketing & Commerce and Data, are expected to have delivered robust growth.

Our fourth-quarter revenue estimates for Sales, Service, Platform & Other, Marketing & Commerce and Data cloud services are pegged at $2.15 billion, $2.31 billion, $1.9 billion, $1.36 billion and $1.77 billion, respectively. We expect the company to report revenues from the Subscription and Support segment of approximately $9.5 billion and the Professional Services division of $513 million.

The ongoing cost restructuring initiative is likely to have boosted Salesforce’s profitability in the fourth quarter. The company’s third-quarter non-GAAP operating margin expanded 190 basis points to 33.1%, mainly driven by an improved gross margin and the benefits of cost restructuring initiatives, which include the trimming of the workforce and a reduction in office spaces.

CRM’s Price Performance & Valuation

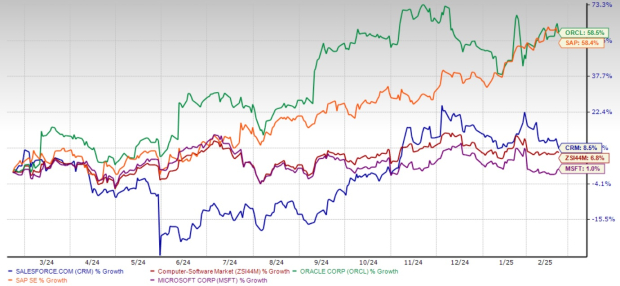

Over the past year, Salesforce shares have risen 8.5%, outperforming the Zacks Computer – Software industry’s growth of 6.8%. Compared with peers, CRM stock has underperformed SAP SE SAP and Oracle ORCL but outperformed Microsoft MSFT. Over the past year, shares of SAP, Oracle and Microsoft have rallied 58.4%, 58.5% and 1%, respectively.

One-Year Price Return Performance

Image Source: Zacks Investment Research

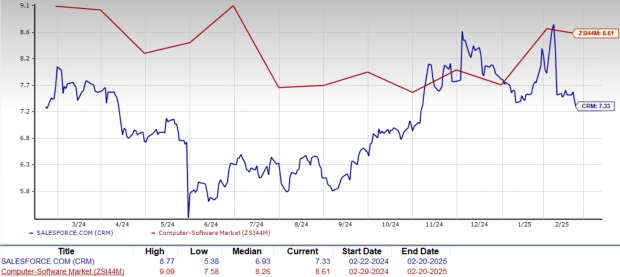

Now, let’s look at the value Salesforce offers investors at the current levels. CRM stock is trading at a discount with a forward 12-month P/S of 7.33X compared with the industry’s 8.61X.

Forward 12-Month P/S Ratio

Image Source: Zacks Investment Research

Investment Thesis for Salesforce Stock

Salesforce is the undisputed leader in the customer relationship management industry, consistently outpacing rivals like Microsoft, Oracle and SAP. Gartner’s annual rankings reaffirm its top position year after year. Its ability to maintain this dominance stems from its expansive product suite, seamless integrations and innovative approach to enterprise solutions.

Strategic acquisitions have played a crucial role in strengthening its market position. The $27.7 billion acquisition of Slack in 2021 transformed its collaboration capabilities, making Salesforce an all-encompassing enterprise software provider. More recently, the $1.9 billion acquisition of Own Company in 2024 bolstered its data protection and AI capabilities, a move that aligns with growing enterprise priorities around security and automation.

Salesforce’s AI initiatives further cement its leadership. Since introducing Einstein GPT in March 2023, the company has expanded its AI-driven functionalities across its entire ecosystem. This technology enhances automation, streamlines workflows and improves customer interactions, giving Salesforce a significant advantage as AI adoption accelerates across industries.

Additionally, Salesforce is positioned to benefit from the continued rise in worldwide IT spending. Gartner projects global IT spending to reach $5.61 trillion in 2025, a 9.8% year-over-year increase. Enterprise software spending is expected to grow even faster, rising 14.2% year over year. As digital transformation remains a top priority for businesses, Salesforce is well-positioned to capture a substantial share of these increasing budgets.

Conclusion: Buy CRM Stock Ahead of Q4 Results

The company’s leadership in customer relationship management, aggressive AI expansion and increasing enterprise IT spending trends create a solid foundation for sustained growth. Its ability to maintain double-digit earnings growth and consistently outperform analyst expectations reinforces its investment appeal.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report