While artificial intelligence represents all the rage these days, the innovation isn’t a singular concept. Rather, AI involves several complex moving parts, with Marvell Technology Inc. MRVL playing a key role. Unlike the primary relevance of Nvidia Corp. NVDA — where the bread and butter focus on providing graphics processors for AI training and inference — Marvell carved out a niche in the infrastructure layer.

In particular, Marvell specializes in application-specific integrated circuits (ASICs), which are custom-designed chips optimized for specific tasks or applications. This laser focus offers greater efficiency and performance compared to general-purpose processors like CPUs or GPUs. Thanks to Marvell’s fundamental relevancy, investors have piled into MRVL stock. Over the past five years, the security gained more than 300%.

Nevertheless, it appears that the market is consolidating recent gains. Over the past half-year period, MRVL stock has gained about 46%. This enthusiasm appears to have waned among market whales, with MRVL encountering bearish activity recently in the options market. Notably, several institutional investors appear to be selling March 14 $105 call options.

Still, on the technical front, it’s possible that MRVL stock is entering a natural consolidation phase following an earlier rally. While not exactly the same, MRVL’s pattern seems to resemble a bullish flag or pennant formation. If so, a breakout move wouldn’t be an unreasonable occurrence.

Keep in mind that Marvell will disclose its fourth-quarter earnings report on March 5. A pleasant surprise here could potentially spark the aforementioned breakout.

Investors Recognize Discounts in MRVL Stock When They See It

Although the immediate circumstances don’t seem particularly favorable for MRVL stock, it’s important to remember that it’s no stranger to the sometimes wild give-and-take in the tech ecosystem. Generally speaking, investors recognize the fundamental relevance of the underlying business. As a result, MRVL enjoys an upward bias.

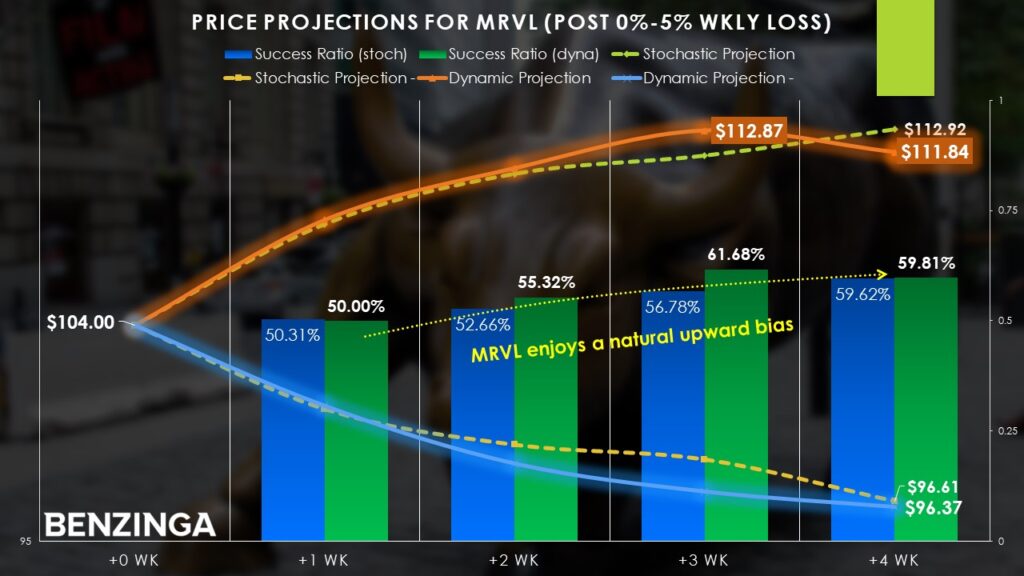

Using data extending back to January 2019 (thus incorporating the full ebb and flow of the COVID-19 impact), a purely stochastic or temporal framework reveals that a position entered at the beginning of the week has a 50.3% chance of rising by the end of it. Granted, that’s only a slight advantage. Still, over a four-week period, this baseline probability rises to 59.6%.

Technically speaking, MRVL stock is on pace to lose around 3% this week. Such a loss is quite normal for negative weeks. When the security loses up to 5% in a one-week period, there is a slight overall uptick in sentiment. By the fourth subsequent week, the long odds improve to 59.8%.

To be sure, that doesn’t sound like much of an advantage over the baseline probabilities. However, a key nuance is that during the third week following modest volatility, MRVL’s long odds tend to rise to almost 62%. Further, it should be noted that extreme volatility — losses between 10% and 20% — push the long odds close to 73% in the fourth subsequent week.

Stated differently, the piqued curiosity probably isn’t a random coincidence. When MRVL stock stumbles, more often than not, investors view it as a buying opportunity.

Compelling Call Spreads for the Intrepid Contrarian

With the negativity surrounding MRVL stock right now, call options appear to be relatively discounted. In other words, bullish strategies offer unusually large rewards because market makers are doubtful that the equity will rise in the near term. Such a framework presents a risky but enticing environment for contrarian speculators.

One idea to consider is a bull call spread for the options chain expiring March 7. This trade assumes a positive outcome following the fourth-quarter earnings report while also advantaging the tendency of a third-week bump following a week of modest volatility. Statistical trends point to an upside target of $112.87. Therefore, it’s not unreasonable to consider a call spread with a short strike price of $112 or even $113.

However, the market is offering a big payout of over 135% for the 108/110 bull spread expiring March 7. This specific transaction involves buying the $108 call and simultaneously selling the $110 call. The idea is to use the proceeds from the short call to partially offset the debit paid for the long call. This capped-risk, capped-reward trade puts $85 at risk for the chance to earn $115.

For a modest bump in the net debit paid, traders can buy the same 108/110 bull spread for the following week’s options chain expiring March 14. Risking $90 in this transaction gives the speculator a chance to earn $110 should MRVL stock reach or exceed the short-strike target of $110.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs