Down 11% this year, Amazon AMZN stock has fallen to under $200 a share again, presenting a more attractive entry point for investors.

Although the broader market has continued a sharp selloff on Monday, it’s certainly a worthy topic of whether now is a good time to invest in the tech conglomerate at a more affordable stock price and valuation.

Image Source: Zacks Investment Research

Market Sentiment & Amazon

Trading 20% beneath its 52-week high of $242 a share, Amazon’s stock hasn’t been immune to recent market volatility but investor sentiment had been high for AMZN before the surge in economic uncertainties.

To that point, Amazon reported record revenue of $637.96 billion last year, with its top line projected to increase over 9% in fiscal 2025 and FY26. Edging toward annual sales of over $700 billion, Amazon’s market dominance as the leading e-commerce and cloud provider (AWS) is even more appealing thanks to the company’s AI initiatives.

Releasing the second generation of its Trainium AI chips in December, the Trainium 2 is designed to enhance the performance and efficiency of machine learning tasks. Furthermore, the Trainium 2 has put Amazon in a position to compete with Nvidia NVDA, AMD AMD and other chip leaders by providing cost-effective and scalable solutions for AI workloads.

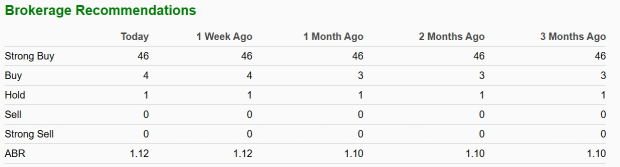

ABR & Price Target

With 51 brokerage firms covering Amazon stock and providing data to Zacks, AMZN currently has an average brokerage recommendation (ABR) of 1.12 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

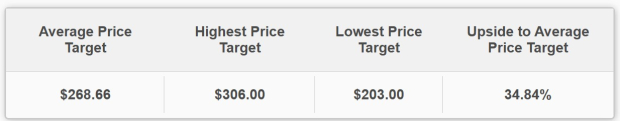

Based on short-term price targets of 50 analysts, AMZN has an Average Zacks Price Target of $268.66, which suggests more than 30% upside from current levels.

Image Source: Zacks Investment Research

Amazon’s More Reasonable Valuation

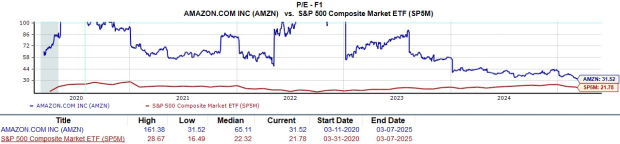

Given Amazon’s appealing growth trajectory, investors are certainly eying the recent dip in AMZN for a better buying opportunity. Optimistically, AMZN is at its cheapest levels in terms of P/E valuation.

Plus, at 31.5X forward earnings, AMZN has moved closer to the benchmark S&P 500’s P/E multiple and trades well below its five-year high of 161.3X while offering a steep discount to its median of 65.1X during this period.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

While there could still be better buying opportunities for Amazon stock amid recent market volatility, AMZN currently lands a Zacks Rank #3 (Hold). Buying or holding AMZN may be perplexing as the tech-centric Nasdaq continues to decline, but long-term investors should certainly be rewarded given Amazon’s attractive outlook and artificial intelligence expansion.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).