Deep-pocketed investors have adopted a bearish approach towards Expedia Group EXPE, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EXPE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 20 extraordinary options activities for Expedia Group. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 15% leaning bullish and 60% bearish. Among these notable options, 11 are puts, totaling $625,679, and 9 are calls, amounting to $432,188.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $200.0 for Expedia Group during the past quarter.

Insights into Volume & Open Interest

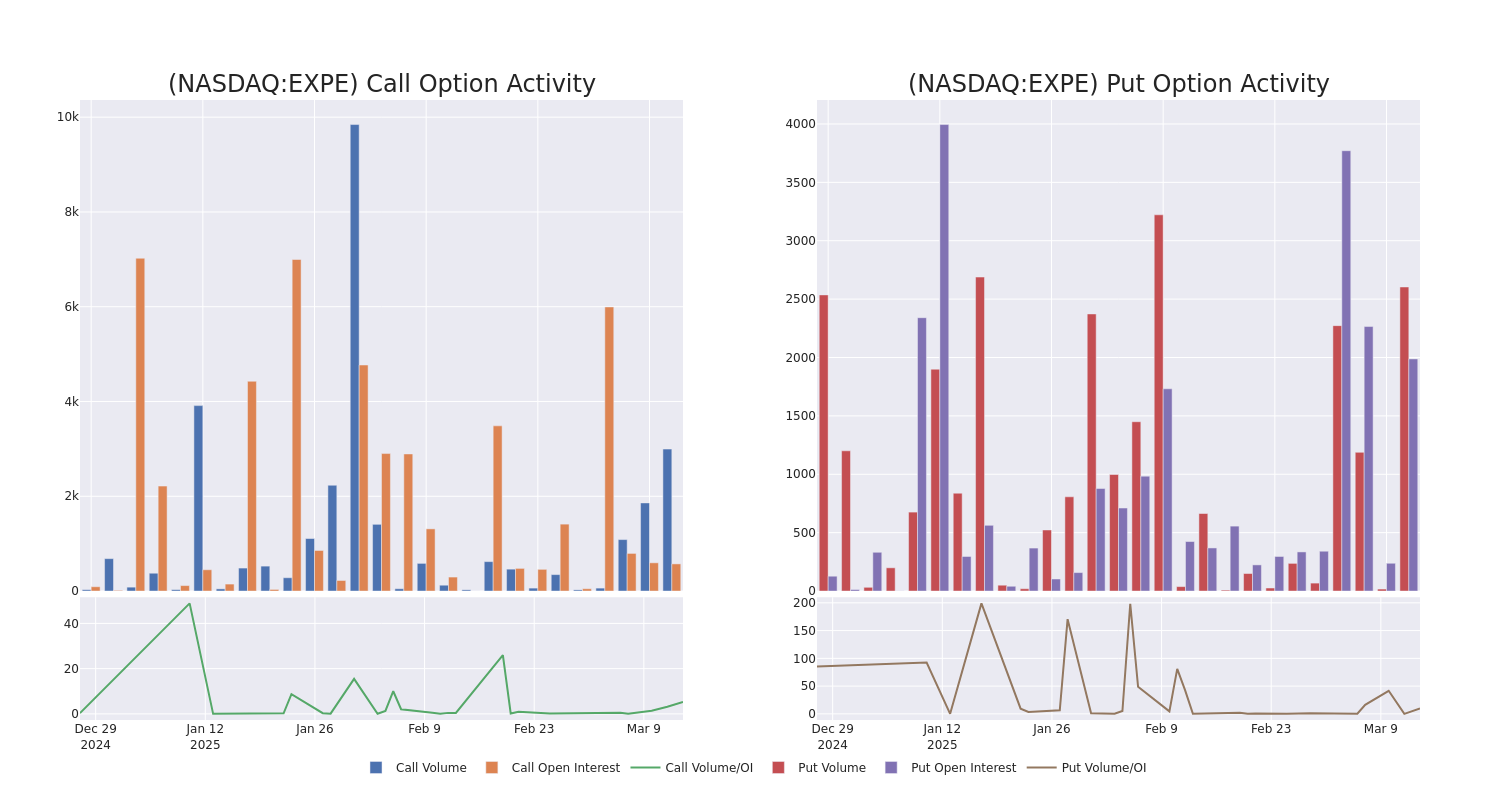

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Expedia Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Expedia Group’s substantial trades, within a strike price spectrum from $75.0 to $200.0 over the preceding 30 days.

Expedia Group Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | CALL | TRADE | BEARISH | 04/04/25 | $7.6 | $7.45 | $7.45 | $160.00 | $122.9K | 1 | 165 |

| EXPE | PUT | TRADE | BEARISH | 03/21/25 | $19.5 | $18.2 | $19.5 | $180.00 | $97.5K | 218 | 51 |

| EXPE | PUT | SWEEP | BEARISH | 06/20/25 | $39.5 | $38.95 | $39.11 | $200.00 | $94.0K | 467 | 160 |

| EXPE | PUT | SWEEP | BEARISH | 03/21/25 | $2.84 | $2.7 | $2.77 | $160.00 | $86.5K | 267 | 597 |

| EXPE | PUT | SWEEP | BEARISH | 03/21/25 | $2.84 | $2.55 | $2.78 | $160.00 | $77.8K | 267 | 876 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2024 sales), air tickets (3%), rental cars, cruises, in-destination, and other (10%), and advertising revenue (7%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Following our analysis of the options activities associated with Expedia Group, we pivot to a closer look at the company’s own performance.

Where Is Expedia Group Standing Right Now?

- With a trading volume of 1,863,997, the price of EXPE is up by 3.18%, reaching $162.11.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 48 days from now.

Professional Analyst Ratings for Expedia Group

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $175.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Expedia Group, targeting a price of $175.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Momentum84.70

Growth35.50

Quality–

Value32.50

Market News and Data brought to you by Benzinga APIs