While President Donald Trump hammers home an economic policy with an array of tariffs, he may face an unintended consequence: a nationwide toilet paper shortage.

If so, the event would spark painful memories of COVID-19. Such an outcome might benefit consumer goods giant Kimberly-Clark Corp KMB.

According to a Bloomberg report, the Trump administration’s plans to increase levies on Canadian softwood lumber to 27% — and possibly to over 50% at some point later — may negatively impact the supply of northern bleached softwood kraft pulp, or NBSK. This is a key component found in toilet paper and paper towels.

Driving the headwind against the delicate supply chain is the financial impact of the aforementioned import taxes, which threatens to put some sawmills out of business. Subsequently, the elimination of vital entities would reduce the supply of wood chips to make pulp. A domino effect may materialize, leading to temporary closures and lower production of NBSK.

Downstream to the consumer, the end result could possibly be pandemic-like shortages of toilet paper and related products, which may eventually metastasize into higher prices. Considering that many households will acutely recall the shortages during the COVID-19 crisis, hoarding behavior wouldn’t be out of the question.

From a cynical perspective, this narrative could benefit Kimberly-Clark’s stock, which is unexciting in any other circumstance.

An Unusual Twist Catapults KMB Stock to Relevance

While the concept of another round of toilet-paper hoarding may sound alarmist, it seems that Wall Street is getting the message. Consider the benchmark exchange-traded fund SPDR S&P 500 ETF Trust SPY, which is down roughly 6% on a year-to-date basis. In contrast, during the same period, Kimberly-Clark stock finds itself up nearly 8%.

Adding to the unusual toilet paper conundrum, replacing the pulp imported from Canada — which clocks in at about 2 million tons — will not be an easy task. For one thing, Canada supplies most of the ingredient that American consumers use. Second, many U.S. paper plants depend on Canadian mills due to processing calibrated for NBSK specifically.

To be sure, cooler diplomatic heads can still prevail. At the same time, the U.S. and Canada have longstanding disputes over lumber, along with dairy. Per a Benzinga report, American lumber producers claim that Canada’s system effectively subsidizes its industry, a charge that the Canadian government denies. Prior to the latest round of tariffs, U.S. duties on Canadian lumber ranged from 11.5% to 17.3%.

Undeniably, 2025 has gotten off to a messy start for multiple sectors. That said, one of the few confidence-inspiring winners is KMB stock. Frankly, the underlying enterprise offers product categories that cannot be avoided nor indefinitely deferred. This reality may attract conservative, buy-and-hold investors.

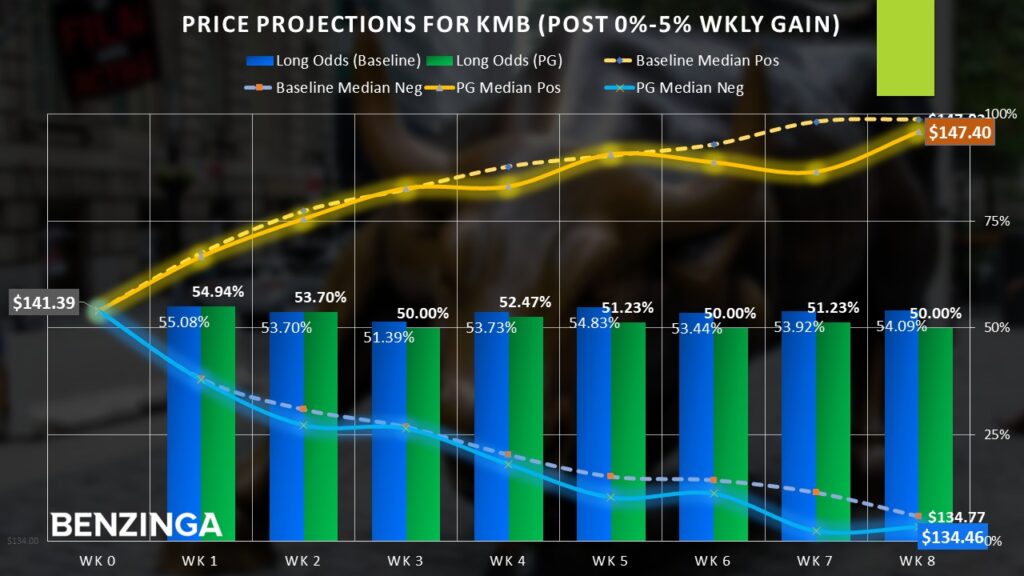

At the same time, the relevancy bump in KMB stock also makes it appealing as a trading prospect. As one might expect, KMB features a gentle upward bias. Based on pricing data from January 2019 onward, a long position held for any given eight-week period has a 54% chance of being profitable. Further, dynamic conditions — such as heightened fear or greed — do not materially change the security’s reliable nature.

Crafting Options Strategies for Kimberly-Clark

Investors who wish to be proactive about the TP conundrum — aside from making a quick grocery run to beat the crowd — can choose to trade Kimberly-Clark options. One idea is to deploy a credit-based options strategy called the bull put spread.

For the options chain expiring April 17, a trader may consider selling the 140/135 bull put spread. This transaction involves selling the $140 put (at a time-of-writing bid of $150) and simultaneously buying the $135 put (at an ask of $60), resulting in a cash inflow of $90.

So long as KMB stock stays above the higher strike price of $140, the trader gets to keep the $90. However, if the security tanks, the maximum loss would come out to $410.

Another approach, which is a debit-based approach, is to consider a bull call spread. For the April 17 expiration date, aggressive traders may consider the 143/145 bull spread. This transaction involves buying the $143 call (at a $180 ask) and simultaneously selling the $145 call (at a $90 bid), resulting in a cash outflow of $90.

Should the Kimberly-Clark share price hit the $145 target at the expiration date — which is reasonable given historical trends — the payout is the difference between the strike prices (multiplied by 100 shares) minus the net debit paid, or $110. That would be a 122.22% payout, which would go a long way in easing the pain from the possible TP shortage.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.