Nvidia Corp NVDA has become the ultimate AI bellwether—but that status is coming under pressure.

After a blistering multi-year run, shares are now down nearly 29% year to date and 8.7% over the past month. Mounting concerns around capital expenditures, valuation, and geopolitical risks create uncertainty for Nvidia stock investors.

“Regarding Nvidia, it is certainly a bellwether within the semiconductor space and AI revolution,” said a Direxion’s Managing Director Ed Egilinsky said in an exclusive interview with Benzinga.

“However, with the Deepseek news last month, and the negative impact it can have on overall capex spending, has led many to be concerned whether its current growth rate is sustainable.”

Read Also: Nvidia, Applied Materials Back Digital Engineering Startup In $115M Round

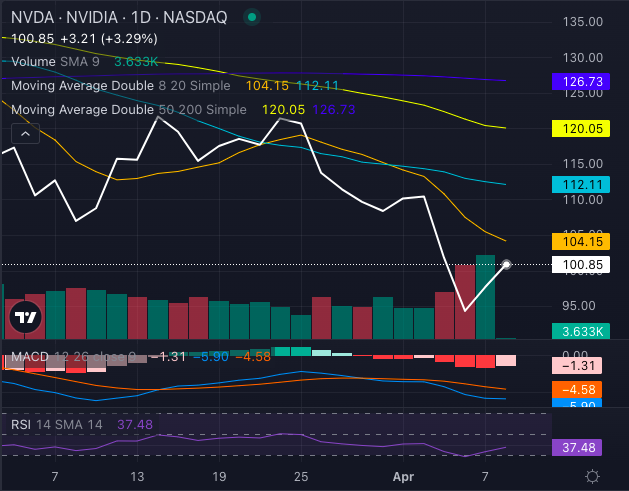

Nvidia Stock Technicals Turns Bearish

Chart created using Benzinga Pro

That sustainability question is colliding with bearish technicals. Nvidia stock is now trading below all key short-term and long-term simple moving averages (SMAs) — an unambiguous ‘Bearish’ signal from a technical standpoint:

- Eight-day SMA: $104.15

- 20-day SMA: $112.11

- 50-day SMA: $120.05

- 200-day SMA: $126.73

- Nvidia stock price: $100.85

The MACD (moving average convergence/divergence) indicator is a negative 5.90 and the RSI (relative strength index) has dropped to 37.48, indicating that bearish momentum is building, though some traders may soon start eyeing a rebound play on oversold conditions.

“In addition, the increasing competitive landscape combined with the overhang of possible further tariff and regulatory restrictions on U.S. chipmakers also could weigh on the stock,” Ed added.

From Market Darling To Valuation Puzzle

While bulls still argue Nvidia’s long-term dominance in AI makes any dip a buying opportunity, traders are split. For those trying to ride either direction of this volatility, Direxion offers tools for both camps.

“For playing either side of the NVDA trade, one can look to either our Direxion Daily NVDA Bull 2X Shares NVDU or the Direxion Daily NVDA Bear 1X Shares NVDD.”

Whether this is a pause before the next leg higher or a sign of deeper correction, Nvidia’s once one-way momentum trade now faces real complications.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs