Advancements in artificial intelligence (AI) have made NVIDIA Corporation NVDA a Wall Street darling for some time. On the other hand, Broadcom Inc.’s AVGO recent share repurchase plan, along with its planned moves to capitalize on the growing AI field, has delighted income-oriented investors.

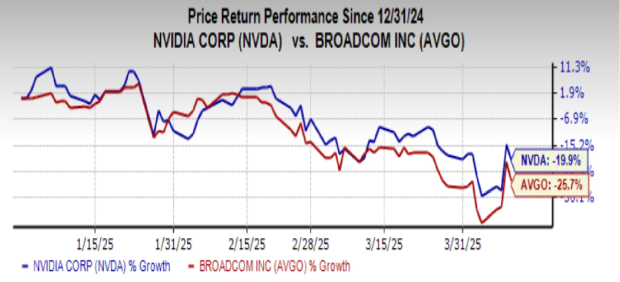

However, the latest trade war between the United States and several other countries has caused market turmoil, with shares of NVIDIA and Broadcom declining 19.9% and 25.7% year to date. This presents an opportunity to buy these quality stocks at a discounted price for long-term gains. But which stock is the better bargain? Let’s explore –

Image Source: Zacks Investment Research

Reasons to be Bullish on NVIDIA Stock

NVIDIA leads the growing graphics processing unit (GPU) market with over 80% share, giving the Jensen Huang-led company a competitive edge over its peers. More than Advanced Micro Devices, Inc.’s AMD ROCm software platform, NVIDIA’s CUDA software platform is in demand among developers.

At the same time, there is an insane demand for NVIDIA’s new Blackwell chips among notable tech firms due to their energy efficiency and faster AI interfaces. The older Hopper chips also maintain steady demand due to their higher quality compared to rival Intel Corporation’s INTC chips (read more: Can Intel Be the Turnaround Stock of 2025? Is the Time to Buy Now?).

NVIDIA, meanwhile, is well-poised to make the most of the increase in AI data center spending. Top cloud computing stocks are fulfilling the increase in demand for AI workloads by acquiring GPUs and are spending $250 billion on AI data center infrastructure. One of NVIDIA’s prominent customers, Microsoft Corporation MSFT, may have reduced data center spending, but Alphabet Inc. GOOGL and Amazon.com, Inc. AMZN are now supporting NVIDIA in this aspect.

Reasons to be Bullish on Broadcom Stock

Broadcom expects the demand for its custom AI accelerator to increase in the near future and the market size for its execution processing units (XPUs) to touch $60-90 billion by fiscal 2027, way higher than last year’s $12.2 billion.

Broadcom’s XPUs can work on a particular workload and even outdo NVIDIA’s GPUs. Moreover, they have the competence to perform tasks more affordably than GPUs. Thus, banking on the rise in demand for accelerator chips, Broadcom is now developing a 2-nanometer AI XPU, which is unique. The company’s application-specific integrated chips (ASICs), known to support AI and machine learning, are witnessing strong demand as well.

NVDA or AVGO: Which Stock is a Better Bargain Buy?

No doubt, with GPUs and XPUs gaining popularity in the coming years, and AI infrastructure spending increasing, the future does look bright for both NVIDIA and Broadcom. However, from a long-term perspective, NVIDIA is a better choice than Broadcom.

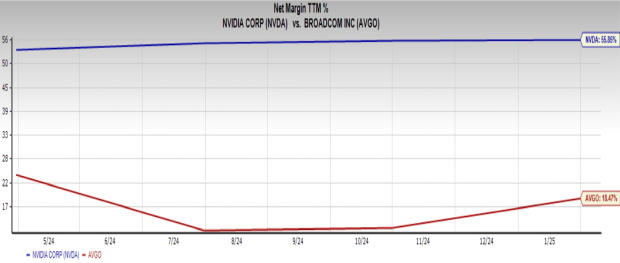

This is because NVIDIA has been able to generate profits more proficiently than Broadcom, with its net profit margin coming in at 55.9%, more than AVGO’s 18.5%.

Image Source: Zacks Investment Research

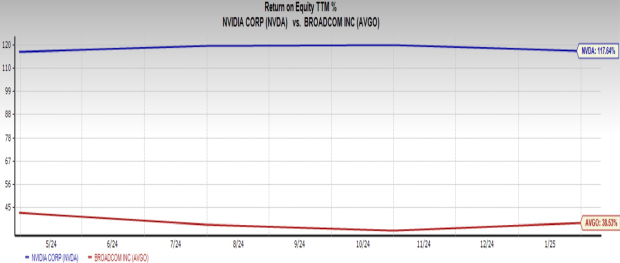

NVIDIA has also been able to control its expenditures and generate profits in a much better way than Broadcom since its return on equity (ROE) of 117.6% outshined AVGO’s 38.5%.

Image Source: Zacks Investment Research

But from a short-term viewpoint, Broadcom has an upper hand over NVIDIA. After all, Broadcom is a solid dividend payer, which is indicative of a better-quality business that can keep the company immune to the current market vagaries.

Broadcom has increased its dividends 6 times over the past five years, and its payout ratio sits at a healthy 52% of earnings. Broadcom also has sufficient cash balance to pay off its dividends. Check Broadcom’s dividend history here.

On the contrary, NVIDIA’s payout ratio sits at a paltry 1% of earnings and the company increased dividends only once in the past five years. Check NVIDIA’s dividend history here.

NVIDIA presently has a Zacks Rank #2 (Buy), whereas Broadcom carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).