Innodata Inc. INOD represents a compelling opportunity in the booming artificial intelligence (AI) ecosystem. With a focus on data engineering for generative AI and large language models (LLMs), the company has emerged as a trusted infrastructure partner to some of the world’s most influential tech giants.

Its solid financial performance, proprietary platform development, and strategic positioning in the AI safety and risk evaluation space give it significant upside potential.

Innodata has delivered a standout performance in the market, with its share price surging 493.5% over the past year, outperforming the 1.9% gain recorded by the Zacks Computer and Technology sector.

One-Year Performance

Image Source: Zacks Investment Research

However, before making any hasty decision to add this stock to your portfolio or sell for profit booking, it would be prudent to understand the factors in detail to better analyze how to play the stock after the price surge.

What’s Driving INOD Stock?

Innodata reported a record-breaking 2024, with revenues up 96% year over year to $170.5 million and fourth-quarter revenues up 127% year over year to $59.2 million. Adjusted EBITDA surged 250% to $34.6 million, and net income flipped from a loss of $0.9 million in 2023 to a profit of $28.7 million in 2024. This growth trend appears sustainable, with management’s FY25 revenue guidance at 40%+, supported by won deals and near-term pipeline visibility.

Innodata’s strategic expansion into AI safety and evaluation seems prudent. In March 2025, Innodata announced the beta launch of its Generative AI Test & Evaluation Platform, developed in partnership with Nvidia NVDA. This platform offers tools for adversarial testing, model benchmarking and vulnerability detection — key concerns for enterprises deploying AI at scale. The platform is a timely response to growing industry and regulatory focus on AI reliability, bias mitigation and model transparency. Early customers, such as MasterClass, are using the platform to ensure their generative AI deployments are secure and dependable.

A key driver of Innodata’s growth potential is its strategic positioning alongside the significant AI infrastructure investments by major technology companies. The company’s client base includes five of the “Magnificent Seven” and three additional Big Tech names, positioning it at the heart of the global AI buildout. Revenues from its seven Big Tech customers (excluding its largest customer) rose 159% sequentially in the fourth quarter, highlighting the success of its “land and expand” strategy. The company has multiple pilots underway that could result in seven or eight-figure revenue opportunities.

It is a trusted partner with leading AI companies like Microsoft Corp. MSFT, Alphabet Inc. GOOGL and Amazon.com Inc. AMZN, among others. This customer base is particularly valuable, given that Amazon, Alphabet, Meta and Microsoft alone are expected to invest a cumulative $325 billion in generative AI infrastructure in 2025. Innodata’s core competencies in LLM data preparation, model fine-tuning and safety evaluations make it a natural beneficiary of these investments.

Through segments like DDS (Digital Data Solutions), Synodex and Agility, the company has a diverse set of revenue streams, addressing verticals from healthcare and legal compliance to public relations and media analytics. With an estimated $200 billion total addressable market (TAM) for generative AI IT services by 2029, Innodata’s platform-driven approach — including its proprietary Goldengate AI stack — provides a long runway for expansion into both enterprise and government markets.

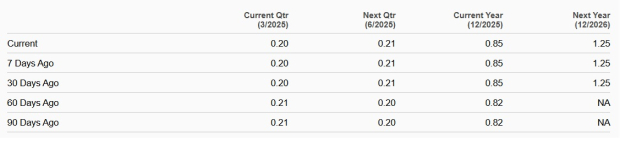

INOD’s Estimate Revisions

With this in the backdrop, the Zacks Consensus Estimate for 2025 is pegged at $246.11 million, indicating year-over-year growth of 44.38%. The consensus mark for 2025 earnings is pegged at 85 cents per share. Earnings estimates have moved north by 3.7% over the past 60 days, indicating analysts’ bullish sentiments about the stock.

Magnitude – Consensus Estimate Trend

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Headwinds to Consider Before Choosing INOD Stock

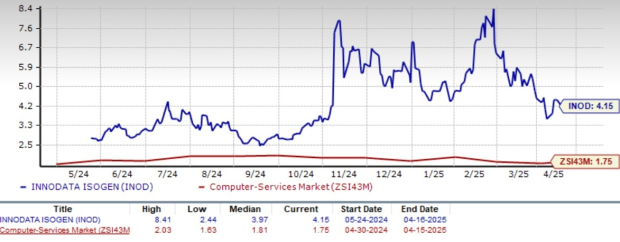

Innodata’s current valuation seems stretched, as evidenced by its one-year forward price-to-sales ratio of 4.15 — well above the Zacks Computer – Services industry average of 1.75. This substantial premium implies that investors may have already factored in a significant portion of the company’s anticipated growth.

P/S F12M Ratio

Image Source: Zacks Investment Research

Despite its diversification efforts, approximately 48% of Innodata’s 2024 revenues came from a single customer. Though the company has expanded other Big Tech relationships, this dependency remains a key operational risk if contract renewals slow or strategic priorities shift.

Parting Thoughts on INOD

Innodata offers a compelling mix of financial momentum, strategic positioning and early leadership in a fast-expanding sector. It is emerging as a foundational player in generative AI infrastructure, trusted by Big Tech and growing among enterprise adopters.

Its generative AI test and evaluation platform, built with NVIDIA Technology, comes at a pivotal time for the AI industry. Moreover, with billions of AI allocation from Amazon, Meta, Microsoft and Google parent, Alphabet, Innodata has solid scope to capitalize upon.

While the current valuation suggests caution for new entrants, existing shareholders should consider holding, and new investors may find a better entry point during market pullbacks or periods of consolidation.

INOD stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Innodata Inc. (INOD) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).