Here’s a quick recap of the crypto landscape for Wednesday (April 16) as of 9:00 a.m. UTC.

Bitcoin and Ethereum price update

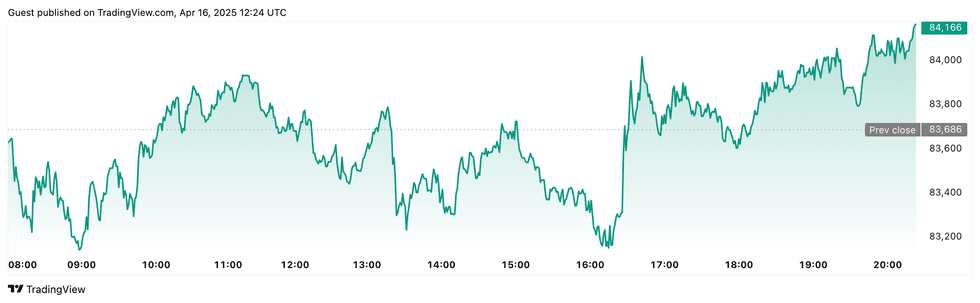

At the time of this writing, Bitcoin (BTC) was priced at US$83,750.32 and is down 1.2 percent in 24 hours. The day’s range has seen a low of US$83,219.21 and a high of US$86,186.23.

Chart via TradingView

Bitcoins slight downturn aligns with a broader sell-off in risk assets, influenced by escalating US-China trade tensions. Despite this dip, Bitcoin’s trading volume surged to US$35 billion, marking a 15 percent increase from the previous day, indicating sustained investor engagement.

Ethereum (ETH) is priced at US$1,575.67, a 3.0 percent decrease over the past 24 hours. The cryptocurrency reached an intraday low of US$1,559.77 and a high of US$1,651.73.

Altcoin price update

- Solana (SOL) is currently valued at US$125.07, down 4.6 percent over the past 24 hours. SOL experienced a low of US$123.93 and a high of US$133.85 on Wednesday.

- XRP is trading at US$2.07, reflecting a 3.1 percent decrease over the past 24 hours. The cryptocurrency recorded an intraday low of US$2.04 and a high of US$2.18.

- Sui (SUI) is priced at US$2.09, showing a decrease of 4.4 percent over the past 24 hours. It achieved a daily low of US$2.06 and a high of US$2.23.

- Cardano (ADA) is trading at US$0.6084, down 4.3 percent over the past 24 hours. Its lowest price on Wednesday was US$0.6013, with a high of US$0.6424.

Crypto news to know

China faces regulatory dilemma over seized crypto assets

China’s growing trove of seized cryptocurrencies—confiscated from fraud, money laundering, and gambling cases—has become a legal and political hot potato as local governments debate how to convert illicit digital wealth into usable state revenue, Reuters reported.

With crypto trading banned and virtual assets not recognized as legal tender, authorities currently rely on loosely regulated private firms to offload seized tokens on offshore exchanges, raising concerns over transparency, corruption, and inconsistent enforcement.

Legal experts, judges, and financial authorities are now calling for new national guidelines, including proposals to centralize asset management, establish crypto disposal agencies, or even hold confiscated Bitcoin as sovereign reserves—a potential pivot that could reshape China’s crypto stance amid broader geopolitical and economic shifts.

OKX ramps up US presence with exchange launch, wallet rollout

OKX, one of the world’s top cryptocurrency exchanges, is making a calculated leap into the US market with a phased rollout of its centralized trading platform and a powerful self-custody Web3 wallet for retail and institutional users.

Spearheading this expansion is newly appointed U.S. CEO Roshan Robert and a fresh San Jose headquarters, signaling the company’s strategic commitment to regulatory compliance and American market penetration.

The exchange offers deep liquidity, low fees, and fast execution, while the new wallet—compatible with over 130 blockchains—lets users manage NFTs, tokens, and dApps across multiple ecosystems.

OKX is also prioritizing transparency, publishing monthly proof-of-reserves reports verified by third-party auditors to reinforce user trust in its custodial holdings.

Semler Scientific doubles down on Bitcoin despite massive unrealized losses

Healthcare technology firm Semler Scientific (NASDAQ:SMLR) revealed a US$41.8 million paper loss on its Bitcoin investment as of Q1 2025, following a sharp decline in BTC’s price—from US$93,500 in January to US$82,350 in March—but has nonetheless pledged to press forward with its crypto acquisition strategy.

The company currently holds 3,182 BTC valued at over US$263 million and remains undeterred, announcing plans to issue up to US$500 million in securities to support further purchases and shore up operating capital.

Semler also disclosed a tentative US$30 million settlement with the Department of Justice related to a civil probe, signaling ongoing legal pressures even as it pushes into risky, non-core asset classes.

The firm’s stock is down 36 percent this year, remaining a polarizing example of Bitcoin’s expanding foothold in non-crypto industries.

Oklahoma pulls out of Bitcoin reserve race after narrow senate vote

Oklahoma’s ambitious plan to become a state-level crypto pioneer came to an abrupt halt after its Strategic Bitcoin Reserve Act (HB1203) failed to pass the Senate Revenue and Taxation Committee by a razor-thin 6–5 vote.

The proposed legislation would have allowed the State Treasurer to allocate up to 10 percent of public fund assets into Bitcoin and other large-cap digital assets, while also exploring staking mechanisms and crypto integration into retirement accounts.

Supporters argued the bill could hedge against inflation and government overreach, but critics raised concerns about volatility, fiduciary responsibility, and the need for deeper regulatory safeguards.

With the bill’s collapse, Oklahoma joins a growing list of states backing away from crypto investment, leaving Arizona, Texas, and New Hampshire as the frontrunners in the race to make Bitcoin a strategic public asset.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.