On Monday, Gary Black, managing partner at The Future Fund LLC, said that he believes Tesla Inc.’s TSLA stock price after its first-quarter earnings report on Tuesday will hinge more on the company’s outlook and key management comments.

What Happened: Black took to X, formerly Twitter, and said, “Tesla’s stock price after tomorrow’s earnings depends far more on what management says about the more affordable vehicle, the timing of the Austin unsupervised autonomous test market, Elon’s future involvement with DOGE, and guidance on FY’25 delivery growth, than actual results,” Black said.

He also provided his predictions for Tesla’s first-quarter and full-year 2025, and compared them to what Wall Street is expecting:

| Metric | Gary Black’s Estimate | Wall Street Estimate |

|---|---|---|

| Q1 Adjusted EPS | $0.37 | $0.44 |

| Q1 Auto Gross Margin (ex-reg credits) | 12.6% | 12.3% |

| Q1 Revenue | $20.0 billion | $21.4 billion |

| 2025 Deliveries | 1.7 million (-5% YoY) | 1.809 million (+1.1% YoY) |

| 2025 Adjusted EPS | $2.60 | $2.64 |

See Also: Ford Recalls Nearly 150,000 Vehicles Over Brake And Powertrain Issues: NHTSA

He points out that the Wall Street consensus may be outdated because analysts usually don’t update their models after a quarter ends until the actual results come in. That makes those numbers possibly too optimistic.

Instead, he says the Tesla Investor Relations (IR) survey of analysts is more realistic.

| Metric | Tesla IR-Compiled Estimate | Wall Street Consensus |

| Q1 Adjusted EPS | $0.38 | $0.44 |

| 2025 Deliveries | 1.731 million (-3% YoY) | 1.809 million (+1.1% YoY) |

| 2025 Adjusted EPS | $2.29 | $2.64 |

Why It’s Important: Last week, it was reported that Tesla has delayed the U.S. launch of a more affordable variant of its Model Y SUV. Internally codenamed “E41,” the vehicle was originally scheduled to debut in the first half of the year.

Musk’s EV giant has also been hinting at the launch of its Cybercab autonomous ride-hailing service in Austin, Texas — but the plan has drawn skepticism from industry experts.

Moreover, Musk is facing mounting criticism from investors over concerns that he’s losing focus on the company, as his attention appears increasingly directed toward his role in President Donald Trump’s Department of Government Efficiency (DOGE).

Since assuming the position following Trump’s inauguration, Musk’s political involvement has sparked nationwide protests at Tesla showrooms and facilities, ranging from peaceful demonstrations to acts of vandalism.

His controversial remarks on foreign affairs have also drawn backlash in Europe, where attacks on Tesla properties and slumping sales have been reported.

Price Action: Tesla’s stock dropped 5.96% on Monday, continuing a broader decline that has seen shares fall by 40.04% year-to-date, according to Benzinga Pro.

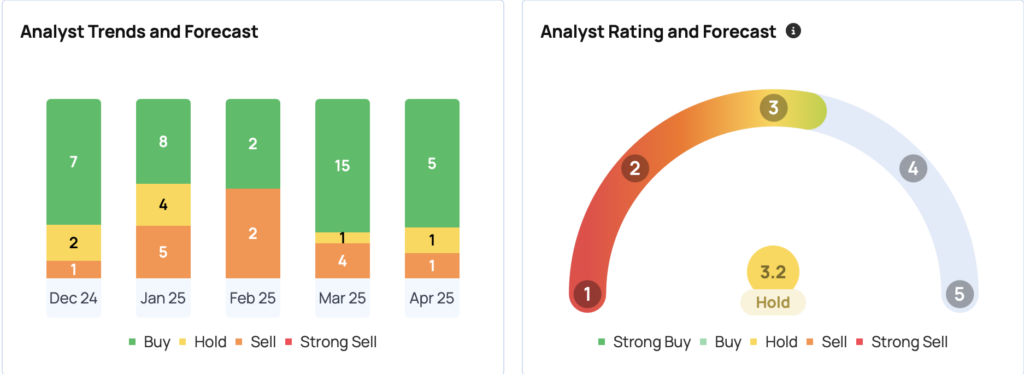

29 analysts tracked by Benzinga have set a consensus price target for Tesla at $298.14. The three latest ratings from Piper Sandler, UBS, and Mizuho suggest a higher average price target of $321.67, indicating a potential upside of 41.17% based on these updated evaluations.

The company currently holds a growth score of 67.59% based on Benzinga Edge Stock Rankings.

Photo Courtesy: Ti Vla On Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs