Trading in shares of ServiceNow, Inc. NOW is quiet on Friday. This comes after Thursday’s rally of more than 15%. The company reported earnings of $4.04 per share, which was ahead of consensus estimates of $3.83.

If the stock keeps moving ahead, there is a good chance it can stall out around the $1,000 level. This is why our team of technical analysts has made it our Stock of the Day.

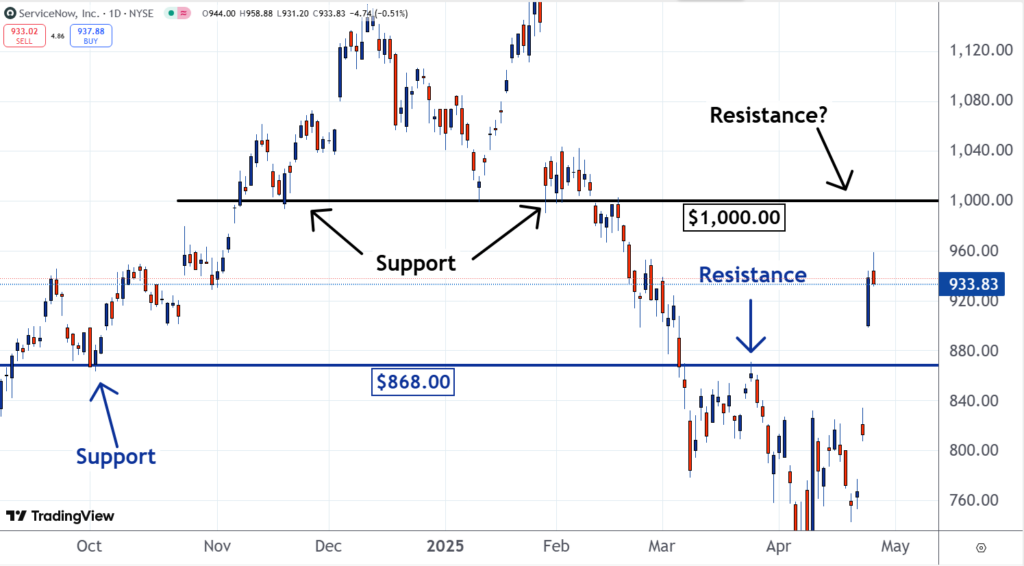

You can see on the chart that this level was support in November, January and February.

Round levels, such as $1,000, are called psychological levels by traders. From a fundamental point of view, meaning considering earnings, there is no valid reason why the $1,000 level is important. But people like to place orders at nice round levels and that gives them importance.

Now that the price of the stock is lower, many of the people who bought shares regret doing so. Some of them have vowed to exit their positions if and when they can eventually do so at breakeven.

Read Also: China Trade War: 4 Big-Brand Stocks That Will Suffer Most

As a result of this, if the stock rallies back up to around $1,000, these remorseful buyers will place sell orders. If there is a significant number of these sell orders, it will form resistance at the price that had been support.

This could put a top on the move higher.

Support turning into resistance is a common occurrence in markets. This dynamic can be seen on the chart with the $868 level. It was support in October, and then it became a resistance level in March.

Sometimes, if a stock is trending higher, a trader may have trouble deciding where to sell it. Savvy traders let the market tell them where to place their orders.

If the price gets close to a level that was support in the past, there is a good chance it finds resistance at it. This would be a logical place to consider selling.

Read Next:

• ‘Stay BIG, Sell Rips’: Hartnett Doubts Bull Market Without 3 Key Catalysts

Photo: JHVEPhoto / Shutterstock

Market News and Data brought to you by Benzinga APIs