China’s tech giants Baidu BIDU and Tencent Holdings Limited TCEHY have both emerged as major players in the artificial intelligence (AI) race. Baidu – often called the “Google of China” – dominates Internet search and online advertising in its home market, while Tencent runs the ubiquitous WeChat super-app and a vast gaming and social media empire. Both companies are investing heavily in AI, from large language models to cloud computing and autonomous driving, making them prime candidates for investors seeking exposure to AI growth.

Importantly, Baidu and Tencent share several similarities that put them at the forefront of China’s AI boom. Each leverages a massive user base (WeChat alone has nearly 1.4 billion users) and rich data resources to train AI systems. Each also enjoys strong government and ecosystem support in China’s push to lead in AI innovation. With generative AI taking off globally, both firms launched their own high-profile AI models – Baidu introduced its ERNIE Bot (a ChatGPT-like chatbot) and Tencent rolled out its Hunyuan foundation model, signaling their intent to stay competitive. In the current AI investing landscape, these two companies are frequently compared as China’s best AI bets.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

The Case for BIDU Stock

Baidu is the leading search engine provider in China, controlling the lion’s share of the online search market (earning it the “Google of China” nickname). This core search and advertising business generates healthy cash flow that Baidu has been channeling into AI initiatives. Beyond search, Baidu has expanded into AI cloud services, autonomous driving (its Apollo unit), and smart devices. In fact, Baidu has been strategically transforming from an Internet-centric to an AI-first business.

Baidu has emerged as a frontrunner in China’s AI race. Its ERNIE Bot quickly gained over 200 million users and handled 1.65 billion daily API calls by late 2024, driven by strong developer and enterprise uptake. The company plans to release an open-source ERNIE 4.5 model with enhanced multimodal reasoning in 2025. Beyond chatbots, Baidu’s Apollo Go robotaxis delivered over 1.1 million rides in the fourth quarter, pushing cumulative rides past 9 million while expanding to new cities, including Hong Kong.

Despite these advances, in cloud computing and AI, Baidu faces competition from Alibaba‘s BABA Alibaba Cloud and Tencent’s cloud services. Alibaba Cloud (Aliyun) is the leading cloud provider in China, offering a wide range of enterprise services. This means that Baidu must continue to innovate rapidly to maintain an edge.

Baidu’s latest financial results paint a mixed picture. Cost controls and efficiency gains boosted profitability even as top-line growth stalled. In 2024, Baidu’s revenues were slightly down, reflecting challenges in its advertising business. On the positive side, Baidu’s AI Cloud segment remained a bright spot, with cloud revenues growing 17% in 2024, and management noted accelerating demand for AI services.

Baidu’s management emphasized that 2024 was a pivotal year that validated Baidu’s AI pivot, and expects AI investments to deliver more significant results in 2025. Baidu also maintains a solid financial foundation with RMB 170.5 billion in net cash (roughly $24 billion) on its balance sheet and healthy free cash flow of RMB 13.1 billion. In 2024, the company repurchased over $1 billion worth of shares (part of a $5 billion buyback program), signaling confidence from management and providing support to the stock. This combination of improving margins, prudent cash management, and ongoing AI-driven growth initiatives bodes well for Baidu’s financial trajectory, provided revenue can re-accelerate as the economy and new AI products gain steam.

The Case for Tencent Stock

Tencent is a more diversified tech conglomerate, with strengths spanning social media, gaming, fintech, cloud, and entertainment. Its crown jewel is WeChat (Weixin), the super-app that serves as the default social network, messaging platform, and digital wallet for China’s populace, boasting nearly 1.4 billion monthly active users as of late 2024. This gives Tencent unparalleled reach and a treasure trove of data. The company also operates China’s largest gaming business (one of the world’s largest video game publishers by revenue) and has a stake in numerous international game studios.

These core franchises (social networks and games) create a steady flow of cash that Tencent has parlayed into new areas like cloud computing and online payments. Tencent’s ecosystem – from QQ and WeChat to its streaming, music, and fintech services – is deeply embedded in daily life in China, creating a wide moat. This stable of mature, cash-generative businesses gives Tencent a robust foundation to invest in frontier tech like AI.

While Tencent was somewhat late to the generative AI spotlight compared to Baidu, it has rapidly ramped up its AI capabilities across the board. In early 2025, Tencent unveiled Hunyuan Turbo S, a next-generation AI model that can deliver chatbot responses within a second – significantly faster than competitors like DeepSeek’s models – without sacrificing quality.

Tencent is embedding AI across its extensive ecosystem, including WeChat, where AI enhances features like Weixin Search and smart mini-program recommendations. The company has reorganized its AI teams to drive product innovation and advanced model research, with increased R&D and capital spending to fuel growth. Through its cloud unit, Tencent Cloud, the company offers AI services focused on speech/image recognition, user behavior analytics, and ad optimization, although it remains smaller than Alibaba Cloud.

Tencent’s financial performance rebounded strongly over the past year. Notably, Tencent saw a return to double-digit revenue growth in the fourth quarter of 2024, fueled by a surge in advertising (thanks in part to AI-driven ad targeting and higher video engagement) and a recovery in its gaming segment. In 2024, Tencent more than doubled its share repurchases to approximately HK$112 billion and proposed a 32% dividend increase for 2025. This is a testament to Tencent’s robust cash flow after funding its investments. Management noted that AI-powered enhancements to its ad technology and products like Video Accounts (WeChat’s short video feed) contributed to the strong results. This shows that AI is already tangibly boosting Tencent’s financial performance.

Share Price Performance & Valuation of BIDU & TCEHY Stocks

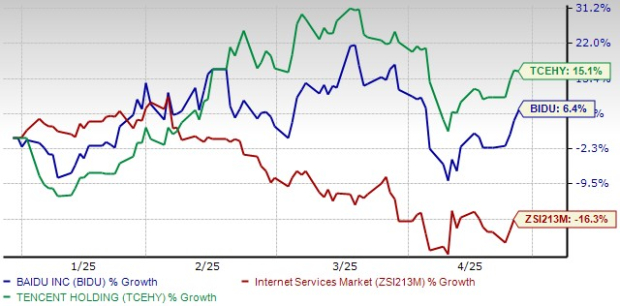

Both Baidu and Tencent stocks have performed better than the Zacks Internet – Services industry so far this year. Yet, Tencent performed comparatively better than Baidu, gaining 15.1% YTD.

Image Source: Zacks Investment Research

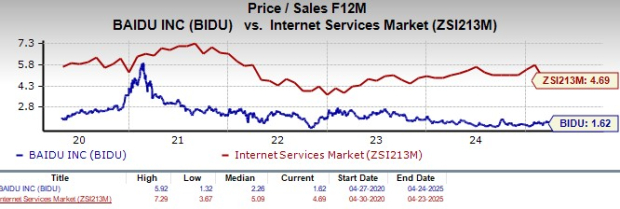

From a valuation standpoint, Baidu is currently trading at a discount relative to its industry and to historical metrics, with its forward 12-month price-to-sales (P/S) ratio sitting below its five-year average. It currently has a Value Score of A.

Image Source: Zacks Investment Research

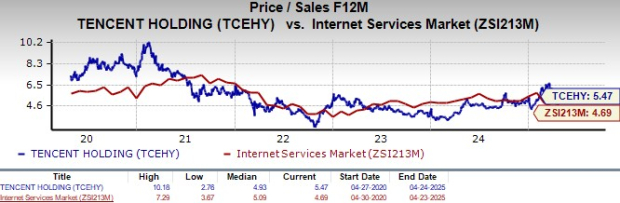

After TCEHY’s decent rally this year, the stock trades at about 5.47X forward 12-month P/S ratio, a premium to the industry average and above its five-year average. This suggests BIDU offers better value on a sales basis.

Image Source: Zacks Investment Research

Earnings Estimates Trend & Growth Rate for BIDU and TCEHY Stocks

Analysts are growing increasingly optimistic about both stocks’ earnings potential. Over the past 60 days, the Zacks Consensus Estimate for Baidu, as well as Tencent’s current year earnings per share (EPS), has increased, as you can see below, reflecting a positive shift in sentiment. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The contrast in growth rates is notable — for the current year, the analysts expect BIDU’s revenues to rise 1.7% to $18.8 billion and EPS to decline 4.3% to $10.08. TCEHY is expected to witness its revenue grow 8.7% to $99.85 billion and EPS to grow 14.4% to $3.74. Tencent’s growth momentum and profitability heading into 2025, looks solid, giving it plenty of financial firepower to continue investing in AI and other growth areas. This justifies its premium valuation.

For Baidu Stock

Image Source: Zacks Investment Research

For Tencent Stock

Image Source: Zacks Investment Research

Conclusion

Both Baidu and Tencent are leaders in the AI space, but Tencent offers a more compelling investment opportunity at this time. Tencent’s diverse revenue streams, robust growth trajectory, and seamless AI integration across its platforms position it for continued value creation in the near-to-medium term. This is reflected in its Zacks Rank #2 (Buy), compared to Baidu’s Zacks Rank #3 (Hold), highlighting Tencent’s more favorable earnings outlook. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).