Traders willing to roll the dice on a high-stakes gamble may have a compelling opportunity on their hands with casino and resorts giant Caesars Entertainment Inc CZR.

With its first quarter of 2025 earnings report scheduled for release on Tuesday after the closing bell, momentum is heating up for the stock. Nevertheless, market makers don’t appear to anticipate that much of a pop, opening the door for extreme contrarianism.

Presently, the implied volatility (IV) of Caesars options for the options chain expiring May 2 comes in at 60.7%, conspicuously lower than realized volatility (RZ) of 83.1%. In practical terms, IV reflects option premiums that imply what the future move might be, a forward-looking indicator. RV, on the other hand, demonstrates what happened in the past.

It’s not unusual for IV to spike above RV for many optionable securities due to two main catalysts: the rise of uncertainty and option sellers demanding higher premiums to cover the risk of unexpected outcomes. With IV being lower than RV in the case of Caesars near-expiry options, the market seems to anticipate a less wild movement than has been observed in the past.

Frankly, it’s not an unreasonable thesis. True, billion-dollar betting events such as the NCAA March Madness tournament likely padded the pockets of gaming-focused enterprises. Still, the issue is that such stats will represent old news come the quarterly disclosure. Plus, with geopolitical tensions impacting the gaming sector in Macau, many investors fear some blowback affecting Las Vegas.

This is where the contrarians have an opportunity.

Momentum Builds For Caesars Stock Ahead of Key Earnings Report

One of the common mistakes in investing market analysis is the projection of price from price. For example, in technical analysis, practitioners attempt to apply fixed structures (such as a head-and-shoulders pattern) to continuous fluid signals with no defined edges. Similarly, in fundamental analysis, practitioners attempt to apply fixed relationships (such as price-to-earnings ratios) to a range of boundless possibilities.

In either case, the perpetual continuity signal represents the logical dilemma of assigning meaning to valuation. To get around this problem, investors can compress all the chaos of price discovery into defined, discrete events. In this manner, an investor can quantify and categorize stages of fear and greed — and the theory is that these stages ebb and flow.

By studying the behavioral state transitions, one can better understand where potential pivots from bearish to bullish might occur.

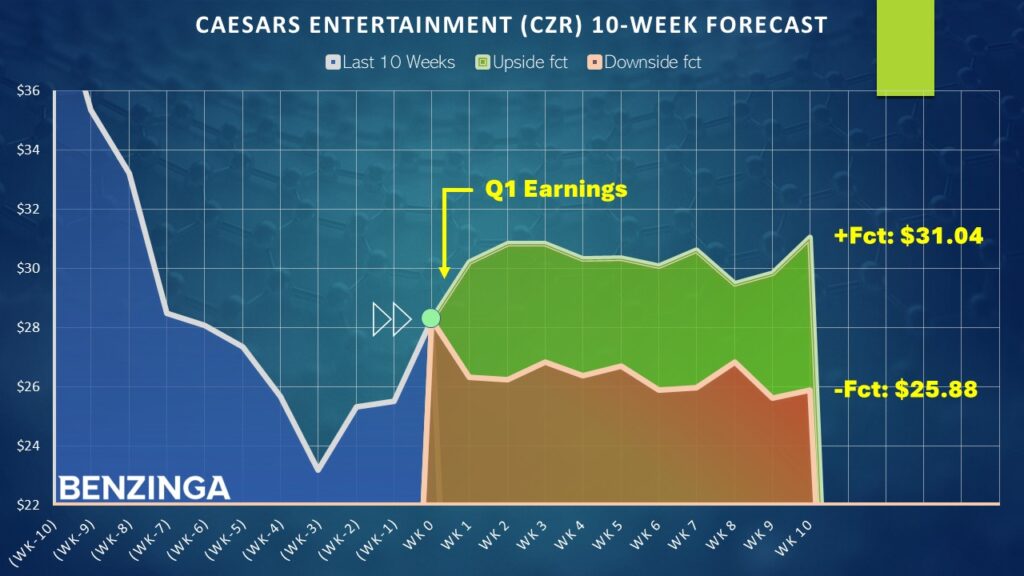

Interestingly, at the beginning of this week, Caesars stock had just completed a “2-8” sequence: two weeks of upside interspersed with eight weeks of downside (with an overall negative trajectory across the 10 weeks).

Over the trailing decade, this sequence has appeared nine times, with an upside reversal happening six times (or roughly 67%).

While a sample size of nine may be laughably small in any other circumstance, the market is a different beast: the data often motivates the observer to react. That’s why technical analysis, though it may lack empirical, repeatable rigor (again, due to the continuity problem), is not completely useless. It just has to be used in a complementary rather than exclusive manner.

More importantly, the strong price action and momentum shift that occurred earlier this week — with Caesars stock up over 12% in the trailing five sessions — appears to have fundamental justification. According to BofA Securities analyst Shaun C. Kelley, management doesn’t appear to be seeing softness in Las Vegas visitation and bookings statistics.

As such, it’s not irrational to assume that Caesars’ stock will benefit from a strong showing.

A Daring Wager Up Ahead

Based on the interplay between IV and RV, market makers are essentially pricing for Caesars stock to pop nearly 7%, which at time of writing would equate to a range between $26.32 and $30.24. For a high-conviction wager, one could opt for the 29/30 bull call spread expiring this Friday.

The above transaction involves buying the $29 call and simultaneously selling the $30 call. It uses the proceeds from the short call to partially offset the debit paid for the long call. Overall, the net cash outlay at time of writing is $46. Should Caesars stock rise through the short strike price of $30 at expiration, the maximum reward is $54, or a payout of over 117%.

To truly swing for the fences, one can go up a step on both legs of the bull spread with the 30/31. This trade only requires a net debit of $30 right now. But if Caesars shoots up and stays elevated through expiration, the maximum reward stands at $70, a massive payout of over 233%.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.