Here’s a quick recap of the crypto landscape for Friday (April 25) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ethereum price update

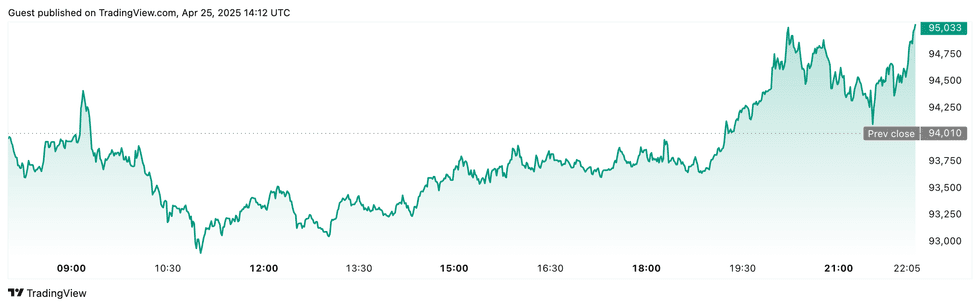

Bitcoin (BTC) was priced at US$93,715.73 as markets closed for the day, up 2.1 percent in 24 hours. The day’s range has seen a low of US$92,817.39 and a high of US$94,816.90.

Chart via TradingView

Bitcoin performance, April 25, 2025.

Fueled by the re-entry of institutional investment, the crypto markets appear to be headed towards a robust recovery; however, the long-term trajectory remains to be seen.

Ethereum (ETH) ended the day at US$1,776.23, a 1.1 percent increase over the past 24 hours. The cryptocurrency reached an intraday low of US$1,745.65 and a high of US$1,793.86.

Altcoin price update

- Solana (SOL) ended the day valued at US$154.64, up 2.9 percent over 24 hours. SOL experienced a low of US$149.38 and peaked at $155.46.

- XRP traded at US$2.20, reflecting a 1 percent increase over 24 hours. The cryptocurrency recorded an intraday low of US$2.17 and reached its highest point at US$2.21.

- Sui (SUI) was priced at US$3.70, showing an increase of 20 percent over the past 24 hours. It achieved a daily low of US$3.13 and a high of US$3.76.

- Cardano (ADA) was trading at US$0.7219, up 2.5 percent over the past 24 hours. Its lowest price on Friday was US$0.6995, with a high of US$0.736.

Today’s crypto news to know

Swiss Central Bank rejects Bitcoin in reserves despite referendum push

Swiss National Bank Chairman Martin Schlegel flatly rejected proposals to include bitcoin in the country’s currency reserves, stating it “cannot currently fulfil the requirements” needed for official holdings.

At the SNB’s annual meeting in Bern, Schlegel cited bitcoin’s extreme volatility and insufficient liquidity as major concerns, making it unsuitable for maintaining the stability and convertibility of the national reserve portfolio.

This comes as activists behind the “Bitcoin Initiative” mount a constitutional referendum campaign that would legally compel the SNB to hold BTC alongside gold. Luzius Meisser, one of the movement’s leaders, argued bitcoin could prove invaluable in a future marked by declining trust in government debt.

The SNB’s resistance, however, signals continued institutional reluctance to enshrine bitcoin as a strategic monetary asset, even in one of the world’s most financially progressive nations.

Trump meme coin rallies after president offers private dinner to top holders

Donald Trump’s $TRUMP meme coin surged over 70 percent after the president promised an exclusive gala dinner for the token’s top 220 holders, including a VIP reception at his Washington DC golf club for the top 25.

Launched just before Trump’s January inauguration, the coin has exploded in both market cap—now estimated around US$2.5 billion—and political intrigue, reflecting the former president’s aggressive expansion into crypto.

This latest move aims to blend campaign optics with digital asset hype, positioning Trump not just as a “crypto president,” but as an active participant in speculative retail culture.

Critics have slammed the dinner-for-holders gimmick as a political stunt and potential conflict of interest, while others say it signals a new model of decentralized donor engagement.

Regardless, the announcement caused a major pump and reignited interest across meme coin forums and pro-Trump financial channels.

Saylor predicts BlackRock’s Bitcoin ETF will eclipse all global ETFs within a decade

MicroStrategy Chairman Michael Saylor declared that BlackRock’s iShares Bitcoin Trust (IBIT) will become the largest ETF in the world within ten years, following a record-breaking week where U.S. bitcoin ETFs drew US$2.8 billion in net inflows.

IBIT led the pack with US$1.3 billion, lifting its total assets to roughly US$54 billion and driving daily trading volumes above US$1.5 billion. For context, the current largest ETF, Vanguard’s VOO, commands a market cap over US$593 billion—nearly ten times IBIT’s current size.

Bloomberg ETF analyst Eric Balchunas acknowledged Saylor’s claim wasn’t far-fetched, but said IBIT would need to consistently attract US$3–US$4 billion per day to overtake VOO within a decade.

The bold prediction reflects mounting institutional appetite for BTC exposure, but also underlines the extraordinary capital movement that would be required for such a paradigm shift in ETF rankings.

ARK Invest now sees Bitcoin hitting US$2.4 million by 2030

Cathie Wood’s ARK Invest has revised its already-optimistic bitcoin forecast, now projecting the asset could reach as high as US$2.4 million by 2030 in its most bullish scenario.

The firm’s April 24 report outlines three trajectories: a bear case of US$300,000, a base case of US$710,000, and a sky-high scenario that factors in growing institutional allocations and rapid expansion of on-chain financial services.

The US$2.4 million target assumes bitcoin captures 6.5 percent of the US$200 trillion global investable asset pool, with sustained 60 percent annual growth in BTC-driven financial infrastructure. National reserves, corporate treasuries, and rising adoption in emerging markets also play critical roles in the model, but ARK identifies institutional capital as the most transformative force.

While skeptics still cite volatility and regulatory uncertainty, ARK argues that BTC’s asymmetric upside—especially amid global monetary shifts—makes it a once-in-a-generation investment thesis.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.