Earnings season continues to move rapidly, with a notably rich reporting docket this week. A few big-tech names and representatives from many sectors have delivered their quarterly prints, with next week just as exciting.

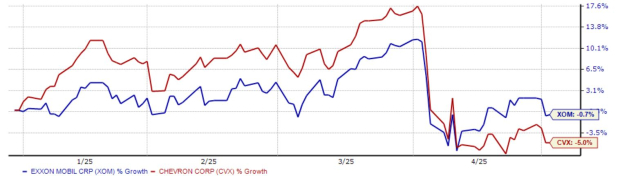

Among the bunch this week are two energy titans, Exxon Mobil XOM and Chevron CVX. There has been a slight performance disparity between the two in 2025, with XOM shares outperforming.

Image Source: Zacks Investment Research

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Energy companies are expected to face a harsh reporting period in general, with earnings for the broader Zacks Oil & Energy sector expected to be down -22.7% from the same period last year on -0.4% lower revenues.

Let’s take a closer look at revisions for XOM and CVX.

Exxon Mobil

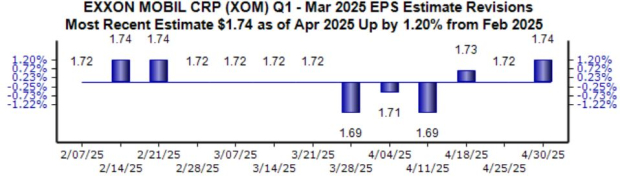

Earnings revisions for the upcoming release have been back-and-forth but overall reflect stability, with the $1.74 Zacks Consensus EPS estimate up 1.2% since just the beginning of February. The value implies a 15% pullback from the same period last year, reflecting a notable profitability crunch.

Image Source: Zacks Investment Research

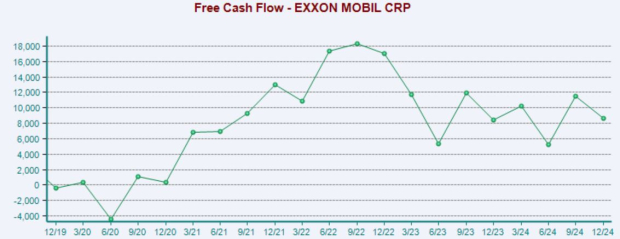

Investors will also be zeroed in on the company’s cash flows, which have allowed it to sport a shareholder-friendly nature for years. Below is a chart illustrating the company’s free cash flow on a quarterly basis.

Image Source: Zacks Investment Research

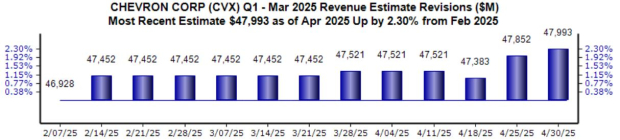

Chevron

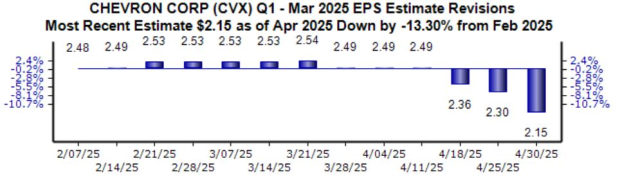

Earnings expectations for CVX’s release have fallen much more, with the current $2.15 Zacks Consensus EPS estimate down 13% over the same timeframe and suggesting a 27% decline year-over-year.

Image Source: Zacks Investment Research

The company’s sales expectations have actually drifted higher, with the current $47.9 billion expected up more than 2% over the same time period while suggesting a 1.5% pullback year-over-year.

Image Source: Zacks Investment Research

Putting Everything Together

Two energy heavyweights – Exxon Mobil XOM and Chevron CVX – are on the reporting docket this week, continuing a hectic week of earnings overall.

The setup for XOM appears to be much more attractive heading into the release given its favorable EPS revisions trend relative to CVX.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).