Tom Yeung here with your Sunday Digest.

Ever wonder why the stock market seems to hibernate during summer?

The most likely explanation comes from 18th-century England. At the time, wealthy British investors often sold their stocks before moving to their country homes for the summer. The seasonal fire sales supposedly caused markets to slump.

Fast forward to today, and much like afternoon tea and handlebar mustaches, this centuries-old habit seems to live on.

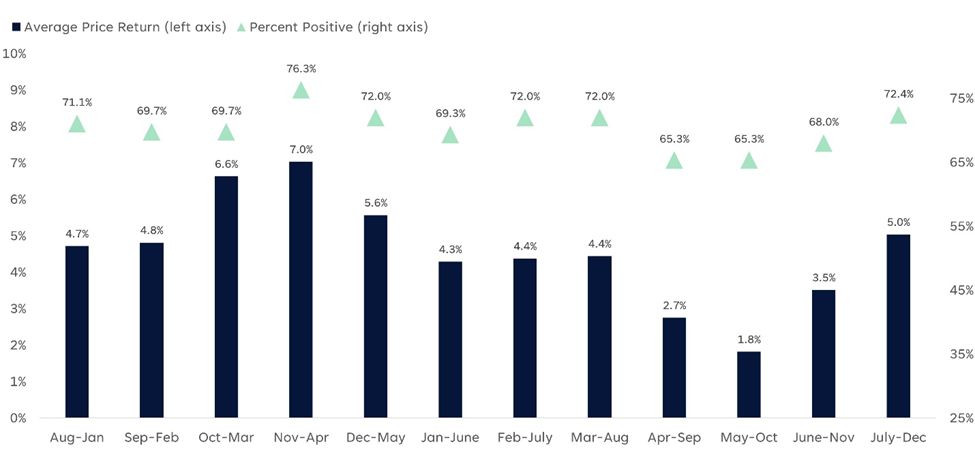

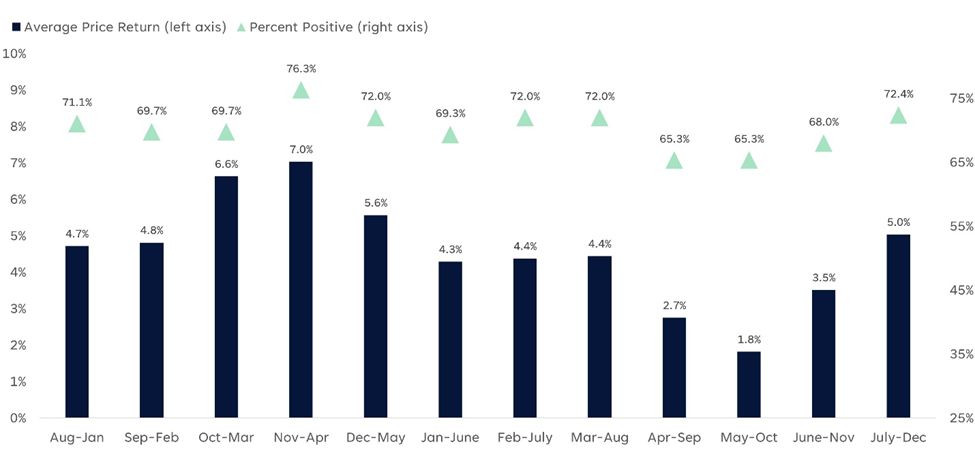

According to a study by LPL Financial, the May to October stretch has been a financial dead zone, delivering just 1.8% annual returns since 1950. Trading volumes typically dry up as traders go on vacation, and there’s simply not enough buying demand to power stocks higher.

Meanwhile, the November to April months have rewarded investors with a much stronger 7% return, as shown in the graph below.

The effect is also noticeable across other countries. A 2002 study by LPL found that 36 of the 37 markets they studied showed lower returns in May to October. The one outlier was Australia, which experiences seasons opposite to those in the Northern Hemisphere.

Still, selling your entire investment portfolio in May isn’t just terrible from a tax perspective. It also causes people to miss out on potential recoveries.

For example, the S&P 500 rose 12% in the summer of 2024 after the Federal Reserve cut interest rates. An investor too distracted by the “sell in May” mantra would have missed out on those gains. The 2008 financial crisis and 2020 COVID-19 pandemic also saw incredible resurgences the following summers.

In today’s Digest, we’d like to give nine other reasons (i.e., stocks primed for success) to stay invested in the summer. Well… I’ll give you two here…

And InvestorPlace Senior Analyst Luke Lango will reveal another seven in a special portfolio he built using his new powerful stock algorithm. It’s designed to do one thing… help you beat the markets and volatility, month after month, by helping him find the best stocks at the best time. You can learn more about how that tool works – and that special seven-stock portfolio – in Luke’s new free broadcast here.

Now, let’s get to the two stocks I’m looking at this summer – and take a quick peek at Luke’s special portfolio and how these seven stocks all represent even more reasons to stay invested this summer…

1. Seasonal Effects Can Dominate

Some companies naturally do well during the warmer months.

Outdoor sportswear makers… ice cream parlors… summer camps…

Then there’s my favorite example, Intuit Inc. (INTU). (You can tell I’m popular at parties).

Sunday Digest readers will recognize this tax and accounting firm as one of my top growth picks for 2025. America’s current tax laws expire at the end of this year, and the Trump administration and Congress are lining up a new “big, beautiful bill” that will change everything from the state-and-local tax (SALT) deduction to the way tips are taxed.

Intuit stands to do well because it serves the individuals and small businesses affected by these changes. Do-it-yourself filers are far more likely to use Intuit’s TurboTax software on a major tax overhaul, and INTU’s shares surged 80% during the last major change in 2017.

The software firm also benefits from a significant summer effect. Most of Intuit’s profits happen during the tax filing season that ends on April 15, and markets seem consistently surprised by the 10X jump in operating profits once they’re reported in late May.

“Seasonal” investing software from our corporate partners, TradeSmith, finds that shares of the TurboTax owner typically rise 10% between May 13 and August 11 as these financial figures are announced and digested. The green line in the graph below shows the typical path INTU shares have taken over the past 20 years.

We’re within 48 hours of the best day of the year to buy.

In addition, TurboTax has several secular tailwinds in its sails. The company will benefit from the end of the IRS Direct File program, which previously offered free tax filing software. And the firm is also a leader in AI-powered accounting, which is helping sales of its popular QuickBooks product.

Though the average firm typically does poorly during summer months, tax firms like Intuit and H&R Block Inc. (HRB) prove that there are some notable exceptions to this rule.

2. Last November-April Returns Were Poor

Last year’s November to April returns were mediocre at best. The S&P 500 dropped 2.8% over this period, compared to its long-term average gain of 7%.

That means markets are unusually cheap for this time of year. The median S&P 500 company now trades at 17.9X forward earnings – 5% lower than last November, and 7% below the 19.2X level seen in the past five Mays.

That’s made several high-quality firms incredibly attractive long-term buys. And one that stands out is Corning Inc. (GLW).

Corning is an upstate New York firm that’s developed high-end glassware since 1851. It invented Pyrex in 1915, the low-loss fiber optic cable in 1970, and the iPhone’s “Gorilla Glass” in 2007.

Today, the firm is a leader in liquid-crystal display (LCD) panels, smartphone screens, and the fiber optic cable used in broadband connections. It’s an up-market manufacturer that’s survived outsourcing and offshoring thanks to decades of innovation.

Perhaps most excitingly, Corning also manufactures the high-end fiber optics used in data centers to link servers. This essential technology allows AI-focused data centers to send more data across tighter spaces. It’s become one of Corning’s greatest growth drivers.

“Our growth is primarily driven by powerful secular trends and more Corning content in our customers’ offerings,” CEO Wendell Weeks said in prepared first-quarter earnings call remarks. “We continue to see and hear reconfirming evidence that our secular trends are intact and remain relevant. We see it in our results and we see it in our order books, and we hear it in our detailed dialogues with our customers.”

Meanwhile, the firm’s profitability is excellent. Corning has earned positive operating earnings for the past two decades (even through two recessions), and analysts expect return on equity to surge to 17% this year – roughly twice as high as market averages. Shares additionally trade at just 19X forward earnings given the November-April selloff.

Now, you might be thinking there must be something wrong. How can a firm have it all? And you’d be right to worry.

Corning supplies many of the world’s top TV makers, which are now facing enormous tariffs on exports to the United States. Public funding for broadband expansion may also get cut in the upcoming federal budget. Both factors have contributed to a 15% selloff since February.

However, it’s becoming increasingly clear that the market’s “sell first, ask questions later” approach has turned Corning into an irresistible “Buy.” Shares still trade 20% below their February peaks, and we believe this firm is an opportunity too good to pass up this summer.

3. The 7 Short-Term Trades

Finally, Luke Lango has long maintained that there’s always a bull market somewhere. Last year, 60 of the S&P 500 companies saw shares rise more than 30%, and this group included names like Iron Mountain Inc. (IRM) (up 58%) and Nvidia Corp. (NVDA) (up 60%).

At first glance, Iron Mountain and Nvidia seem to have little in common. The former is a blue-chip warehousing firm known for safekeeping corporate documents and Prince’s unpublished music. The latter is a hypergrowth chipmaker at the bleeding edge of artificial intelligence.

Nevertheless, the two do have some commonalities.

On the fundamental side, both firms saw accelerating growth in the fiscal year leading up to 2024. Iron Mountain came from a relatively low base to notch 24% growth in earnings before interest and taxes from the previous year, while Nvidia’s earnings quadrupled to $37 billion.

Meanwhile, the technical factors were also on their side. Iron Mountain’s shares had risen 40% the previous year, while Nvidia’s had surged 240%. History tells us that rising stocks tend to keep going up. The two companies also saw significant analyst upgrades, another sign of gains to come.

Luke and his team have spent over a year assembling these insights into a single system called Auspex. This monthly process now screens over 8,000 stocks on the last day of each month and helps them identify “perfect” stocks with strong growth momentum for shorter holding periods.

In a new presentation, Luke reveals the secrets behind this system and shows how it has now selected seven elite stocks that look set to buck the summer doldrums.

But don’t wait long.

For Luke’s special Project Auspex presentation and insights into his Auspex portfolio picks, simply click here.

The Trouble With Selling in May

Studies have found it’s hard to outperform the stock market by selling in May and rebuying in October. Transaction costs and taxes tend to erase any potential gains even if you put the money into yield-returning T-bills.

In addition, this year has seen some incredible first-quarter results. According to FactSet, the average S&P 500 firm reported a 12.8% increase in earnings per share. We’re seeing firms like The Walt Disney Co. (DIS) surge 16% on strong earnings figures. Selling now would leave people missing out on the typical post-earnings bump.

That’s why we’ve been broadly recommending investors stay in the market. There’s a great deal of opportunity for those who know where to look, and that’s why I urge you to watch Luke’s free Auspex presentation to learn more.

Until next week,

Tom Yeung

Market Analyst, InvestorPlace.com