NVIDIA Corporation’s NVDA data center graphics processing units (GPUs) for artificial intelligence (AI) tasks have boosted its business, while C3.ai, Inc.’s AI AI applications have won over a diverse client base. Does this mean C3.ai can rival NVIDIA, and is the stock a buy? Time to discover –

Reasons to Be Bullish on AI Stock

The Department of Defense, the U.S. Army, the Marine Corps, and the National Science Foundation, among others, receive custom AI-powered solutions from C3.ai. The company recently received a contract increase with the U.S. Air Force, raising the limit to $450 million from $100 million.

C3.ai’s AI solutions will help the U.S. Air Force identify maintenance needs for aircraft, weapon systems and equipment. In fiscal year (FY) 2025, federal government contracts accounted for approximately 26% of C3.ai’s bookings, which ended on April 30.

In FY 2025, C3.ai also experienced a substantial rise in bookings from the oil and gas industry, including Exxon Mobil Corporation XOM. Most notably, a renewed partnership with Baker Hughes Company BKR drove sales higher. C3.ai’s revenues in FY 2025 reached $389.1 million, a 25% increase from the previous year. Projections for FY 2026 suggest sales between $447.5 million and $484.5 million.

Additionally, partnerships with Microsoft Corporation MSFT and Alphabet Inc. GOOGL are expected to boost its growth and profitability. C3.ai is now considered the most desirable AI application on Azure and Google Cloud services (read more: BigBear.ai Vs. C3.ai: Which is the Better Stock and a Buy?).

Can AI Stock Be the Next NVIDIA?

Despite revenue growth, C3.ai has not turned a profit, which hampers its stock growth. In FY 2025, C3.ai reported a net loss of $288.7 million. In contrast, NVIDIA remains profitable despite export restrictions affecting China-bound H20 chips.

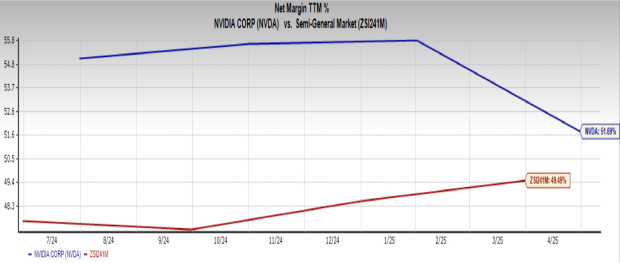

In the first quarter of fiscal 2026, NVIDIA’s net income increased by 26% to $18.8 billion, or 76 cents per share, up from $14.9 billion, or 60 cents per share, a year earlier. In reality, NVIDIA has generated profits more effectively than the Semiconductor – General industry, with a higher net profit margin of 51.7% compared to the industry’s 49.5%, indicating potential for further growth.

Image Source: Zacks Investment Research

Furthermore, the growing demand for advanced Blackwell chips, AI GPUs, and CUDA software will propel NVIDIA’s growth in the cloud and auto sectors. Therefore, it’s premature to assume that C3.ai can replicate NVIDIA’s success.

NVIDIA stock is expected to outperform C3.ai’s due to its stronger profitability and market position. Notably, NVIDIA became the most valuable company worldwide on Wednesday, with shares reaching a record high of $154.31 (read more: Is NVIDIA’s Rise in Value a Sign to Invest in NVDA Stock?).

Should I Invest in AI Stock Now?

While C3.ai may not mimic NVIDIA’s rapid growth, it boasts impressive sales, key partnerships and a strong financial position with ample assets, significantly exceeding liabilities in the fiscal fourth quarter.

Additionally, C3.ai maintains a healthy cash reserve, enabling it to meet financial obligations and reduce vulnerability to potential defense budget cuts under the Trump administration through diversification.

All these factors make C3.ai stock an attractive investment. C3.ai currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).