Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

In 2025, CEOs of several companies – GameStop GME, Everest Group EG, and MicroStrategy MSTR – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

GameStop Sees Bullish Outlook

Most investors are familiar with GameStop thanks to the ‘meme stock’ mania a few years back, with the company reflecting the poster child of the bunch overall. Though shares are down nearly 20% year-to-date, CEO Ryan Cohen stepped in and purchased 500k shares at a total transaction value of roughly $10.7 million.

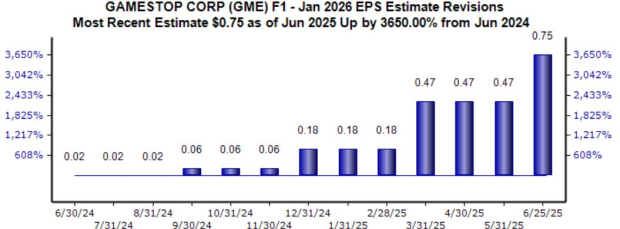

Analysts have continued to deliver bullish EPS revisions for its current fiscal year, with the current $0.75 Zacks Consensus EPS estimate up big from the $0.02 per share estimate in June of last year.

Image Source: Zacks Investment Research

MicroStrategy Shares Outperform

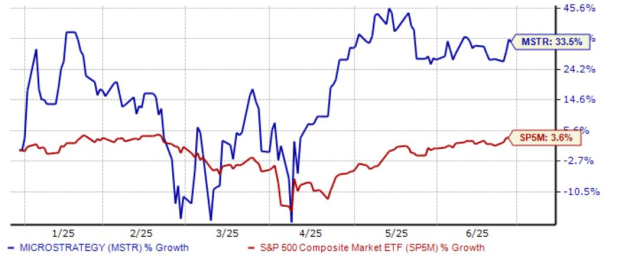

MicroStrategy shares have become notably popular amid the broader surge in bitcoin over recent years, up nearly 34% in 2025 and widely outperforming relative to the S&P 500. CEO Phong Le swooped in earlier in the year and acquired 6k MSTR shares at a total transaction value of roughly $510k.

Image Source: Zacks Investment Research

Investors should be aware of the high-volatility nature of MSTR shares, which are largely dictated by price swings within BTC.

EG Enjoys Consistent Sales Growth

Everest Group, through its subsidiaries, provides reinsurance and insurance products principally in the United States, Bermuda, and internationally. CEO James Williamson 1k shares at a total transaction value of roughly $340k.

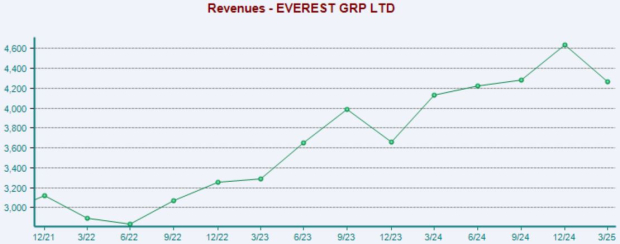

The company’s top line has shown consistent growth over recent years, as shown below.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, looking to receive insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – GameStop GME, MicroStrategy MSTR, and Everest Group EG – have seen recent insider activity.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

GameStop Corp. (GME) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).