The automotive giant, Ford Motor Company F, is steadfast in its race toward relevance. As the company electrifies its product lineup through the Model e segment, its legacy Ford Blue segment is the cash engine behind it. The traditional internal combustion engine business has iconic models like the F-Series, Ranger, Maverick, Bronco, Explorer and Mustang under its name.

In the last reported quarter, total wholesale volume in the Ford Blue segment decreased 6% year over year to 588,000 units but exceeded our expectation of 524,000 units.

Ford Blue segment had logged revenues of $21 billion (with an EBIT of $96 million) compared to Ford Pro and Model e’s revenues of $15.2 billion and $1.2 billion, respectively, in the first quarter of 2025. Model e remained a loss-making segment. As Model e’s ambitions require capital-intensive investments, Ford primarily funds those with the profitability from its ICE vehicles.

The massive Ford Blue segment continues to generate profits to balance off losses, maintain customer loyalty with legacy models, leverage dealer networks and lead through innovation in hybrid models. This would act as a strong foundation for Model e to build on its EV and software-led business.

Ford expects to sell fewer ICE vehicles compared to last year. Additionally, a shift in product mix and foreign exchange headwinds will drag profits. Despite that, it is expected to sufficiently do well as a bridge to EVs’ long-term growth strategy.

Peer Check: GM & STLA

General Motors Company (GM), Ford’s closest rival, boasts of 17.2% U.S. auto market share. General Motors has lowered its full-year 2025 guidance, owing to an estimated $4-$5 million exposure to the impacts of auto tariffs. However, it is advancing well in its electrification journey. In the final quarter of 2024, General Motors’ EV portfolio became “variable profit positive” with plans to cut EV-related losses further this year. On the other hand, the company continues to invest heavily in expanding ICE production at the U.S. plants.

Stellantis N.V. (STLA), another multinational automaker, has plans to reassess its capital spending strategies. The company has also brought down its EV production and is bringing its ICE back. Stellantis notices that U.S. markets are still demanding the traditional gas-powered muscle cars. EVs are gaining traction but will be put in the backseat for now. A slower shift to EVs will allow Stellantis to examine its infrastructure challenges.

The Zacks Rundown for Ford

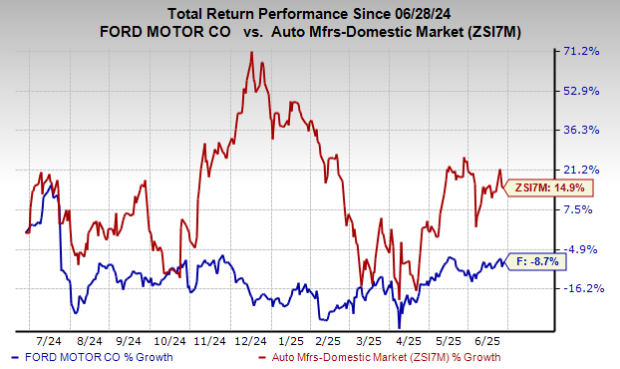

Shares of Ford have lost around 8.7% over the past year against the industry’s growth of 14.9%.

Image Source: Zacks Investment Research

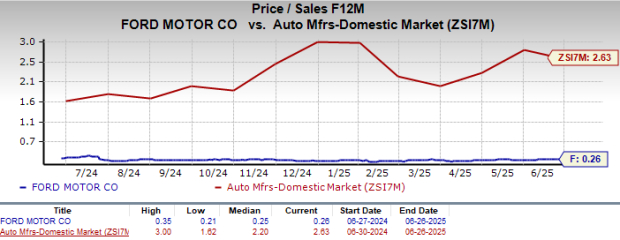

From a valuation standpoint, F trades at a forward price-to-sales ratio of 0.26, below the industry average. It carries a Value Score of A.

Image Source: Zacks Investment Research

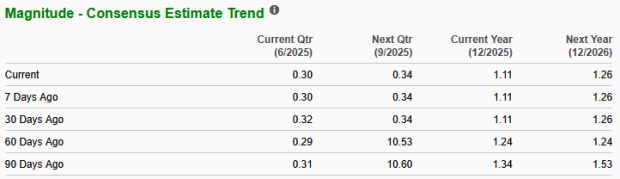

Take a look at how Ford’s EPS estimates have been revised over the past 30 days.

Image Source: Zacks Investment Research

Ford currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Picks Stock Most Likely to “At Least Double”

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).