When stocks are cruising near all-time or 52-week highs, it reflects considerable bullishness with trends where buyers are in control. Stocks making new highs tend to make even higher highs, particularly when analysts’ positive earnings estimate revisions are present.

That’s been precisely the case for Credo Techology Group CRDO and Heico HEI, both of which presently sport a favorable Zacks Rank and are trading near 52-week highs with notable momentum. Let’s take a closer look at what’s been driving the bullish behavior.

Credo Benefits from AI Surge

Credo Technology, a Zacks Rank #1 (Strong Buy) provides innovative, secure, high-speed connectivity solutions that deliver improved power efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market.

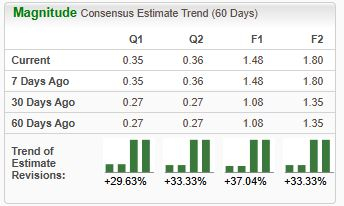

The company’s EPS outlook remains bullish across the board.

Image Source: Zacks Investment Research

Credo’s latest set of strong quarterly results was fueled by continued strong demand for its services, with the stock a big beneficiary of the AI frenzy. The increased AI spend is set to continue for years, positioning the company nicely to continue reaping the benefits.

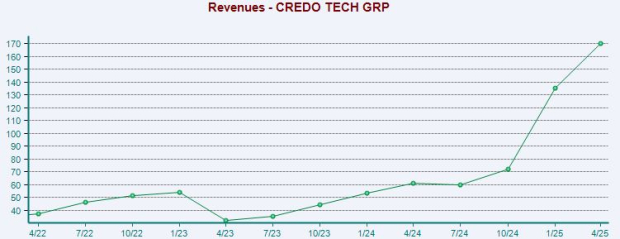

CRDO crushed our consensus expectations in the above-mentioned release, with sales up a rock-solid 180% year-over-year. Below is a chart illustrating the company’s sales on a quarterly basis, with the acceleration visibly seen over the past few periods.

Image Source: Zacks Investment Research

HEICO Breaks Records

HEICO, a Zacks Rank #1 (Strong Buy), is a growing technology-driven aerospace, industrial, defense and electronics company. Its products are found on large commercial aircraft, regional, business and military aircraft, and more.

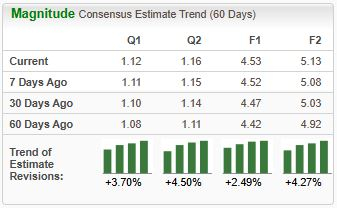

The company’s bullish EPS outlook is illustrated below.

Image Source: Zacks Investment Research

Like CRDO above, HEICO is coming off a notably strong quarterly release, posting record Q2 sales and net income. Both items crushed our consensus expectations, with sales growing 15% alongside a 27% boost in net income.

Strength was broad across both the company’s segments (Flight Support and Electrical Technologies), enjoying sales bumps of 19% and 7%, respectively. Its consolidated operating margin also saw nice expansion, coming in at 22.6% vs. 21.9% in the same period last year.

Bottom Line

Stocks making new highs tend to make even higher highs, particularly when positive earnings estimate revisions hit the tape.

That’s precisely what both stocks above – Credo Techology Group CRDO and Heico HEI – have enjoyed, with each sporting a favorable Zacks Rank and seeing their shares trade near 52-week highs.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Heico Corporation (HEI) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).