Intel Corporation INTC has partnered with Exostellar to make enterprise-grade AI infrastructure accessible in a cost-effective manner. Intel’s partnership with this leading innovator in autonomous compute orchestration and cloud optimization, which leverages AI and ML technologies, is likely to deliver an end-to-end solution with support for quota enforcement, dynamic borrowing, fair queuing and priority-based scheduling. This, in turn, will bring cloud-like agility and efficiency to on-premises or hybrid infrastructure for a more competitive AI hardware ecosystem.

The collaboration combines Intel Gaudi AI accelerators with Exostellar’s advanced Kubernetes-Native AI Orchestration, Multi-Cluster Operator to enable customers to maximize utilization, control access and streamline the compute resources across teams and projects. It aims to empower organizations to build and scale AI initiatives faster, more efficiently and more cost-effectively by developing an open ecosystem with multi-vendor support that boosts ROI while maintaining flexibility.

The Intel Gaudi 3 AI accelerator is poised to power AI systems with remarkable efficiency. Equipped with up to tens of thousands of accelerators interconnected through Ethernet, the Gaudi 3 accelerator promises a substantial boost in AI training and inference capabilities, enabling global enterprises to deploy AI at scale with ease. It boasts impressive performance metrics, offering faster time-to-train and superior inference throughput. Furthermore, Intel’s commitment to open, community-based software and industry-standard Ethernet networking ensures flexibility and scalability for enterprises, allowing them to seamlessly integrate AI solutions tailored to their specific needs.

INTC Focuses on AI Chips, 5N4Y

Intel remains on track with its 5N4Y (five nodes in four years) program to regain transistor performance and power performance leadership by 2025. Intel Xeon platforms have reportedly set the benchmark in 5G cloud-native core with substantial performance and power-efficiency improvements, additional power-saving capabilities and easy-to-deploy software. This has triggered healthy demand trends from major telecom equipment manufacturers and independent software vendors to optimize and unleash proven power savings for a more sustainable future.

Intel has witnessed healthy traction in AI PCs, which have taken the market by storm and remain firmly on track to ship more than 100 million by the end of 2025. Panther Lake – the chip based on Intel 18A and the architectural successor to the well-received Lunar Lake – is slated to be launched in the second half of 2025, while Clearwater Forest – the first Intel 18A server product – is likely to be unveiled in the first half of 2026.

Price Performance

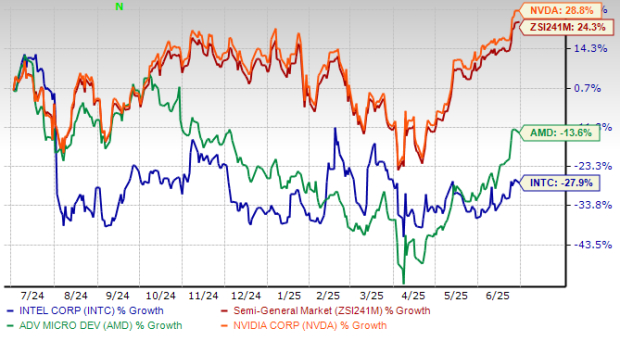

Despite AI chip traction, Intel has plunged 27.9% in the past year against the industry’s growth of 24.3%, lagging its peers Advanced Micro Devices, Inc. AMD and NVIDIA Corporation NVDA. While Advanced Micro has declined 13.6%, NVIDIA has gained 28.8% over this period.

One-Year INTC Stock Price Performance

Image Source: Zacks Investment Research

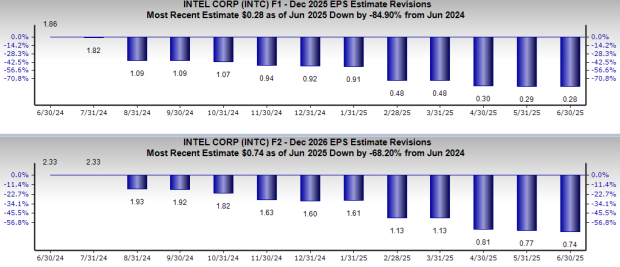

Estimate Revision Trend of INTC

Earnings estimates for Intel for 2025 have moved down 84.9% to 28 cents over the past year, while the same for 2026 has declined 68.2% to 74 cents. The negative estimate revision depicts bearish sentiments for the stock.

Image Source: Zacks Investment Research

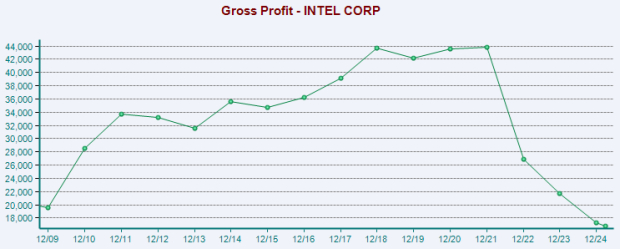

INTC Plagued by Margin Woes

Although Intel has scaled its AI footprint, it seems to lag NVIDIA on the innovation front, with the latter’s H100 and Blackwell GPUs being runaway successes. Leading technology companies are reportedly piling up NVIDIA’s GPUs to build clusters of computers for their AI work, leading to exponential revenue growth.

An accelerated ramp-up of AI PCs further affected the short-term margins of Intel as it shifted production to its high-volume facility in Ireland, where wafer costs are typically higher. Margins were also adversely impacted by higher charges related to non-core businesses, charges associated with unused capacity and an unfavorable product mix.

Image Source: Zacks Investment Research

US-China Trade Tariffs Hurt INTC

China accounted for more than 29% of Intel’s total revenues in 2024, making it the single largest market for the company. However, the communist nation’s purported move to replace U.S.-made chips with domestic alternatives significantly affected INTC’s revenue prospects. The directive to phase out foreign chips from key telecom networks by 2027 underscores Beijing’s accelerating efforts to reduce reliance on Western technology amid escalating U.S.-China tensions.

Moreover, weaker spending across consumer and enterprise markets, especially in China, resulted in elevated customer inventory levels, resulting in soft demand trends. Strict export control measures are further likely to affect the market dynamics, leading to below-par revenue growth in the near term.

End Note

Intel has been facing challenges due to the disruptive rise of over-the-top service providers in this dynamic industry. Price-sensitive competition for customer retention in the core business is expected to intensify in the coming days. Aggressive competition is likely to limit the ability to attract and retain customers and affect operating and financial results.

The road ahead for Intel is bumpy and strewn with daunting challenges, and how it navigates these roadblocks in the coming days remains to be seen. Intel carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).