AI’s creative destruction turns on itself… the investment action steps to take now… one of the best ways to play the ETH breakout… a tool to let you follow order flow just like the big money

VIEW IN BROWSER

In 2011, venture capital billionaire Marc Andreessen declared that “software is eating the world.”

He was right. From retail to banking to entertainment, software ate industry after industry, chewing up antiquated analog systems and spitting out sleek digital interfaces.

It was an economic and business-model revolution.

But that revolution has evolved, and where it stands today recalls another quote, this one from Jacques Mallet du Pan, a royalist during the French Revolution:

The Revolution devours its children.

Artificial intelligence is getting so capable – and so cheap – that it’s about to eat software itself. And this isn’t a distant “someday” risk. It’s already beginning.

Let’s go to Bloomberg from yesterday:

Growing worries that artificial intelligence tools could soon disrupt the world’s biggest software businesses are sparking a selloff across the sector.

A 30% plunge in Monday.com Ltd. shares grabbed investor attention in Europe on Tuesday, with some analysts saying the drop reflected concerns over the long-term competitive threat of AI as much as results that failed to meet higher investor expectations.

Such worries fueled big losses across the sector.

Wall Street isn’t just reacting to quarterly misses. Investors are starting to price in the possibility that AI can replicate – or even replace – core software businesses, at near-zero marginal cost.

Let’s go to our technology expert Luke Lango in yesterday’s Innovation Investor Daily Notes:

Last week’s launch of ChatGPT-5 — alongside Grok 4 a few weeks prior — confirmed that foundational AI models are evolving at breakneck speed.

ChatGPT-5 can literally build a functional, custom language-learning app in minutes.

This is game-changing for application developers… but it’s also a wrecking ball for entry-level enterprise software.

Why pay for an expensive AI marketing automation tool when your team can just fire up ChatGPT-5 and do it themselves — faster, better, and cheaper?

The same way AI has wiped out entry-level jobs, it’s now threatening to wipe out entry-level AI software companies.

The disruptors are becoming the disrupted. That’s how fast this space is moving.

This is the same cycle of creative destruction that’s played out for centuries. The difference is that it’s now happening at an accelerating rate…and to yesterday’s tech.

So, what are the investment action steps?

Two things immediately pop up:

- Avoid/Sell: Beware of companies whose moat is purely feature-based software – especially in design, content creation, or project management. They’re at high risk.

If their only defense is “AI can’t do it yet,” they’re on borrowed time.

- Hold/Buy: Focus on companies that own the distribution layer (Apple, Microsoft, and Google – disclaimer: I own all three), the compute infrastructure (like Nvidia), or the AI models themselves.

And as I tackled in yesterday’s Digest, don’t overlook the emerging winners in “Physical AI” – where small language models (SLMs) run locally on laptops and other devices, powering robotics, wearables, and edge intelligence without the cloud.

Back to Luke:

The AI Boom isn’t broadening — it’s narrowing.

Gains are consolidating into the hands of the real visionaries and moat-builders. Our job is to keep adapting so we stay with them…

Stay nimble. The winners are getting smaller in number… and bigger in returns.

Bottom line: The same technological progress that fueled the software revolution is now poised to compress, commoditize, and consume it.

So, forget “software eating the world.” That story is over.

AI is going to eat the entire universe…and it’s starting today with its own family.

Ethereum’s “MicroStrategy Moment” – and the tool tracking it in real time

If you haven’t been watching, Ethereum (ETH) is soaring.

As you can see below, while Bitcoin (BTC) has added 19% over the last three months, Ethereum is up 89%.

Source: TradingView

Related to this, veteran trader Jonathan Rose has been flagging what he calls one of the biggest under-the-radar stories in finance right now.

It’s not dominating headlines yet – inflation prints and tariff chatter are grabbing the spotlight – but you’re going to hear more about it.

Back in 2020, Michael Saylor of MicroStrategy Inc. (MSTR) made a radical pivot…

He began raising capital to buy Bitcoin, over and over.

The market stopped caring about his company’s legacy software business and began valuing it almost entirely on its Bitcoin holdings.

Here’s Jonthan with the net effect and the relevance to Ethereum:

As Bitcoin ran higher, MicroStrategy didn’t just follow along – it multiplied the gains, fueled by scarcity and investor FOMO.

Now another company is taking a page straight out of the MicroStrategy playbook. Only this time, it’s Ethereum leading the charge.

Meet BitMine Immersion Technologies Inc. (BMNR), the “MicroStrategy” for Ethereum

Jonathan’s research finds that BitMine has a clear, public mission: to own 5% of all ETH in existence – about 6 million coins.

They’ve already amassed roughly 1.15 million ETH, worth around $5 billion at today’s ~$4,650 price, making theirs the largest public ETH treasury in the world.

They’re moving aggressively, with influential backers like billionaire venture capitalist Peter Thiel in the wings. The result is that BMNR’s stock is morphing into a pure Ethereum proxy.

Each time they raise capital and buy more ETH, their market cap swells alongside the growing treasury. And in a crypto bull market like we have today, that growth is supercharged by ETH’s price gains, creating a double engine for value creation.

Jonathan’s analysis shows the potential is enormous…

At 6 million ETH, BitMine’s treasury could be worth over $26 billion (with an implied share price north of $320). And that’s before accounting for the price-tightening effect that such a massive accumulation might have on ETH itself.

So, how can we profit?

Obviously, you can just buy BMNR.

But to really track what’s happening, Jonathan has created a tool called BasisWatch.

From Jonathan:

It tracks BMNR’s ETH treasury, USD value, and percentage of ETH supply. And it updates daily so you can see exactly when holdings jump from a new purchase…

This is your dashboard for the biggest ETH accumulation story on Wall Street.

This is Ethereum’s MicroStrategy moment — only bigger.

BMNR isn’t just playing the ETH game — they’re trying to own a significant piece of the board.

If they succeed, they won’t just ride the next wave… they could help make it.

For more on BMNR, Jonathan’s BasisWatch Tool, and the “Ethereum Michael Saylor” trade, click here to check out yesterday’s free MIT Live broadcast.

If you’re new to Jonathan’s style of trading, these free Masters in Trading Live broadcasts –every day the market is open at 11 a.m. ET – are a great way to get a sense of it, to deepen your understanding of trading, and to see firsthand the strategies that Jonathan uses to capture triple-digit gains – sometimes in just days.

BasisWatch isn’t the only trading tool available to you today

Wall Street has been watching you for years…

Not in a “hidden camera” way, but it’s spying, nonetheless.

As Keith Kaplan, CEO of our corporate partner TradeSmith explains, it’s more like financial surveillance:

High-frequency trading firms pay your broker to see your trades.

Then they use sophisticated algorithms to exploit your every move — often by getting ahead of the trade you just made.

That edge, called “payment for order flow,” has minted billions for hedge fund titans. Citadel posted a record $16 billion profit in 2022. Virtu went five years with just one losing trading day.

The lesson? Seeing order flow before the public does is a license to print money.

But here’s the twist – Keith says that you can flip the script:

What if instead of being the watched, you could also become the watcher?

That’s the premise behind TradeSmith’s money flow tool, a system that tracks unusual buying and selling activity from big Wall Street players, often before the headlines hit.

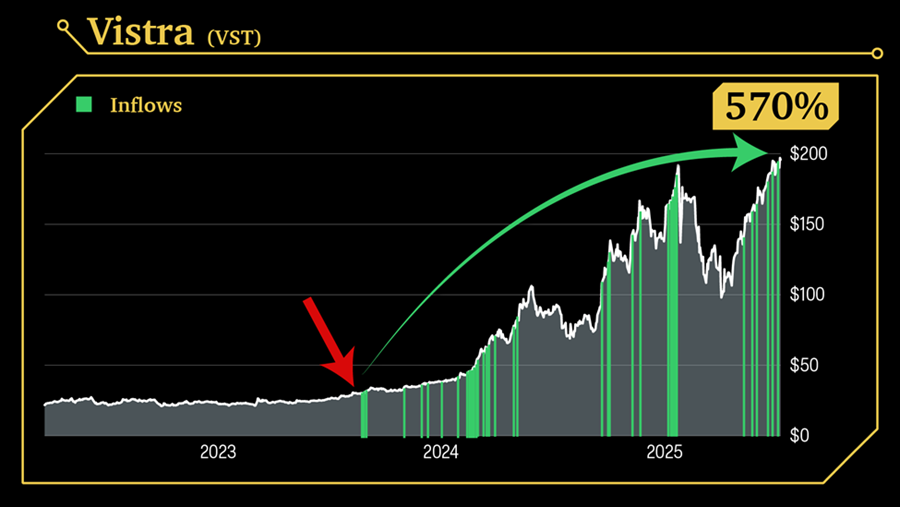

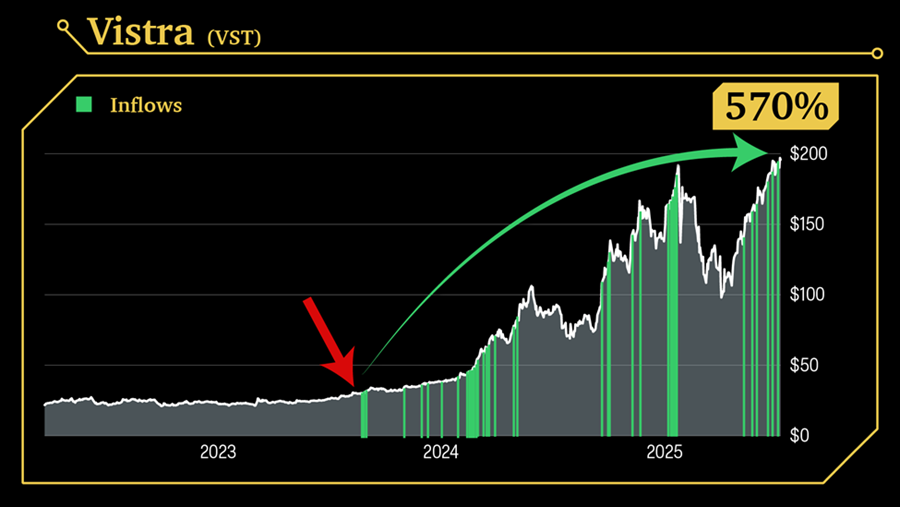

For a quick illustration of what you can do with it, let’s turn to Vistra Corp. (VST), an integrated power company.

As early as August 3, 2023, Keith’s market tool picked up on unusually large Wall Street money flows pouring into the stock. In the chart below, those flows show up as vertical green bars.

Here’s Keith with how it played out:

At the time, Vistra shares traded at about $28. Today, they’ll set you back about $198.

So, if you got in on the day our system flagged Vistra, you’d be sitting on gains as high as 570% in two years

Tomorrow at 10 a.m. Eastern, Keith will reveal exactly how the system works – and how, according to back-testing, it could have outperformed the market 5-to-1 going all the way back to 1990.

Best of all, when you sign up, you’ll get a free trial of the tool, plus the name of a stock that Keith writes “could soon see a flood of money pouring in.”

To instantly reserve your seat, just click here.

Let’s give Keith the final word:

If you’re tired of being Wall Street’s prey – and want to become a predator instead – join us.

Have a good evening,

Jeff Remsburg