Dell Technologies DELL Client Solutions Group (CSG) has been gaining traction, particularly in the commercial PC market, which includes notebooks, desktops, workstations, and peripherals for enterprise customers.

The commercial PC segment’s growth is a critical driver for Dell’s overall Client Solutions Group (CSG), which saw a 5% revenue increase to $12.5 billion in the first quarter of fiscal 2026. The company has experienced five consecutive quarters of year-over-year growth in commercial PC market. Commercial Client revenues increased 9% year over year to $11.04 billion in the fiscal first quarter.

The company is a prominent PC maker and is expected to benefit from the recovering demand driven by the PC-refresh cycle. It is benefiting from the Windows 11 PC refresh cycle as many enterprise customers upgrade to new AI-capable Windows 11 devices, driving strong demand in the commercial segment.

Dell’s commercial PC demand has been strongest in North America, where it holds the #1 market share with 32.4%. Additionally, regions like Europe, the Middle East, and Africa (EMEA) and Asia Pacific and Japan (APJ) have seen double-digit growth in the first quarter of fiscal 2026, showcasing Dell’s ability to cater to diverse markets globally.

Product innovations have also played an important role in Dell’s success in the commercial PC space. The company’s streamlined AI PC portfolio, featuring advanced processors, longer battery life, and enterprise-grade security, has positioned it as a leader in the AI era.

DELL Suffers From Stiff Competition

Dell Technologies suffers from stiff competition in the PC market from the likes of HP HPQ and Apple AAPL.

HPQ is benefiting from a sustained focus on launching new and innovative products. The growing interest in generative artificial intelligence-enabled PCs, along with Windows 11 upgrades and a probable PC refreshment cycle, is likely to drive fresh demand for PCs in 2025.

The growing interest in generative AI-enabled PCs might give a fresh boost to HP’s PC demand in the years ahead. The company forecasted that 40-60% of all PCs will be AI PCs in the next three years. To make the most of the growing opportunities in this category, HP has launched several AI PCs this year and plans to continue to expand its AI PC portfolio.

Apple’s Mac business is benefiting from strong demand for M4, M4 Pro, and M4 Max chips. In the third quarter of fiscal 2025, Mac sales of $8.05 billion increased 14.8% year over year and accounted for 8.6% of total sales. Solid demand for the M4 MacBook Air drove Apple’s top-line growth. Apple saw double-digit sales growth in emerging markets and double-digit growth in both the number of upgraders and new Mac customers.

DELL’s Share Price Performance, Valuation, and Estimates

DELL’s shares have gained 17.4% year to date, outperforming the broader Zacks Computer & Technology sector’s return of 13.9%. The Computer – Micro Computers industry declined 7.2% in the same time frame.

DELL Stock’s Performance

Image Source: Zacks Investment Research

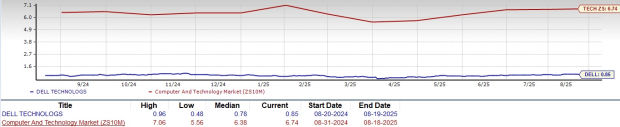

DELL shares are cheap, with a forward 12-month Price/Sales of 0.85X compared with the Computer & Technology sector’s 6.74X. DELL has a Value Score of B.

Price/Sales (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for second-quarter fiscal 2026 earnings is pegged at $2.28 per share, which has remained unchanged in the past 30 days. This indicates a year-over-year increase of 20.63%.

The consensus mark for 2025 earnings is pegged at $9.45 per share, which has remained unchanged in the past 30 days. This suggests 16.09% year-over-year growth.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

DELL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Apple Inc. (AAPL) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).