Two of the more popular retail apparel companies will be reporting their Q2 results this week in Abercrombie & Fitch ANF and PVH PVH, the parent company for iconic fashion brands such as Calvin Klein and Tommy Hilfiger.

Despite what has been weaker demand for premium apparel items, their stocks may be catching investors’ attention as buy-the-dip candidates, especially with a potential rate cut ahead in September.

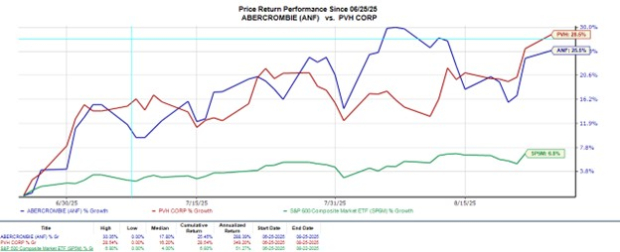

That said, let’s see if it’s time to buy ANF or PVH shares for a continued rebound, with both trading more than 25% from their 52-week highs, despite soaring over +25% in the last two months, respectively.

Image Source: Zacks Investment Research

Q2 Expectations

Set to release its Q2 results before-market hours on Wednesday, August 27, Abercrombie & Fitch’s margins have been under pressure due to higher freight costs and tariffs, although the company has still seen strong performances across global regions, particularly for its casual beach-inspired Hollister brand.

Based on Zacks’ estimates, Abercrombie & Fitch’s Q2 sales are thought to have increased nearly 5% year over year to $1.19 billion. However, Q2 earnings are expected to be down 9% to $2.27 per share compared to EPS of $2.50 a year ago.

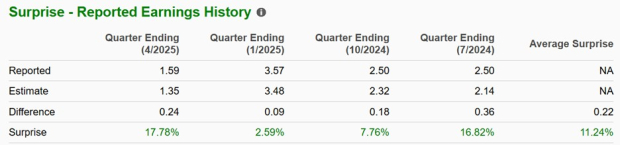

It’s also noteworthy that Abercrombie & Fitch has surpassed sales expectations for 11 consecutive quarters and has topped the Zacks EPS Consensus for nine straight quarters, with an average earnings surprise of 11.24% in its last four quarterly reports.

Image Source: Zacks Investment Research

Reporting after-market hours on Tuesday, August 26, higher tariffs have also cut into PVH’s profits, as it has a reliance on global markets like China and Europe. PVH’s Q2 sales are expected to be up 1% to $2.1 billion, but a steeper decline is expected on its bottom line, with quarterly EPS thought to have dropped over 34% to $1.97 versus $3.01 per share in the prior period.

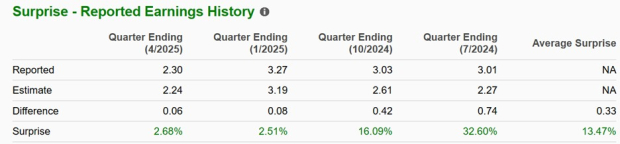

Reassuringly, PVH has surpassed sales estimates for six straight quarters and has exceeded the Zacks EPS Consensus for 17 consecutive quarters with an average earnings surprise of 13.47% in its last four quarterly reports.

Image Source: Zacks Investment Research

ANF & PVH Check an “A” Value Score

Even with inflation and tariff concerns dampening their earnings potential at the moment, what stands out most about these popular retail apparel companies is their attractive valuations, as their stocks trade under 10X forward earnings.

Plus, ANF and PVH shares trade well under the optimum level of less than 2X sales, with both checking an “A” Zacks Style Scores grade for Value.

Image Source: Zacks Investment Research

Bottom Line

While it’s very tempting to buy Abercrombie & Fitch and PVH stock at their current levels, their Q2 reports and guidance will be critical to more meaningful upside. For now, both stocks land a Zacks Rank #3 (Hold) but are certainly desirable rebound targets.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).