Roku’s ROKU Devices business is facing mounting pressure as hardware revenues continue to decline. In the second quarter of 2025, Devices revenues dropped 6% year over year to about $136 million, pressured by tariffs, intense competition from Amazon and Apple, and slower consumer demand as households hold on to existing devices. While the platform segment dominates profitability, Devices segment remains essential for expanding Roku’s user base and ad-driven ecosystem.

To navigate these challenges, Roku is shifting its focus, treating hardware as a strategic gateway rather than a core revenue source. Despite the revenue decline, the segment achieved break-even gross profit, a marked improvement from losses a year ago. Innovation remains central to this strategy, with Roku recently introducing compact, energy-efficient Streaming Sticks priced between $29.99 and $39.99, aimed at enhancing affordability and usability. A refreshed Roku TV lineup, including the Pro Series with QLED and Mini-LED technology, enhanced audio and an upgraded Voice Remote Pro, underscores efforts to strengthen brand appeal.

Looking ahead, management expects Devices revenues to stay flat or slightly lower through 2025, suggesting challenges will persist. However, by prioritizing user acquisition over Devices’ profitability and leveraging advanced ad solutions, Roku aims to offset hardware weakness with stronger platform monetization. Adding to investor confidence, Roku’s Devices revenues beat the Zacks Consensus Estimate by 9.95% and 4.81% in the first and second quarters of 2025, respectively. Per Pixalate’s Global CTV Device Market Share Reports, the company’s 37% U.S. connected TV market share offers a solid foundation for long-term growth.

Despite ongoing challenges, Roku’s commitment to innovation and ecosystem expansion positions the Devices segment for a measured rebound rather than prolonged weakness.

Roku’s Competition in the Devices Business

Amazon‘s AMZN Fire TV devices, which include the Fire TV Stick 4K and Fire TV Cube, offer Wi-Fi 6, Dolby Vision, Dolby Atmos and stronger processing power for smoother performance than Roku. Amazon strengthens its edge with Alexa integration, Prime Video, cloud gaming and app flexibility — areas where Roku falls short. Despite these advantages, Amazon’s Fire TV holds an 18% share, while Roku continues to dominate the U.S. CTV device market share at 38%.

Apple’s AAPL Apple TV 4K uses the A15 Bionic chip to deliver fast, smooth performance with HDR10+, Dolby Vision, Dolby Atmos, AirPlay, HomeKit and Apple Arcade. While Roku leads with affordability and broad app support, Apple builds strength through its ecosystem integration, premium quality and brand trust. Even so, Apple’s Apple TV maintains just a 12% market share versus Roku’s 39%.

ROKU’s Share Price Performance, Valuation & Estimates

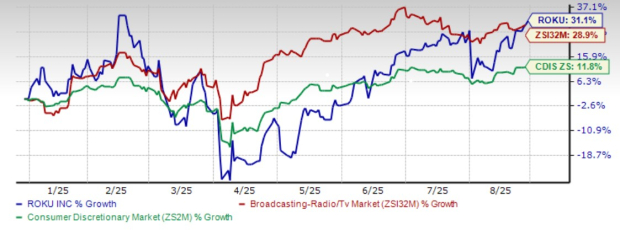

ROKU shares have risen 31.1% year to date, outperforming the Zacks Broadcast Radio and Television industry’s growth of 28.9% and the Zacks Consumer Discretionary sector’s return of 11.8%.

ROKU’s YTD Price Performance

Image Source: Zacks Investment Research

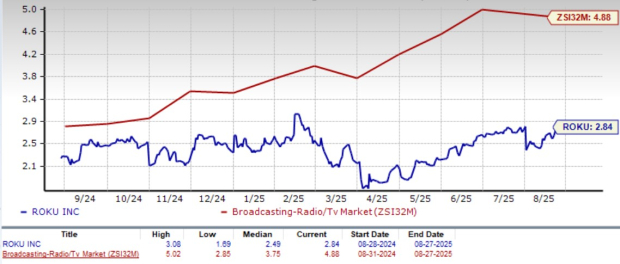

From a valuation standpoint, Roku stock is currently trading at a forward 12-month Price/Sales ratio of 2.84X compared with the industry’s 4.88X. ROKU carries a Value Score of D.

ROKU’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ROKU’s 2025 earnings is pegged at 12 cents per share, revised upward significantly over the past 30 days. The earnings figure suggests improvement over the year-ago quarter’s loss of 89 cents per share.

Image Source: Zacks Investment Research

Roku stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don’t build. It’s uniquely positioned to take advantage of the next growth stage of this market. And it’s just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).