A handful of stocks benefited massively during the pandemic. It was an interesting time to be an investor, to say the least, and those who targeted the stay-at-home stocks were rewarded handsomely with considerable gains.

A few of those stocks include Shopify SHOP and Zoom Video Communications ZM. Let’s take a closer look at each.

Shopify Stands Tall

Shopify’s platform gained widespread attention during the period as consumers increasingly shifted to online shopping. To little surprise, the digital trend has continued to only get more popular, providing the company with serious growth since.

And its earnings results have helped reinforce the idea, which have regularly been strong over recent periods. Sales grew 31% year-over-year throughout its latest period, with SHOP posting double-digit percentage YoY sales growth in ten consecutive periods.

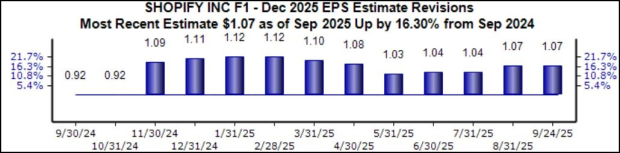

Importantly, the EPS outlook for its current fiscal year remains one of positivity, with the current $1.07 Zacks Consensus EPS estimate for its current fiscal year up 16% over the last year.

Image Source: Zacks Investment Research

Zoom Sees Weak Sales

Zoom Video Communications’ cloud-native unified communications platform combines video, audio, phone, screen sharing, and chat functionalities. It’s easy to understand why shares gained popularity during that period, as many were forced onto the platform for both personal professional reasons.

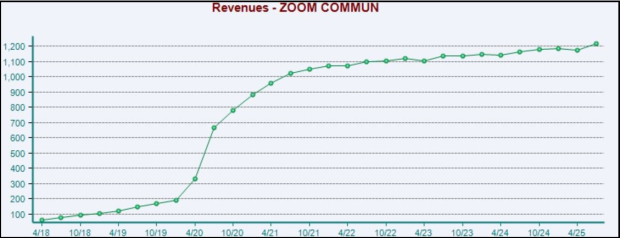

Sales exploded during the pandemic before leveling off significantly over recent years, as shown below.

Image Source: Zacks Investment Research

ZM’s sales grew by nearly 5% from the year-ago period in its latest release, with adjusted EPS of $1.53 climbing 10% year-over-year. Its cash-generating abilities did see a nice boost, with operating cash flow of $516 million up from the $449.3 million mark in the same period last year. Free cash flow of $508 million was up big from $365 million in the year-ago quarter.

EPS expectations for its current fiscal year do reflect positivity, with the current $3.60 Zacks Consensus EPS estimate up nearly 40% over the last year.

Image Source: Zacks Investment Research

Bottom Line

While stocks such as Shopify SHOP and Zoom Video Communications ZM were widely hailed during the pandemic, the attention since has drastically reduced.

Shopify has, and remains, the true leader of the group concerning overall performance and fundamentals. The company hasn’t struggled post-pandemic like others, with the staying power of online shopping driving the positivity.

Zoom shares have shown life off lows, though shares remain in desperate need of a strong quarterly release that reveals meaningful sales growth.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the “first wave” of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks’ AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>

Shopify Inc. (SHOP) : Free Stock Analysis Report

Zoom Communications, Inc. (ZM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).