More bad numbers in the labor market… there will be a stock crash eventually… the dance between momentum and valuations… Luke Lango’s subscribers are nearing 500% gains… a massive American “financial reset”

VIEW IN BROWSER

The government shutdown is delaying economic reports we’d usually highlight.

This morning, the Labor Department was scheduled to release initial jobless claims. Tomorrow would have brought the big jobs report – the nonfarm payrolls count from the Bureau of Labor Statistics.

As I write, we will see neither, as our politicians perform their tired, partisan dance in this government shutdown.

We can, however, highlight a relatively new set of data indicators compiled by the Chicago Federal Reserve, out this morning. These indicators combine real-time private sector data with official labor statistics.

Here’s CNBC:

Unemployment changed little in September while layoff and hiring rates both slowed…

The jobless level was little changed at 4.34%. That represented little change from August, though was just 0.01 percentage point away from moving up to 4.4%, the highest level since October 2021.

Meanwhile, the latest Challenger, Gray & Christmas report, also out this morning, finds growing labor market weakness:

In the third quarter, planned layoffs by U.S. employers totaled 202,118, the highest Q3 total since 2020…

So far this year, companies have announced 946,426 job cuts, the highest YTD since 2020…

It is up 55% from the 609,242 job cuts announced through the first three quarters of last year and is up 24% from the 2024 full year total of 761,358.

The 2025 year-to-date total is the fifth highest in the 36 years Challenger has reported.

Here’s Andy Challenger, Senior Vice President and labor expert for Challenger, Gray & Christmas:

Right now, we’re dealing with a stagnating labor market, cost increases, and a transformative new technology.

With rate cuts on the way, we may see some stabilizing in the job market in the fourth quarter, but other factors could keep employers planning layoffs or holding off hiring

Against this backdrop, the S&P touched a fresh all-time high this morning.

Remember – no party lasts forever…

Our technology expert Luke Lango just reminded his readers of this.

From his Daily Notes in Innovation Investor:

No stock market boom endures forever.

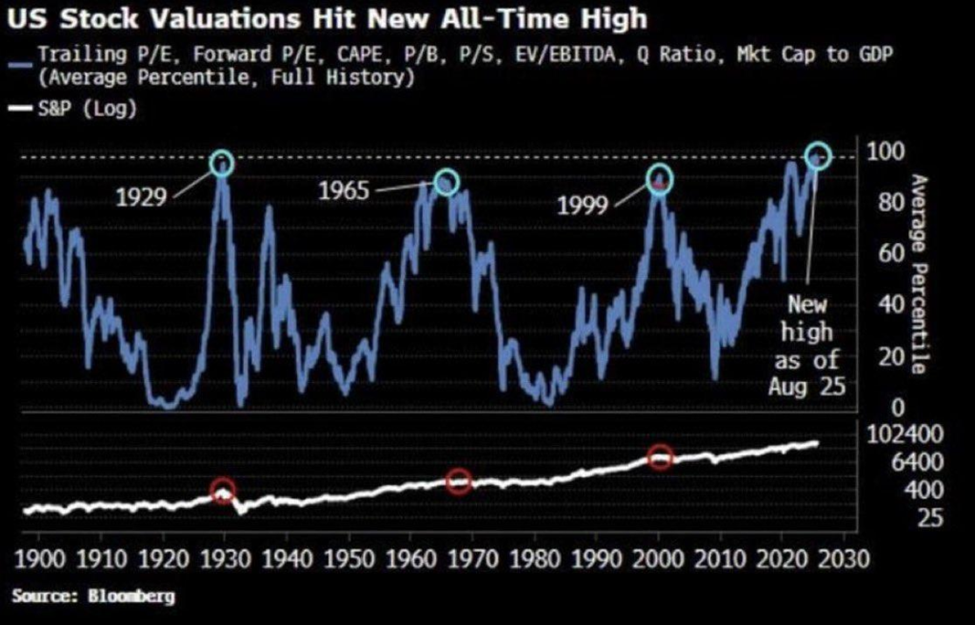

The warning signs are there, especially when you look at valuations.

Across a composite of metrics – price-to-earnings, price-to-sales, price-to-book, etc. – the U.S. stock market is currently trading at its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression.

Source: Bloomberg / Luke Lango

This doesn’t mean a crash is imminent.

But it does mean it is inevitable over time.

Now, let’s be clear: Luke remains bullish in the near term.

Record investments in AI infrastructure and surging momentum are likely to drive markets higher for the next 12 months.

And while skepticism from bears is understandable, I want to key in on “momentum” to prevent any naysayers from stepping in front of a potential steamroller…

Momentum, valuation, and what drives stock prices…

It’s tempting to look at nosebleed valuations, call the market irrational, and go bearish.

But doing so would mean ignoring Keynes’ timeless market truth: “The market can remain irrational longer than you can remain solvent.”

In the long run, earnings and fundamentals do win out – they’re the anchors that prices eventually return to. But in the short- and medium-term, momentum outweighs valuation.

Academic research has dug into this and there’s a large body of evidence to support this conclusion: Momentum overpowers valuation in the nearer term, even when fundamentals seem extreme.

For one illustration, market veteran Cliff Asness, founder and managing principal at AQR Capital Management, authored a research study that dove into market timing, valuation, and momentum.

One of the takeaways was that over 5-to-10-year horizons, valuation is the dominant driver of market performance. But in monthly or quarterly time frames, momentum often leads the way.

From the piece:

We nearly always find better historical results from momentum than contrarian timing…

The evidence challenges the idea that valuation signals alone can be used to time markets or inform asset allocation decisions. When others seem greedy, they may still get greedier for many years to come…

Momentum investing may feel too much like jumping on a bandwagon… But our results suggest that even a small dose of momentum, whether applied explicitly or just by rebalancing less frequently or smoothing valuation signals, may improve market timing decisions.

The graphic below from Morgan Stanley illustrates the shift. It shows us the key drivers of stock performance over various lengths of time.

The column on the left shows us the drivers over one year. “Multiple” (which means “investor sentiment” – which is what drives momentum) is in red; it’s the dominant influence at 46%.

Revenue growth (the basis for “earnings”) is in blue; it accounts for just 29% of stock-price performance.

But see how this flips the further out you go (the columns to the right).

Source: Morgan Stanley / The Future Investors

After 10 years, “multiple” (meaning sentiment/momentum) drives just 5% of stock performance.

Bottom line: In the short term, fighting momentum is like trying to swim upstream. So, rather than worry about nosebleed multiples, investors are better served by tracking buying pressure, watching volume, and closely monitoring the technical signals.

While momentum is strong, don’t fight it – ride it.

This is Luke’s approach in his trading service Breakout Trader. And recent weeks have brought a great illustration of the power of momentum.

“Let’s tweak our plan”

Breakout Trader subscribers hold Kratos Defense & Security Solutions (KTOS), one of the hottest stocks in today’s market.

About a month ago, Luke analyzed KTOS to identify where it might top out based on the “stage analysis” framework that underpins Breakout Trader. He had told his investors that they would be selling when the stock hit that highwater mark.

But upon achieving the milestone in mid-August, Luke changed his mind:

Let’s tweak our plan…

Why cut our gains prematurely in the middle of bullish momentum? We have no idea how far this run will take us.

So, rather than sell at $70, let’s just keep riding the move till exhaustion.

When the buying pressure runs out, that’s when we’ll sell our final tranche of KTOS. But until then, let’s follow the trading truism that’s gotten us this far…

Let your winners run.

With this in mind, let’s fast-forward to Tuesday’s Breakout Trader Weekly Issue:

This is why we didn’t sell at $70…

Since last Tuesday, KTOS jumped another 9%, closing yesterday at $88.08.

But because of how long we’ve been in this trade – and the relatively low price at which we bought in – that 9% climb meant our trade jumped from last week’s total return of 410% to yesterday’s close of 451%.

Since that issue, KTOS is up another 6%, putting the official KTOS return at 482% as I write Thursday.

A huge “congratulations” to Luke and all the Breakout Trader subscribers on this monster performance – and the wise call to ride the tide.

Circling back to today’s overall market conditions, yes, valuations are high – but equally yes, momentum is bullish – at least in AI.

If you’re cautious, you don’t have to jump into this current, but if you’re in the water already, please don’t try to swim against it.

As for us, we’re aware of today’s nosebleed valuations – and concerned – but for now, momentum is the name of the game.

The four pages that could change everything

Let’s switch gears to an event Luke believes would reshape America’s financial future.

Some of America’s greatest turning points started with just a few sheets of paper. The Declaration of Independence was barely 1,500 words. The GI Bill fit into a few hundred lines of legislation.

Today, Luke believes that another slim document – just four pages long – could soon join that list.

Signed in the closing weeks of President Trump’s first term, this plan is set to go live on October 21. Luke calls it Project Yorktown, because just as the Battle of Yorktown secured America’s political independence, he believes this document is designed to secure America’s financial independence from foreign creditors once and for all.

From Luke:

On October 21, Trump’s four-page document stops being just ink on paper.

It becomes reality.

I believe it could be a financial reset on par with the greatest economic turning points in U.S. history.

Luke argues this reset could redirect $4 trillion into an overlooked corner of the markets and create a once-in-a-generation chance for investors.

To explain what’s happening and dig into the opportunity, Luke is hosting a free broadcast: President Trump’s “Project Yorktown” Summit this Monday, October 6 at 1 p.m. Eastern. (Click here to get automatically signed up.)

Here’s Luke with more:

I’m hosting this event to share why and how this project is being activated on October 21… and more details on the sector of the economy that stands to benefit the most.

You’ll have the chance to see it coming before anyone else.

Plus, I’ll share a free pick poised to double in the next 12 months… name, ticker, and analysis included!

Whether or not you agree with Luke’s thesis, this is a story worth tracking. After all, when the financial system shifts, fortunes can be made faster than most investors can react. You can instantly register to attend right here.

We’ll keep you updated on all these stories here in the Digest.

Have a good evening,

Jeff Remsburg