The Trump trade has taken on a literal connotation, with the White House recently investing in several mining and technology companies that have publicly traded stocks.

Historically, the U.S. government has avoided direct ownership of public companies to maintain free-market principles and prevent favoritism. Instead, it usually supports broader industries through grants and subsidies, tax incentives, or regulatory support.

Under President Trump, the White House has broken this precedent, but has focused on critical minerals and national security. This fits under the rare exception where direct equity stakes in public companies are acceptable and are usually tied to a crisis or the nation’s strategic needs.

If you’re wondering, the only other major example of direct government investment in public companies was during the 2008 financial crisis, when the U.S. took stakes in banks and automakers to prevent a collapse.

Needless to say, the stocks that are receiving this sort of preferential treatment now are soaring, either hitting or getting closer to their 52-week highs.

Technology & Security

Intel – INTC: The most notable stock on the list, Intel has made headlines in recent months as the U.S. government became its largest shareholder, taking a 10% stake in the iconic semiconductor company to support domestic chip production.

This aligns with national security goals as it relates to technology protocols and defending these interests away from tech competitive frenemies such as China. Notably, the government converted funds Intel received through the CHIPS Act grants into equity, with Intel receiving roughly $11 billion in grants for commercial and military chip production.

Intel’s downturn and recent struggles have been well documented, so the helping hand from the government fits the crisis criteria as well. Optimistically, INTC shares have hit a new 52-week peak of $38, soaring +60% in the last three months. Fueling the rally, Intel has also received a $2 billion investment from Softbank SFTBY along with $5 billion from Nvidia NVDA as part of a deal to co-develop data centers and PC chips.

Image Source: Zacks Investment Research

Mining & Critical Metals

Lithium Americas – LAC: The government has taken a 5% stake in Lithium Americas and its Thacker Pass lithium project in Nevada, alongside a $435 million loan.

The Thacker Project is a joint venture with General Motors GM and is expected to become one of the largest sources of lithium in North America, with the element being essential for electric vehicle production and other technologies. LAC has soared more than +200% in the last three months, recently hitting an all-time high of $9 a share.

Lithium Americas is based in Vancouver, although President Trump has made surprising (and unrealistic) comments about Canada becoming the 51st state.

MP Materials – MP: Headquartered in Nevada, MP Materials produces rare earth minerals, and the investment here is actually at the discretion of the Pentagon. Aiming to counter China’s dominance in rare earth mineral extraction, the Pentagon has invested $400 million in MP Materials, becoming its largest shareholder with a 15% equity stake.

Using a provision from the Defense Production Act to bypass standard procurement laws, the Pentagon’s broader strategy is to secure domestic supply chains for rare earth elements that are used in Defense Systems, including production of the more stealthy and technologically advanced F-35 fighter jets.

In the last 90 days, MP has surged +130%, and is moving closer to its 52-week high of $82 a share.

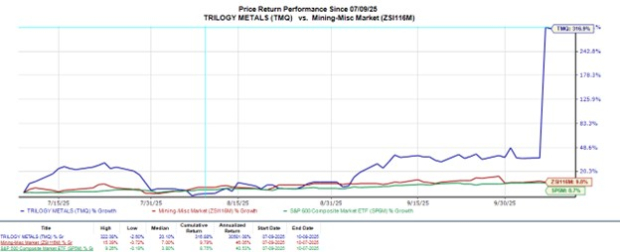

Trilogy Metals TMQ: Another Canadian mining company, the White House has acquired a 10% stake in Trilogy Metals to support the development of Alaska’s Ambler mining district, which is rich in copper, cobalt, and geranium.

With its projects primarily located in the Ambler mining district, Trilogy Metals’ stock has skyrocketed over +300% in the last three months, with TMQ trading near a one-year high of $7 a share.

Image Source: Zacks Investment Research

Bottom Line

These “White House” stocks all land a Zacks Rank #3 (Hold) at the moment, suggesting the potential improvement to their outlook could be favorable. Thanks to high investor sentiment, it wouldn’t be surprising if these stocks continued to rise, but there could be better buying opportunities ahead, considering their sharp rallies.

Beyond Nvidia: AI’s Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren’t likely to keep delivering the biggest profits. Little-known AI firms tackling the world’s biggest problems may be more lucrative in the coming months and years.

See “2nd Wave” AI stocks now >>

Intel Corporation (INTC) : Free Stock Analysis Report

MP Materials Corp. (MP) : Free Stock Analysis Report

Trilogy Metals Inc. (TMQ) : Free Stock Analysis Report

Lithium Americas Corp. (LAC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

SoftBank Group Corp. Unsponsored ADR (SFTBY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).