Tech stocks have been soaring lately thanks to excitement over new artificial intelligence (AI) technologies. Ever since the launch of OpenAI’s ChatGPT in late 2022, businesses have been ramping up spending on GPUs from Nvidia, new data centers, and general infrastructure to harness the power of generative AI and run AI models.

However, one big tech company is increasingly looking left behind. That’s Apple (NASDAQ: AAPL). Unlike peers Microsoft, Alphabet, Amazon, and Meta Platforms, Apple hasn’t drawn much attention to its large language models, and it hasn’t formed a meaningful AI partnership the way Microsoft has with OpenAI, or, to a lesser extent, Alphabet and Amazon have with Anthropic.

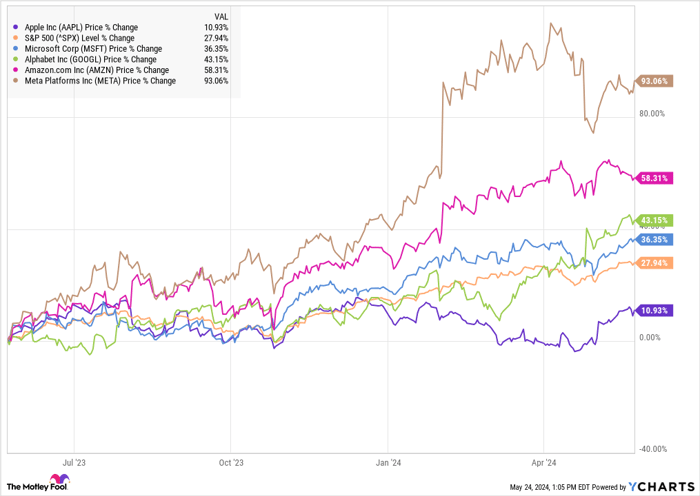

As a result, the stock has underperformed its peers over the past year.

While its peers have soared in the generative AI boom, Apple has been essentially range-bound, and it’s trailing the S&P 500 by a significant margin as well.

Can Apple get back on track, or are its best growth days behind it? Let’s look at where the company is today and where it will be another year.

Apple’s current challenges

Apple stock has grown in recent years, even as revenue has been nearly flat. The company has managed to grow earnings per share by expanding margin through growth in its higher-margin services segment and by buying back stock.

That trend was on display in its most recent quarter, as revenue fell 4% year over year to $90.8 billion. Sales in its product channel were particularly weak, down more than 10% in part because of challenges in China and extending iPhone upgrade cycles as customers delay new purchases.

Image source: Getty Images.

Earnings per share were flat in the quarter. The lack of growth comes at a time when the rest of the big tech sector is seeing top-line growth reaccelerate coming out of the tech bear market in 2022. Apple, meanwhile, has yet to report meaningful revenue from the Vision Pro, the spatial computing device it released in February, and it hasn’t found a way to monetize AI yet.

The company also pulled the plug on its decadelong autonomous vehicle project, known as Project Titan, a setback for the company and for investors hoping that it could have been Apple’s next breakthrough product.

What will change for Apple over the next year?

Apple’s business a year from now should be driven by the next iteration of the iPhone, the iPhone 16, and potential developments with the Vision Pro and artificial intelligence.

iPhone sales have a history of jumping every few years because of “supercycles” driven by significant upgrades, or pent-up demand. However, there don’t seem to be significant signs that a boom in iPhone sales is on the way.

Apple will hold its annual developer conference in June, and we could learn more about developments in AI and other innovations at the presentation. CEO Tim Cook had promised in February to reveal what the company is doing with AI earlier in the year so we could hear more at the World Wide Developer Conference (WWDC).

Considering it’s the leading consumer tech device maker, Apple has a whole product portfolio that could be improved with AI, including technologies such as Siri, but most of the company’s intentions in AI have been a mystery so far. Investors should expect more clarity on that over the next year.

Is Apple stock a buy?

Apple’s most recent earnings report makes it hard to justify the company’s price-to-earnings ratio of 30.

Revenue is falling, and the company’s primary product categories look mature. That landscape isn’t significantly different from where the company was a few years ago, and Apple stock has managed to be a winner growing the services business and raising prices on devices like iPhone. But that doesn’t seem like a strategy that can work forever.

Apple may wow investors at the WWDC next month, but assuming that will happen isn’t a good enough reason to buy the stock. At its current price, investors can find better stocks to own elsewhere.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

www.barchart.com

www.barchart.com  www.barchart.com

www.barchart.com  www.barchart.com

www.barchart.com