Editor’s note: “Say Hello to the $400 Billion AI Bazooka Aimed at the Market” was previously published in October 2025 with the title, “Say Hello to the $400 Billion AI Bazooka Aimed at the Market.” It has since been updated to include the most relevant information available.

The skeptics are getting louder again. They’ve got their charts, their bubble analogies, and their “AI stocks can’t keep this up” narratives. And yet – the market keeps proving them wrong.

Just look at this past month: OpenAI signed more than $400 billion worth of next-generation chip and compute deals with Nvidia (NVDA), AMD (AMD), Broadcom (AVGO), and Oracle (ORCL) – locking in over 26 gigawatts of GPU power for its coming models. Meanwhile, Big Tech’s AI capex continues to surge toward record highs.

It all underscores one simple fact: most of the money in the modern economy is still going to AI. That’s why AI stocks have been soaring… and why they’re likely to keep doing so.

When you follow the money, the trail doesn’t just point to AI; it leads straight to the beating heart of the global economy itself…

Big Tech Is the Global Economy

Let’s stop pretending otherwise: Big Tech doesn’t just influence the global economic order – they are the global economic order.

Nvidia, Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Meta (META), Broadcom, Taiwan Semiconductor (TSM), Tesla (TSLA) – the valuations alone tell the story.

All are trillion-dollar companies. If Nvidia and Microsoft were countries, they would rank as the fifth and sixth largest economies in the world, bigger than India, the U.K., France, Italy, Brazil, Canada, Russia, and Mexico.

And these are the behemoths that are going all-in on AI spending.

Not dabbling or cautiously allocating. They’re loading up a financial superweapon – what I call the AI Bazooka – and firing it almost exclusively at expanding AI infrastructure.

The AI Capex Explosion

The numbers are staggering. Let’s start with Meta.

In 2022, the company spent about $32 billion on servers and data centers. This year, analysts expect spending to approach $40- to $45 billion, with AI infrastructure being the biggest driver.

And it isn’t alone.

Microsoft’s annual capex has nearly doubled since the pandemic, topping $50 billion, and guidance suggests it could push higher as AI cloud demand accelerates.

Alphabet has boosted annual capex from roughly $25 billion in 2021 to more than $50 billion in 2025, with a majority directed at AI compute and data centers.

Amazon remains the heavyweight: consensus estimates peg AWS-related spending above $70 billion this year.

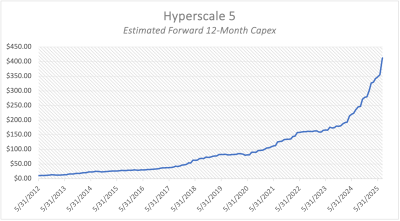

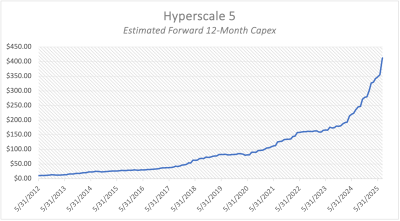

Together, the “Hyperscale Five” are projected to exceed $250- to $300 billion in annual AI-related capex – a dramatic leap from under $150 billion in 2022.

That means that in less than three years, we’ve seen a 2.5x increase – and it’s still accelerating. Just look at that chart above. Like AI stock prices, it’s going vertical.

And just when it looked like the hyperscalers were maxing out their budgets, OpenAI stepped in and turned the spending dial to 11…

The OpenAI Effect: Supercharging the AI Arms Race

According to recent reporting from Yahoo Finance, OpenAI has inked a series of massive hardware deals worth up to 26 gigawatts of GPU capacity… enough computing power to run more than 20 million homes.

In September, the ChatGPT creator signed a landmark agreement with Nvidia, which will invest up to $100 billion in OpenAI in exchange for the company buying roughly 10 gigawatts of GPUs over the next several years. The first deployment will begin in the second half of 2026, when Nvidia rolls out its next-generation Vera Rubin superchips.

Not stopping there, OpenAI also struck a deal with AMD, purchasing a stake equal to about 10% of the chipmaker in return for another 6 gigawatts of GPU supply. Those will also arrive in 2026, when AMD launches its MI450 series.

And just this week, OpenAI announced yet another blockbuster partnership – a 10-gigawatt co-development deal with Broadcom to design and deploy custom AI accelerators purpose-built for OpenAI’s next-generation models.

Add in OpenAI’s $300 billion “Stargate Project” with Oracle, which includes another 4.5 gigawatts of compute, and the scale becomes clear: this is the largest private buildout of computing capacity in human history.

All told, these commitments represent an unprecedented wave of spending that could reshape global chip, data center, and energy markets. And they underscore a simple truth: AI infrastructure is the new oil.

What Makes This Different From Any Other Spending Cycle

Tech spending cycles are nothing new. But this is different in three important ways:

- The Scale – These companies aren’t just big. They are the largest profit-generating entities in human history. Their capex increases aren’t measured in percentages. They’re measured in entire GDPs of small countries.

- The Focus – Nearly every incremental dollar is going into AI infrastructure – data centers, chips, networking, power, cooling. One sector, full blast.

- The Flywheel – AI infrastructure enables better AI models, which drive more products, which generate more revenue, which funds more infrastructure. This is compounding growth in action.

That’s why I call it the AI Bazooka. It’s the concentrated firepower of the world’s richest corporations, aimed squarely at one target: AI dominance.

Where the AI Bazooka Money Lands

All that money has to find a home, and Wall Street has been more than happy to receive it. The beneficiaries are spread across the entire AI supply chain.

- Raw Materials: Rare earths supplier MP Materials (MP) is up 450% year-to-date.

- Chips & Foundries: Nvidia is up more than 1,200% in five years; Taiwan Semi has risen about 280% since ChatGPT’s launch in November 2022 and is hitting record revenues (~$30.1 billion).

- Memory & Storage: Micron (MU), Western Digital (WDC), Seagate (STX) are all breaking 52-week highs.

- Semiconductor Equipment: ASML (ASML), Lam Research (LRCX), Applied Materials (AMAT) are selling the pickaxes in this gold rush.

- Networking & Optics: Astera Labs (ALAB) – up 175% since April – Arista (ANET), Marvell (MRVL), Rambus (RMBS) are critical for AI’s high-speed data pipes.

- Power & Cooling: Vistra (VST), Quanta Services (PWR), and Eaton (ETN) benefit as data centers strain grids and cooling demand surges.

This is the blast radius of the AI Bazooka. These stocks have been winning, and so long as the bazooka keeps firing, they’ll keep rising.

Why This AI Spending Boom Won’t Stop

The big question: Is this just a temporary surge, or a sustained trend?

In our view, it’s only just getting started.

Over $400 billion is expected to pour into AI infrastructure in the next 12 months. By 2030, analysts expect annual AI-related capex to approach $1 trillion. The more compute power deployed, the more indispensable AI becomes. This cycle reinforces itself.

So, when pundits say AI stocks can’t keep going up, they’re ignoring the single biggest capital allocation trend in the world.

It’s not just that Big Tech wants to dominate AI. They must. The competitive stakes are existential. The company with the most compute wins the AI race. That’s why they’re emptying their vaults into chips, data centers, and power grids.

Wall Street isn’t dumb. It follows the money. And right now, the money – all the money – is headed into AI.

Naturally, some analysts are starting to question whether this scale of spending is sustainable – or if we’re witnessing an AI version of the dot-com bubble. The concern is that the industry might “overbuild” before demand fully catches up.

But as experts like Ram Bala of Santa Clara University recently told Yahoo Finance, long-term demand will almost certainly justify the investment. In other words: even if there’s a short-term mismatch, the payoff will come – and the companies building today’s infrastructure will control tomorrow’s AI economy.

The Bottom Line on AI Stocks

The AI Bazooka is locked, loaded, and firing hundreds of billions of dollars into one of the most powerful technological buildouts in history. The winners are clear: AI infrastructure stocks, from chipmakers to cooling providers, are riding the blast wave.

As long as Big Tech keeps spending (and they will), these stocks will keep ripping higher. The skeptics can cling to their valuation charts and bubble metaphors. The rest of us will follow the money.

Because in this market, the AI Bazooka always finds its target. And my goal is to help you lock in before it explodes on impact, sending primed AI stocks ever higher.

Next week, I’m presenting my brand new AI Market Update at the 2025 Stansberry Conference in Las Vegas. In-person tickets are sold out, but you can still see all the action from the comfort of your own home with a Livestream Pass.

This conference is the marquee event held by our friends and corporate affiliate Stansberry Research.

I’ll be speaking on the main stage with dozens of other incredible experts from the finance and tech industry – names you’ll surely recognize like famed journalist and author Kara Swisher, Dr. Peter Diamandis, CNBC‘s Josh Brown, Marc Chaikin, Dr. David Eifrig, and crypto whiz Eric Wade.

In addition to fantastic ideas, speakers will also share their top stock recommendations… You do not want to miss this!

A Livestream Pass allows you to log in to the event right from your phone or laptop – no travel required… and at a fraction of the cost.

Click here to get your discounted Livestream Pass to watch us live from Vegas.