Three years ago, the world changed – but few realized how important a day it was.

On November 30, 2022, ChatGPT was released to the public … and the AI era was born.

Seemingly overnight, AI went from the realm of science fiction to the center of everyday life and ignited one of the most powerful technological revolutions in history.

AI has become the driving force behind nearly every major innovation story on Wall Street – from chipmakers to data centers to software firms.

Just look at NVIDIA Corporation (NVDA). The dominant maker of graphics processing units (GPUs) has seen its stock price rise nearly 1,100% since then.

And investors who acted early made a fortune.

Now, in my four-decade career, I’ve made a habit of finding game-changing market trends early thanks to my proprietary system. NVIDIA included.

But here’s the key point: the AI Revolution isn’t finished.

Far from it.

AI and AI data center stocks have dominated the market again this year, carrying the bulk of the S&P’s gains in 2025.

But I’ve already started to see some changes. The market is evolving.

If there’s one thing I’ve learned in my career, it’s that you always need to be looking for “the next big thing.”

And we’re standing on the edge of the next chapter of investing … and this new technology could redefine the entire AI Revolution.

It’s called quantum computing.

In today’s Market 360, I’ll explain why quantum computing is shaping up to be the next phase of the AI Revolution and how I identified these early leaders. I’ll even share one of my favorite quantum picks today.

And I’ll tell you how my colleague Jonathan Rose’s trading strategy can help you amplify opportunities like this.

From Microchips to Qubits

Throughout my career, I’ve built quantitative models to find where the big money is moving before Wall Street catches on.

In the 1980s, that meant semiconductor stocks at the dawn of personal computing.

In the 1990s, it was the first wave of internet leaders.

In the 2000s and 2010s, it was clean energy, cloud software and the early stages of AI.

Each era brought a new technology that changed how the world works – and rewarded investors who recognized it early.

Now, I believe we’re standing at the start of another transformation. Quantum computing could do for the next decade what the microchip did for the last fifty years.

See, traditional computers handle data in bits – ones and zeros. Quantum computers use qubits, which can represent multiple states simultaneously. That gives them exponentially greater power for solving complex problems.

For AI, that means faster learning, more advanced simulations, and the ability to process vast datasets that today’s supercomputers can’t handle.

Quantum computing could accelerate the AI Revolution – tackling problems ranging from clean energy to medical breakthroughs.

The investing public is only just starting to catch on. But I’ve been talking about this breakthrough since the summer of 2024, when few people were paying attention.

Back then, I called quantum computing the missing link that could take machine learning and data processing to an entirely new level. I even released several reports for my readers exploring the early players in this space – purely as speculative research ideas, not formal portfolio holdings.

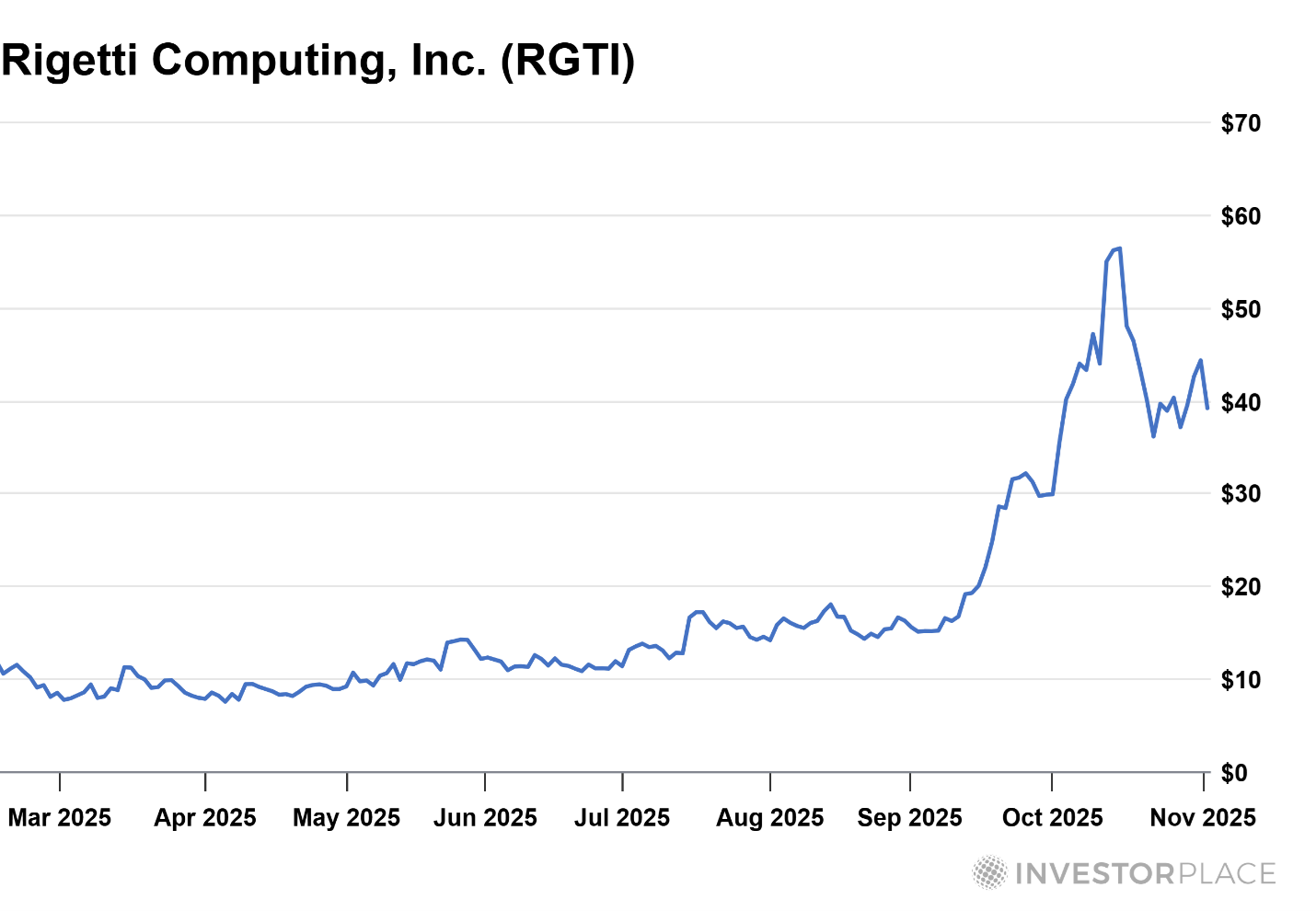

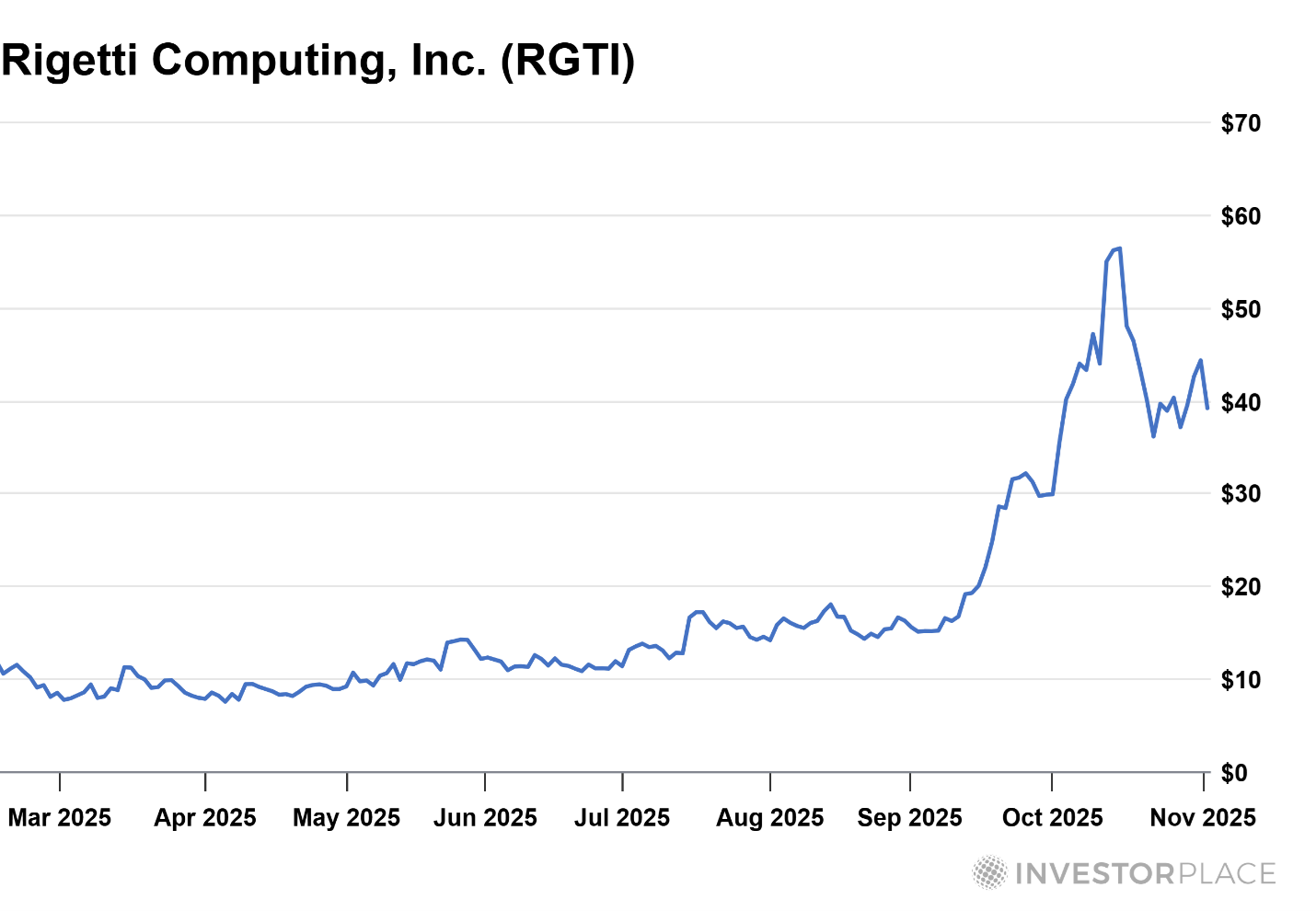

One of those names was Rigetti Computing (RGTI).

I highlighted it in February 2025 as a small but promising company building cloud-based access to its own quantum processors. Since then, Rigetti’s stock is up about 213%.

That’s an impressive move for a moonshot company. And it’s currently rated a B in my proprietary Stock Grader system, making it a “strong” stock.

But like any emerging field, these stocks are volatile. Their moves can be fast, sharp and unpredictable. That’s exactly what makes them exciting – and challenging – for investors.

But here’s the incredible part: a colleague of mine, veteran trader Jonathan Rose, found a way to turn that same setup into a 233% gain in just four days.

Jonathan Rose: The Newest Member of Our Team

Jonathan and I both watch the same trends shaping the market, but we approach them from very different angles.

While I look for strong fundamentals and institutional buying pressure that can lift a stock over months or years, Jonathan looks for where traders are positioning their money right now.

He’s been doing it for more than 25 years – first as a floor trader on the Chicago Mercantile Exchange and later as a market maker on the Chicago Board Options Exchange. During the 2007–2008 financial crisis, he made more than $6 million by understanding how volatility moves through the market.

He has since built a community of everyday traders who follow his research and trading strategies. And in December 2024, his system detected a surge of trading activity around the stock. Within just days, his followers were able to capture a 233% profit.

Same story. Different playbook.

That’s what makes Jonathan’s approach such a powerful complement to mine.

I’ve always said that speculative stocks can be worthwhile – as long as you treat them like what they are: high-risk, high-reward “lottery ticket” ideas. Quantum computing fits that description perfectly.

What Jonathan has shown is that you don’t have to sit on those ideas for years, hoping they eventually pay off. His trading strategy gives you a way to act on the volatility directly – taking advantage of short bursts of momentum to potentially capture big profits in a fraction of the time.

It’s a faster, more tactical approach that can pair beautifully with ideas like quantum computing. Because while these companies are still in their early days, with Jonathan’s strategy, you can trade around them to maximize your returns.

Join Me and Jonathan on November 10

Between the Federal Reserve’s new rate-cutting cycle and the next wave of innovation in AI and quantum computing, I believe we’re entering one of the most promising environments for active traders in years. Volatility is returning, and that’s when disciplined systems tend to shine.

That’s why I’m teaming up with Jonathan Rose, Eric Fry and Luke Lango for a special event next week.

It’s called The Profit Surge Event, and it’s happening Monday, November 10, at 1 p.m. Eastern.

In it, Jonathan will show how his trading strategy can boost potential gains by 500% or more on the very same ideas Eric, Luke and I are following – including my latest quantum pick.

When you sign up, you’ll get all three of our top stock ideas for free (including my latest quantum pick) and see firsthand how to make the most of this powerful market window.

Go here to reserve your free spot now.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)