Everybody loves dividends, as they provide a passive income stream, limit drawdowns in other positions, and provide more than one way to profit from an investment.

And when considering dividend-paying stocks, those with a history of boosting their payout are prime considerations, reflecting their commitment to increasingly rewarding shareholders.

And when it comes to a consistent history of increased payouts, look no further than the Dividend Aristocrats. Coca-Cola KO, Caterpillar CAT, and McDonald’s MCD all belong to the elite group. Let’s take a closer look at each.

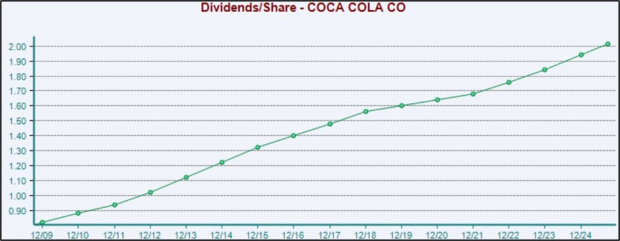

Coca-Cola

KO is a a member of not only the elite Dividend Aristocrats group, but the Dividend Kings group as well, further underpinning its dividend reliability. As shown below, the company has rewarded its shareholders handsomely for years.

Shares currently yield a solid 2.8% annually, with the company sporting a 4.8% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

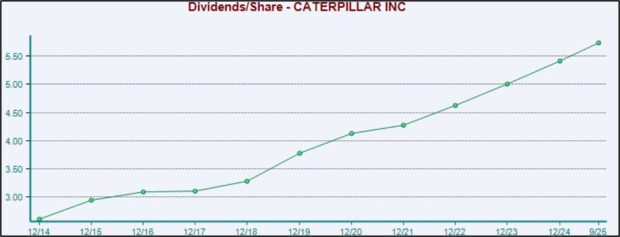

Caterpillar

Caterpillar is the world’s largest construction equipment manufacturer. We see its iconic yellow machines at nearly every construction site.

CAT shares currently yield 1.0% annually, undoubtedly on the lower side of things. But while the current yield may be on the lower end, Caterpillar’s 8.2% five-year annualized dividend growth rate picks up the slack.

Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

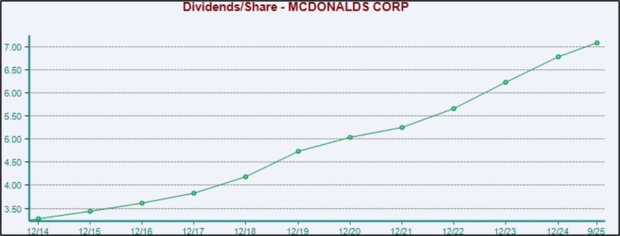

McDonald’s

We’re all familiar with the restaurant titan McDonald’s, seeing those golden arches at seemingly every stop. MCD shares presently yield 2.3% annually, paired with an 8.2% five-year annualized dividend growth rate.

Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

Bottom Line

Everybody loves dividends, essentially investors’ form of payday. They can help limit drawdowns in other positions and provide a passive income stream, two key traits that all market participants enjoy.

And for those seeking companies with a consistent history of steady payouts, all three above – Coca-Cola KO, Caterpillar CAT, and McDonald’s MCD – fit the criteria.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Caterpillar Inc. (CAT) : Free Stock Analysis Report

CocaCola Company (The) (KO) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).