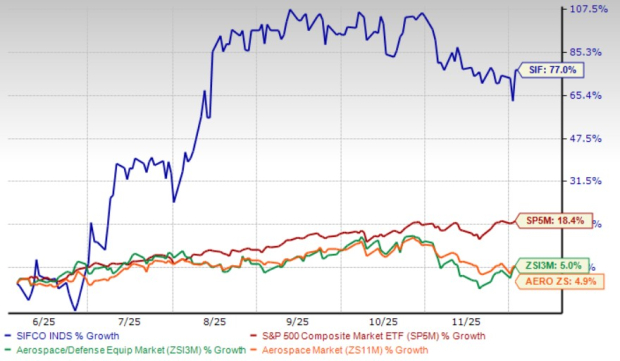

SIFCO Industries, Inc.’s SIF investors have been experiencing some short-term gains from the stock of late. Shares of the Cleveland, OH-based manufacturer of forgings, sub-assemblies and machined components (primarily serving the aerospace and energy or A&E markets) have surged 77% in the past six months compared with the industry’s 5% rise. The stock also outperformed the sector and the S&P 500’s 4.9% and 18.4% gains, respectively, in the same time frame.

A major development of SIF in recent months includes the announcement of its promising third-quarter fiscal 2025 results in August. In the fiscal third quarter, the company posted a strong increase in both revenue and earnings. Profitability improved sharply despite only a modest rise in sales, highlighting significant operational efficiencies and disciplined cost control.

Management noted that demand for SIFCO’s forged and machined components remained solid, supported by higher production from A&E-sector customers. While raw-material availability improved compared with earlier periods, lingering supply-chain constraints continued to cap shipment volumes.

SIF’s Six Months Price Comparison

Image Source: Zacks Investment Research

Over the past six months, the stock’s performance has remained strong, outperforming that of its peers like Optex Systems Holdings, Inc OPXS and Park Aerospace Corp. PKE. Optex and Park Aerospace’s shares have gained 55.9% and 41%, respectively, in the same time frame.

Despite several challenges within the aerospace industry, including widespread supply chain weaknesses and the complexities of navigating rapid digitalization and new technologies, the favorable share price movement indicates that the company might be able to maintain its positive market momentum at present.

SIFCO specializes in forging, heat-treating, chemical processing and machining services, catering to original equipment manufacturers, Tier 1 and Tier 2 suppliers and aftermarket service providers. These multiple growth drivers reflect robust growth potential.

SIF’s Strong Fundamentals Weigh In

SIFCO continues to ride a favorable demand setup in its core A&E markets. Management says end users are increasing production, which is keeping orders for the company’s forged and machined components resilient. Raw-material availability has improved versus earlier periods, easing some bottlenecks, and pricing discussions with customers have generally been favorable. Even with a few lingering supply-chain constraints that can still temper shipment flow, the overall demand tone remains constructive.

SIF’s second driver is stronger forward visibility from an expanding backlog. The company reports a higher year-over-year order backlog, helped primarily by recovery in aerospace markets and broader program activity. This suggests SIFCO is capturing bookings across multiple platforms and provides a clearer runway for production and deliveries over the next several quarters. The backlog build, alongside improving sales trends in key aerospace categories, supports confidence in near-term revenue conversion.

SIFCO has materially improved its strategic and financial footing following portfolio streamlining and refinancing. It exited its non-core European CBlade operation to refocus on domestic aerospace forging, and used proceeds plus new financing to repay prior credit agreements. Management indicates these actions resolved earlier going-concern uncertainty and strengthened liquidity, leaving a leaner structure better positioned to leverage rising volumes. Recent margin and profit improvement further reinforces the benefits of this refocus.

Challenges Ahead for SIFCO

SIFCO still faces a couple of hurdles that could temper momentum. First, while demand is solid, management notes that lingering supply-chain constraints can still restrict shipment volumes, so converting orders into revenue may remain uneven. Second, despite refinancing progress, the capital structure remains sensitive to lender terms because the revolver and term loan carry covenants and a collateral-value acceleration feature that keeps most debt classified as current, sustaining liquidity and compliance pressure.

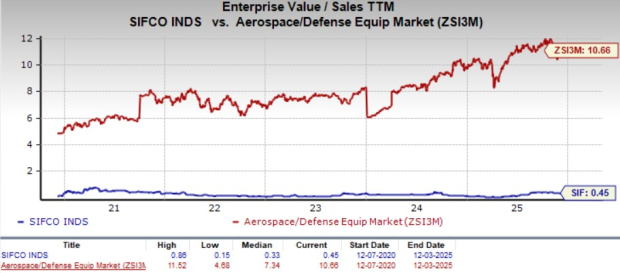

SIF Stock’s Valuation

SIFCO’s trailing 12-month EV/Sales of 0.5X is lower than the industry’s average of 10.7X but higher than its five-year median of 0.3X.

Image Source: Zacks Investment Research

Optex and Park Aerospace’s trailing 12-month EV/Sales currently stand at 2.4X and 5.2X, respectively, in the same time frame.

Our Final Take on SIFCO

There is no denying that SIFCO sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The stock’s strong core growth prospects present a good reason for existing investors to retain shares for potential future gains. New investors may get motivated to add the stock following the current uptrend in share prices.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. However, if investors are already holding the stock, it would be prudent to hold on to it at present.

Zacks’ Research Chief Picks Stock Most Likely to “At Least Double”

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>

Park Aerospace Corp. (PKE) : Free Stock Analysis Report

SIFCO Industries, Inc. (SIF): Free Stock Analysis Report

Optex Systems Holdings Inc. (OPXS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).