Ford Motor Company (NYSE: F) recently unveiled its fourth-quarter sales data, signaling significant progress in electric vehicle (EV) sales. However, this comes at a cost, with billions in near-term losses. While the losses are substantial, there is a silver lining for Ford investors amidst the current turbulence.

Digging into the Data

In 2023, Ford’s U.S. sales surged by 7.1%, reaching nearly 2 million vehicles. Notably, this growth was propelled by robust performance in its F-Series full-size trucks, commercial vehicles, and a record-breaking year in EV sales.

Ford’s F-Series, a key revenue driver, maintained its stronghold as America’s best-selling truck for the 47th consecutive year and the best-selling vehicle for the 42nd consecutive year. The company’s success with the F-150 Lightning as the top-selling electric truck and the F-150 Hybrid as the leading full-size hybrid truck demonstrates its favorable position to transition its dominance in gasoline-powered trucks to the realm of EVs.

The EV Impetus

Further substantiating its progress, Ford’s EV sales witnessed a record surge in the fourth quarter, with sales of nearly 26,000 vehicles, marking a 24% increase from the previous quarter. The strong performance was driven in large part by the F-150 Lightning, which experienced a substantial 74% increase in sales compared to the previous year’s fourth quarter, and a commendable 55% increase for the full year. This exemplary achievement secured Ford’s position as the No. 2 EV brand in America for 2023.

Data source: Ford Motor Company presentation.

Navigating the Gloom

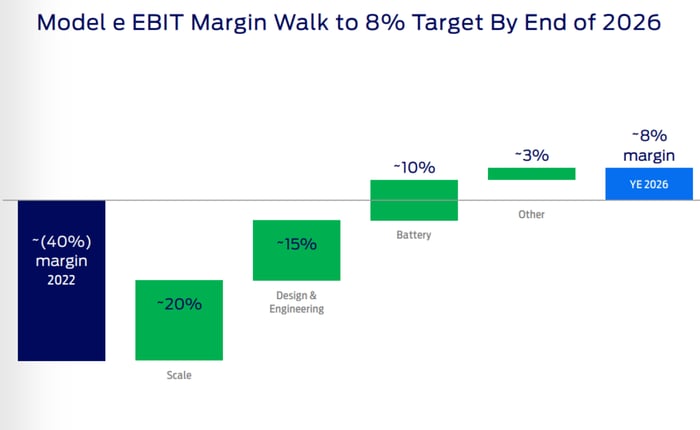

Despite the remarkable sales surge in EVs, Ford continues to grapple with substantial losses, with its EV business unit, Model e, anticipated to incur approximately $4.5 billion in losses in 2023. Management projects that these challenges will persist until the end of 2026, when they foresee a shift towards profitability, but the path to recovery necessitates persevering through the current hardships.

With a strategic focus on achieving 8% EBIT margins by the conclusion of 2026, Ford aims to derive the majority of margin gains from scaling production and sales, complemented by advancements in design, engineering, and reduced battery costs.

The Road Ahead

While Ford concluded 2023 with a surge in sales, the company anticipates further growth in 2024, primarily driven by its robust performance in full-size trucks and SUVs. The upcoming launch of new F-150s, Rangers, Explorers, Expeditions, as well as Lincoln Aviators, Navigators, and Nautilus, is poised to fortify Ford’s market presence.

Amid headlines about Ford’s substantial EV-related losses, the company’s continued emphasis on achieving record-breaking EV sales serves as a pivotal element in expediting its journey towards profitability. Despite current setbacks, Ford’s resolute commitment to scale its EV business underscores its long-term vision for success.