With the fourth quarter earnings season underway, two financial investment conglomerates that are garnishing much attention are BlackRock (BLK) and Goldman Sachs (GS).

After BlackRock impressively surpassed its Q4 earnings expectations on Friday, investors are surely wondering if Goldman Sachs can do the same when it reports its quarterly results next Tuesday, January 16. Let’s explore whether now is a good time to buy stock in either of these finance titans.

BlackRock Q4 Review

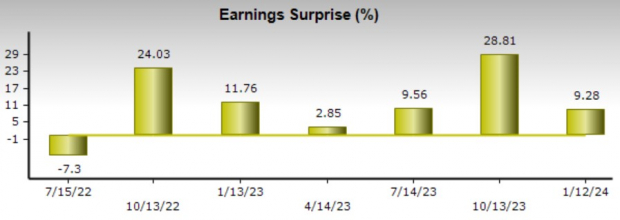

BlackRock posted fourth quarter earnings of $9.66 per share which topped the Zacks Consensus of $8.47 a share by 9% and rose 8% year over year. On the top line, Q4 sales of $4.63 billion slightly topped estimates of $4.62 billion and spiked 7% from the prior-year quarter. Notably, BlackRock has now exceeded earnings expectations for six consecutive quarters.

Image Source: Zacks Investment Research

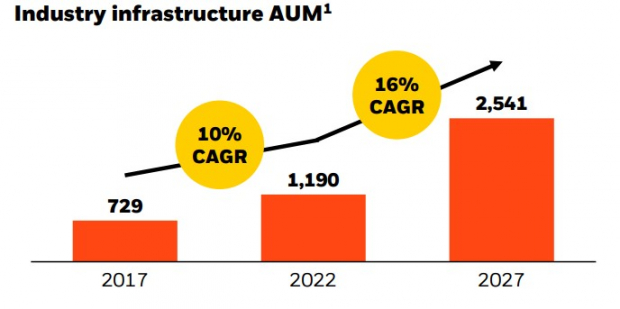

The favorable Q4 results were accompanied by news that BlackRock would acquire Global Infrastructure Partners GII for around $12 billion. The deal will create a leading infrastructure platform valued at over $150 billion, well-positioned to meet fast-growing investor demand with Global Infrastructure Partners being a leader among independent infrastructure fund managers.

CEO Larry Fink called the deal transformational as infrastructure is forecasted to be one of the fastest-growing segments of private markets.

Image Source: BlackRock Q4 Investor Presentation

Goldman Sachs Q4 Preview

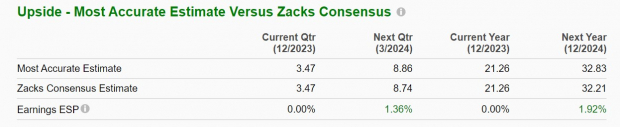

Investors will be hoping Goldman Sachs’ Asset & Wealth Management segment keeps helping the company expand amid a recovery in capital markets. According to Zacks estimates, Goldman Sachs’ Q4 earnings are anticipated to rise 4% to $3.47 per share with sales projected to be up 1% to $10.71 billion.

The Zacks ESP (Expected Surprise Prediction) does indicate Goldman Sachs should reach earnings expectations with the Most Accurate Estimate also having Q4 EPS at $3.47 a share and on par with the Zacks Consensus.

Image Source: Zacks Investment Research

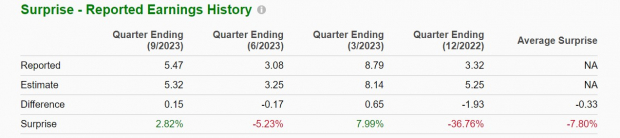

Goldman Sachs most recently topped Q3 earnings expectations by 3% in October with EPS at $5.47 per share but has also missed estimates twice in its last four quarterly reports.

Image Source: Zacks Investment Research

Bottom Line

At the moment, BlackRock’s stock currently sports a Zacks Rank #2 (Buy) with Goldman Sachs landing a Zacks Rank #3 (Hold). Both investment management firms should be able to sustain their robust top and bottom line figures, and BlackRock stands out after beating earnings expectations for a sixth consecutive quarter.