Large-cap stocks are often the bedrock of an investor’s portfolio. They exude stability, a testament to their long-standing track record and penchant for consistent dividends. While small-cap stocks can be exhilarating, large-caps are the reliable, well-groomed old-timers at the stock market gala. The big names like Target TGT, Cardinal Health CAH, and Arista Networks ANET have been gaining traction among investors for their promising growth.

Arista Networks: Riding the AI Wave

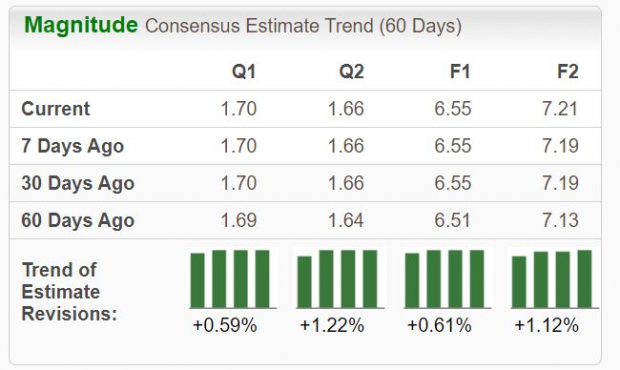

Arista Networks has been leveraging the AI craze to great effect. The company specializes in network switches for hyperscalers, enhancing the inter-server communications. It holds a favorable Zacks Rank #2 (Buy), with all signs pointing to a continued upward trajectory.

The company’s growth profile is nothing short of impressive, with consensus estimates for the current fiscal year painting a portrait of 43% earnings growth on a 33% surge in sales. The crescendo is set to continue into FY24, with estimates hinting at a further 10% earnings uptick accompanied by an 11% revenue climb.

Target: From Bricks to Clicks

Target’s evolution from a purely brick-and-mortar retailer to a versatile omni-channel entity has been a boon for its investors. Sporting a Zacks Rank #2 (Buy), the company’s earnings estimates have been scaling new heights, promising a robust profitability picture for the current fiscal year, with consensus estimates touting 40% earnings growth.

The cherry on top is its substantial dividend yield, currently at a market-beating 3.1%. As a testament to its shareholder-friendly stance, Target boasts a substantial 15% five-year annualized dividend growth rate.

Cardinal Health: A Pillar of Strength

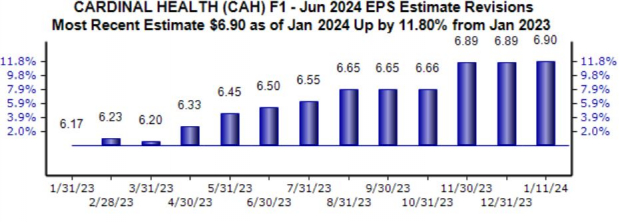

Cardinal Health’s prowess as a nationwide drug distributor and service provider to pharmacies and healthcare entities has propelled it to a Zacks Rank #2 (Buy). The revisions trend for its current fiscal year bears a particularly robust momentum, up 12% over the last year.

The consensus expectations for the current fiscal year augur a 20% surge in earnings on a 10% spike in sales. The future looks equally promising, as FY25 estimates indicate an additional 12% earnings growth paired with an 8% revenue climb. The company has demonstrated its mettle, surpassing both earnings and revenue expectations in each of its last five releases.

Bottom Line

Large-cap stocks are the cornerstones of countless portfolios. Their stability and proven track records make them indispensable. For investors eyeing large-cap exposure, the buoyant outlooks for all three stocks – Target TGT, Cardinal Health CAH, and Arista Networks ANET – make them earnest contenders for a spot in their portfolios.

Investors in today’s market are like gold prospectors of yore, seeking the next mother lode of value. The allure of lithium batteries is akin to the gold rush, with the electric vehicle revolution fueling exponential demand. Millions of lithium batteries are being churned out, and the potential for an 889% surge in demand is electrifying. As investors seek to capitalize on this trend, the opportunity for enormous gains is palpable.

For the savvy investor, the potential prosperity hinged on the lithium boom is too compelling to ignore. The stage is set for a new era of wealth creation – an era where keen foresight mirrors the prescience of the gold rush fortune-seekers.