Earnings season always provides a dramatic peek behind the corporate veil, offering investors a tantalizing glimpse of what lies beneath the surface. With the big banks already disclosing their results, the pace of revelations is set to quicken, drawing attention to major players such as Morgan Stanley, PPG Industries, and Taiwan Semiconductor.

Morgan Stanley

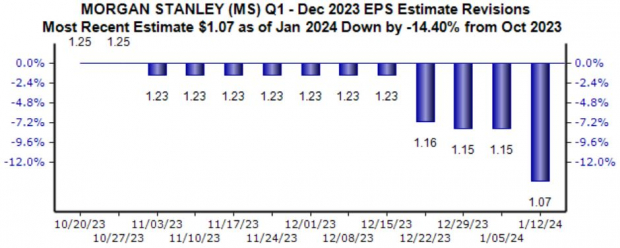

Renowned as a leading financial services powerhouse catering to individuals, governments, and corporations worldwide, Morgan Stanley has consistently outperformed earnings expectations in recent times. However, analysts’ downbeat stance ahead of its upcoming report reveals a nearly 15% decline in the Zacks Consensus EPS Estimate since October last year, indicating an 18% retreat from the previous year’s corresponding period.

Image Source: Zacks Investment Research

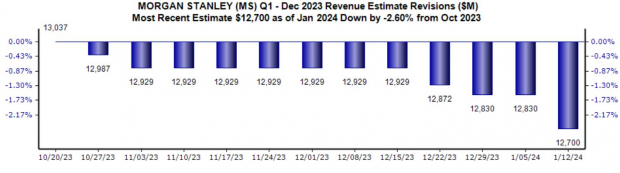

Although top-line revisions haven’t been as drastic, the expected quarterly revenue of $12.7 billion reflects a nearly 3% reduction from the initial projection, hinting at a marginal 0.4% year-over-year pullback.

Image Source: Zacks Investment Research

PPG Industries

A global supplier of paints, coatings, chemicals, and specialty materials, PPG Industries has delivered a mixed bag of quarterly results, falling short of revenue expectations in two out of its last four reports. Despite this, the company has consistently surpassed the Zacks Consensus EPS Estimate, boasting an average beat of almost 9%.

Image Source: Zacks Investment Research

Analysts haven’t significantly adjusted their expectations for PPG Industries’ upcoming quarter, with the Zacks Consensus EPS Estimate nudging just 0.7% above October’s figure. Meanwhile, projections for a 22% year-over-year earnings surge remain steadfast, with a mere 0.6% drop anticipated in quarterly sales, reflecting 2% growth year-over-year.

Taiwan Semiconductor

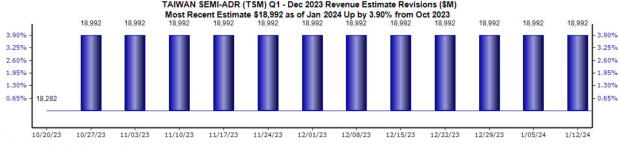

As the world’s largest integrated circuit foundry, Taiwan Semiconductor has outstripped the Zacks Consensus EPS Estimate for 12 consecutive quarters. Analysts have maintained an uncharacteristic silence on the company’s imminent release, holding the EPS estimate steady since last October. However, bullish revisions have emerged on the revenue front, with an expected 4% uptick to $19 billion in quarterly sales alongside predicted earnings and revenue declines of 26% and 5% respectively.

Image Source: Zacks Investment Research

Bottom Line

The stage is set for a riveting earnings season with Morgan Stanley, PPG Industries, and Taiwan Semiconductor taking center stage this week. As the financial world eagerly awaits these quarterly performances, investors are advised to tread with caution and brace themselves for potential market turbulence. While these reports may unlock opportunities, they also carry inherent risks, and a prudent approach is essential. Cautious optimism and careful analysis will be the watchwords for investors navigating the capricious waters of earnings season.