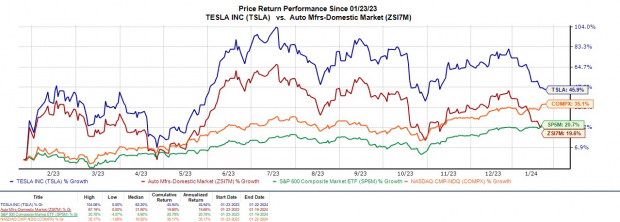

Tesla’s TSLA stock has experienced a significant -15% decline since the start of 2024, but is it time to seize this opportunity before the earnings report?

Image Source: Zacks Investment Research

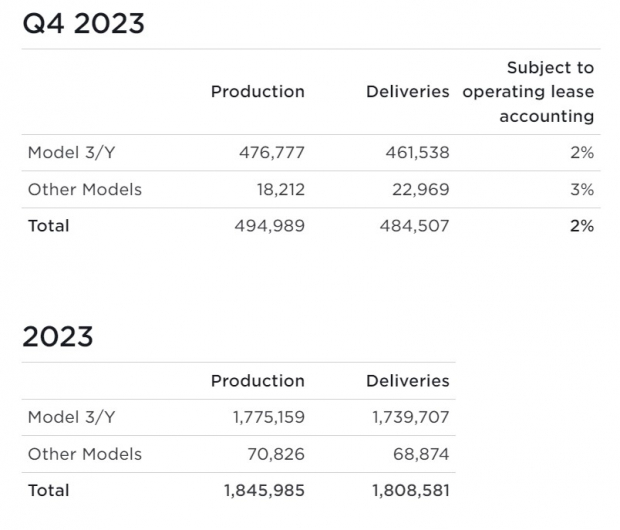

Deliveries & Market Share

In Q4, Tesla achieved 484,507 deliveries, reinforcing its position as a global EV leader. The company maintains a stronghold on the domestic market, surpassing competitors like General Motors GM and Ford F. The strong quarterly deliveries were driven by the popularity of Tesla’s Model Y and Model 3, which continue to outsell rival electric vehicles in the United States.

Image Source: Tesla Investor Relations

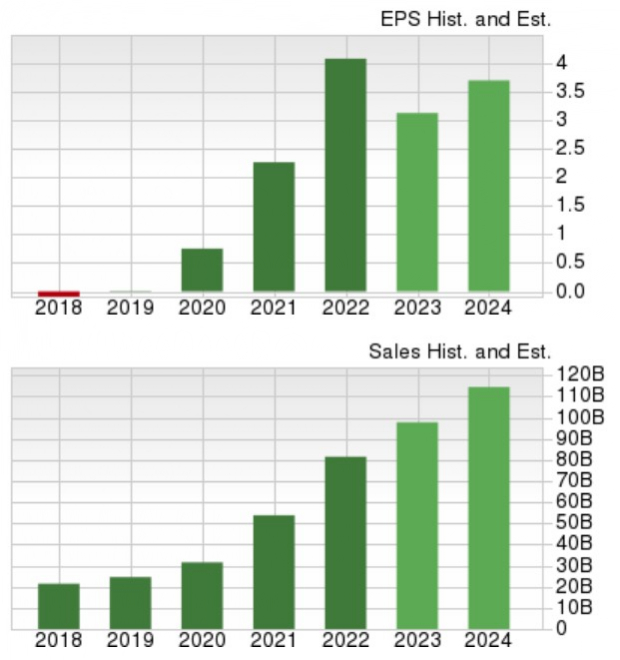

Q4 Financial Preview & Outlook

Despite another record for annual deliveries, Tesla’s Q4 earnings are projected to decline to $0.74 per share, reflecting the company’s emphasis on offering a more affordable EV lineup. Quarterly sales are expected to rise by 6% to $25.94 billion, despite the anticipated decrease in profitability.

Image Source: Zacks Investment Research

Tesla’s Valuation is More Reasonable

Following the recent selloff, Tesla’s forward earnings multiple has become more reasonable, standing at 55.5X, which is significantly lower than its historical highs. Additionally, the price-to-sales ratio of 5.7X is a marked reduction from the previous year’s peak and median levels.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

As Tesla prepares to disclose its Q4 financial results, its stock has the potential for further growth. Despite the recent correction, the company remains an intriguing growth stock, especially for long-term investors, and is currently adorned with a Zacks Rank #2 (Buy).