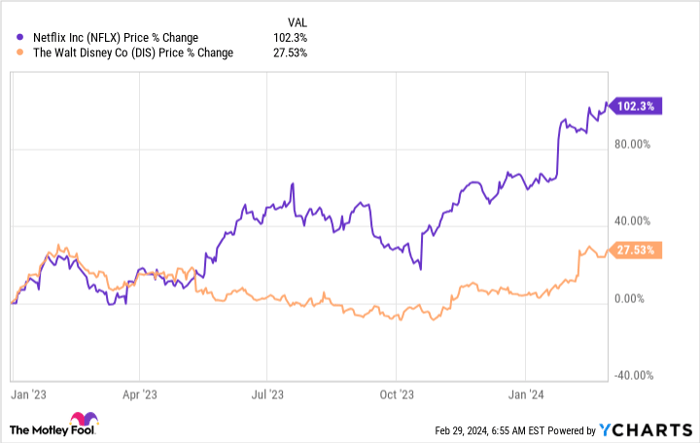

My skepticism towards Netflix (NASDAQ: NFLX) has been a long-standing companion, but 2023 marked a turning point for me. The urge to replace my market-losing position in Walt Disney (NYSE: DIS) became irresistible after its recent rally, leading to my casual entry into Netflix shares, belated albeit, just as the streaming giant was on a winning streak.

The traditional media industry is in disarray, save for Netflix. What exactly was the factor that tipped the scales for me to invest in Netflix despite its stock doubling in the past year?

Data by YCharts.

The Dawn of Profitability for Netflix

For years, my reluctance stemmed from Netflix’s lack of profitability, despite being a subscriber myself. While GAAP net income figures glimmered, the crunch of free cash flow, a metric that encompasses content creation costs, left Netflix wanting.

But behold, the grand shift arrived in 2023. Netflix, coming of age, embraced profitability across all measures in the past year. Free cash flow now outpaces GAAP net income, signifying a monumental shift.

Data by YCharts.

The market swiftly recognized Netflix’s financial uptick, propelling its stock price skyward, especially since the onset of 2023. With shares commanding a premium at 50 times trailing 12-month earnings and nearly 40 times free cash flow, one might argue that it’s too late to join the Netflix party.

A Lucrative Future: Years of Prosperous Expansion Await

Netflix continues to witness growth in its subscriber base, unbound by international borders that constrict traditional TV networks. Years of investment in diverse content have positioned Netflix as a frontrunner. The subscriber count swelled by 13% year over year, breaching 260 million in Q4 2023.

Despite the modest slice of global screen time it commands, single digits across key markets, Netflix’s trajectory remains skyward. Rising subscription prices, coupled with nascent ventures into ads, pave the way for a quasi-cable model, allowing consumers to curate their viewing experiences.

Management’s vision to bolster profit margins and the projection of sustaining a comparable $6 billion free cash flow from 2024 indicate a financially robust Netflix. Shareholders have reaped rewards, with $6 billion in cash returned via stock repurchases in the prior year.

In essence, Netflix emerges from the bearish shadows as a thriving, profit-churning media powerhouse. I envisage augmenting my Netflix stock holdings as the year unfolds.

Is Netflix the right investment for you?

Before taking the plunge, ponder this:

The Motley Fool Stock Advisor team has unearthed what they deem the “10 best stocks” for current investors to consider, with Netflix not making the cut. Could these 10 stocks proffer monumental returns in the foreseeable future?

Stock Advisor facilitates a roadmap to investment success, furnishing guidance on portfolio construction, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has eclipsed the S&P 500 returns threefold*.

*Stock Advisor returns as of February 26, 2024

Nick Rossolillo and his clients have positions in Netflix. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool upholds a disclosure policy.