The Dichotomy of Q1 Results

The Q1 results from the ‘Magnificent 7’ group members have brought about a tale of two cities: while Microsoft and Alphabet bask in investor confidence with their robust reports, Tesla and Meta face challenges that have left a few question marks hovering over their once-stellar performance.

Meta and the Metaverse Dilemma

Meta, once the high-flying star of the tech world, faced investors’ skepticism due to higher capital expenditure plans aimed at bolstering AI capabilities. The sharp contrast in reactions between Meta and its peers like Microsoft and Alphabet raises concerns about the legacy of past metaverse strategies and the need for aggressive spending to maintain AI leadership.

Tesla’s Troubles in the Automotive Arena

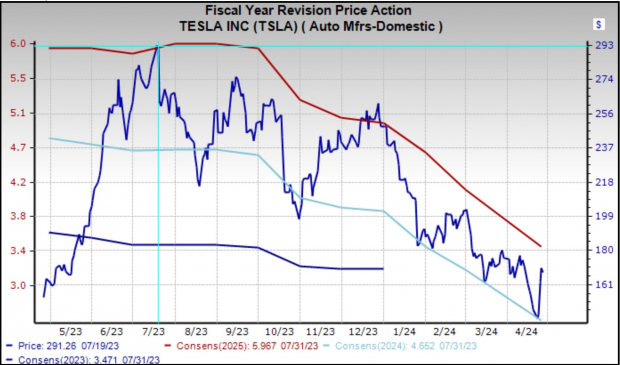

Tesla, the supposed golden child of the group, has fallen out of favor with investors due to a grim earnings outlook stemming from weakened demand and intensifying competition, forcing price cuts and eroding profitability. The charts indicate a downward spiral for the electric vehicle giant, sparking doubt about its place among the Mag 7 leaders.

Image Source: Zacks Investment Research

Despite these setbacks, Tesla managed to outperform the dismal expectations, albeit by a narrow margin. The market’s relief was palpable as the actual results didn’t plunge to the abyss where speculations had cast them.

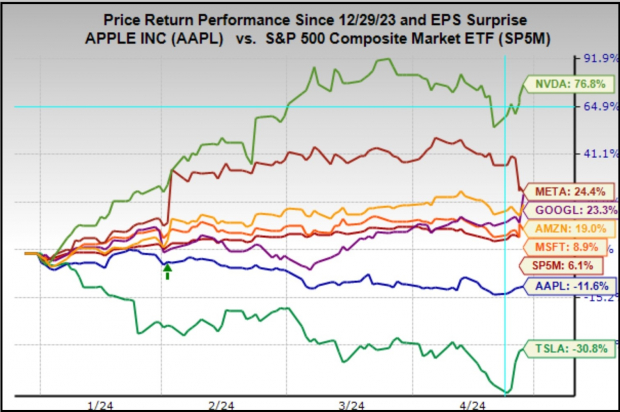

Tesla’s shares remain in the doldrums compared to its Mag 7 counterparts, portraying a challenging road ahead for the electric car pioneer.

Image Source: Zacks Investment Research

Market Dominance and Future Outlook

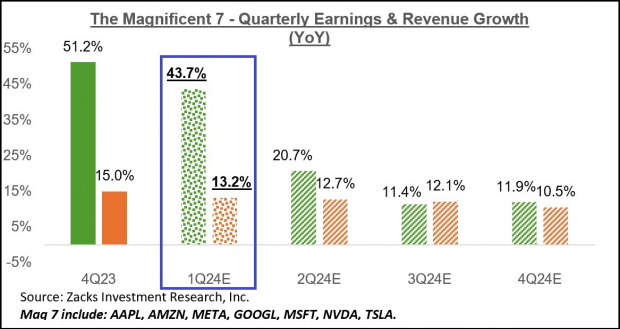

The Mag 7 group’s influence over the S&P 500 index is undeniable, accounting for a substantial market capitalization share. Projections suggest a continued earnings stronghold, with expectations of contributing a significant portion to the index’s overall earnings in the years ahead.

The solid financial performance and growth trajectory of these tech behemoths solidify their market leadership, underlining their crucial roles in shaping the tech sector landscape.

Looking beyond the Mag 7, the Technology sector is poised for a healthy Q1, with expectations of impressive earnings and revenue growth, a positive sign for the sector’s overall vitality.

Image Source: Zacks Investment Research

The forthcoming earnings reports from Apple, Amazon, and Nvidia, promising significant insights into the sector’s performance, add to the anticipation surrounding the ongoing earnings season.

The Q1 Earnings Landscape

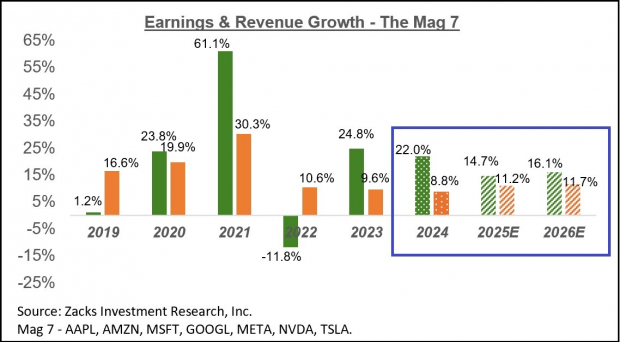

As the earnings season unfolds, Q1 reports present a mixed bag, with some surpassing expectations while others face challenges. The historical context provides a lens through which to view the current growth rates, shedding light on the trajectory of earnings and revenue performance.

Image Source: Zacks Investment Research

The essence of the Q1 earnings season, characterized by resilience in the face of challenges and the promise of growth, sets the stage for a dynamic period in the financial markets.

With a diverse array of companies showcasing their financial prowess, the market awaits the unfolding narrative that will shape investor sentiment and chart the course for the future.

Insight into the 2024 S&P 500 Earnings Forecast

The 2024 S&P 500 earnings forecast paints an intriguing picture ahead, with expectations set to rise by a commendable +8.3% coupled with a respectable +1.7% revenue growth. This projection ushers in a wave of anticipation and optimism for investors eyeing potential opportunities in the market.

A Glimpse into Historical Context

Reflecting on historical trends, the market has exhibited significant strength during presidential election years since 1950. This backdrop of positivity sets the stage for a compelling narrative for the upcoming quarters in the financial realm.

Highlighting Upcoming Trends

Turning our gaze to the forthcoming periods, the trajectory of market performance is poised to witness notable shifts and developments. With the anticipation of robust earnings on the horizon, investors have a ripe landscape to navigate through potential opportunities.

Navigating the Market Amidst Uncertainty

As uncertainties loom in the financial panorama, astute investors are tasked with navigating through a terrain rife with challenges and prospects. The fluctuating market dynamics demand a keen eye and strategic maneuvering to capitalize on emerging trends.

Fostering Informed Investment Decisions

Amidst the evolving market landscape, staying informed and agile is paramount for making informed investment decisions. By delving into comprehensive research and analysis, investors can equip themselves with the tools necessary to navigate the intricate web of financial opportunities.