Apple’s stellar performance in the second quarter, coupled with Amazon’s robust show, marked a week characterized by market enthusiasm post Fed Chair Jerome Powell’s reassuring comments on interest rates.

Apple managed to surpass earnings per share expectations for Q2, reporting a record high of $1.53 despite a slight decrease in sales compared to a year ago.

Q2 Financial Highlights

Apple’s revenue achievements in various countries propelled its Q2 EPS to a historic $1.53, outstripping analyst estimates and signaling a resilient performance despite economic flux.

Apple didn’t just meet but exceeded market expectations for five consecutive quarters, underlining its consistent growth trajectory and ability to surprise investors positively.

Image Source: Zacks Investment Research

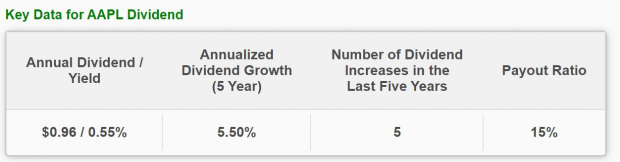

Dividend Increase & Stock Buybacks

Apple authorized further share repurchases of $110 billion, signaling confidence in its performance and commitment to shareholders. Moreover, the company hiked its dividend by 4% to $0.25 per share quarterly, with plans for continued increases.

Image Source: Zacks Investment Research

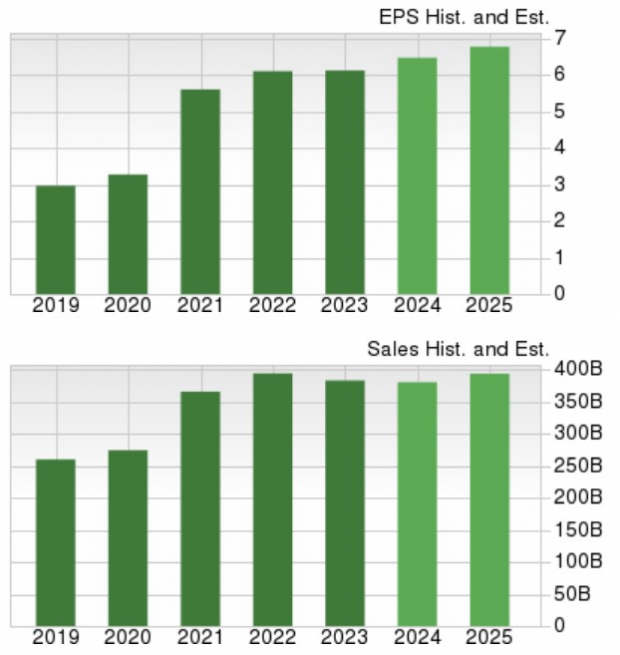

Growth Trajectory

Apple’s future looks promising, with expected annual earnings growth of 6% in fiscal 2024 and a further 8% in FY25. Although total sales might see a slight dip this year, projections indicate a 5% rise in FY25, reflecting steady upward momentum.

Image Source: Zacks Investment Research

Takeaway

Apple’s Zacks Rank #3 (Hold) signifies its resilience in navigating challenges and expanding market reach, despite ongoing concerns. Investors might find opportune moments ahead for buying into this tech giant’s growth story.

Highest Returns for Any Asset Class

It’s not even close. Bitcoin’s historical returns during presidential election years have surpassed all other assets: 2012 +272.4%, 2016 +161.1%, 2020 +302.8%. Anticipated surges suggest further growth potential.