With Walmart’s first quarterly results post its 3-1 stock split coming up on Thursday, May 16, all eyes are on WMT as investors anticipate the outcome.

As the retail landscape evolves, Walmart’s report will provide insight into current consumer shopping trends, particularly with Target’s TCG earnings on the horizon. Let’s delve into whether now presents an opportune moment to delve into Walmart’s stock as Q1 earnings draw near.

Anticipated Q1 Performance

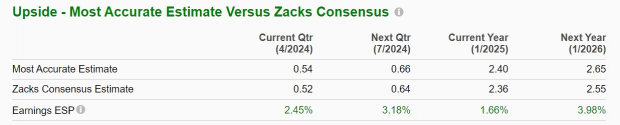

Estimates from Zacks project a 6% increase in Walmart’s Q1 earnings to $0.52 per share, with anticipated quarterly sales growth of 4% to $159.33 billion. Zacks ESP suggests the possibility of Walmart surpassing earnings projections, with the Most Accurate Estimate placing Q1 EPS at $0.54, 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

In the past four quarters, Walmart has outperformed bottom-line expectations in three instances, notably exceeding Q2 EPS estimates by 9% in February, reporting earnings of $0.60 per share against the Zacks Consensus of $0.55.

Image Source: Zacks Investment Research

Growth Trajectory & Future Outlook

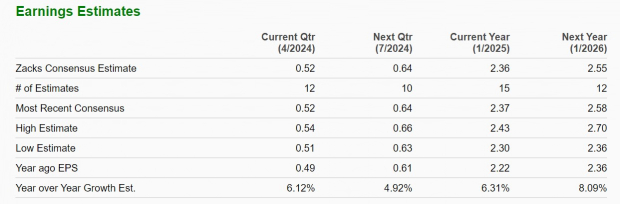

Predictions indicate a 6% uptick in Walmart’s annual earnings for fiscal 2025, with a further 8% increase expected in FY26, reaching $2.55 per share. Total sales are forecasted to climb 4% in FY25, with Walmart’s top line projected to expand another 4% in FY26 to $699.86 billion.

Image Source: Zacks Investment Research

Recent Performance & Valuation Analysis

Walmart’s ability to offer affordable solutions and act as a buffer against inflation has facilitated a commendable 18% climb in the past year. While this lags behind the S&P 500’s 26% rise, it surpasses Target’s 1% dip. Year-to-date, Walmart has soared 14%, outperforming both the benchmark index and Target.

Image Source: Zacks Investment Research

In terms of valuation, Walmart currently trades at 25.6X forward earnings, slightly above the S&P 500’s 21.9X but notably surpassing Target’s 17.1X. The forward P/S ratio for WMT stands at 0.7X, significantly below the ideal level of less than 1X and comparable to Target’s figure, while notably lower than the S&P 500’s 3.8X.

Image Source: Zacks Investment Research

Key Takeaway

As Walmart’s Q1 report looms, the stock holds a Zacks Rank #3 (Hold). Although its current valuation might suggest potential for enhanced buying opportunities ahead, long-term investors could continue to reap benefits from current levels.

Research Chief Names “Single Best Pick to Double”

Amidst thousands of stocks, 5 Zacks experts each highlight their top picks expected to surge by over 100% in the coming months. Director of Research Sheraz Mian hand-selects one standout with the most promising upside potential.

This particular company caters to millennial and Gen Z demographics, hauling in close to $1 billion in revenue last quarter alone. A recent price dip makes this an optimal moment to get on board. While not all Zacks selections hit the mark, this one could outshine previous Zacks’ high performers like Nano-X Imaging, which soared +129.6% in a little over 9 months.