Deciphering Wall Street Analyst Ratings

Investors often turn to Wall Street analysts for stock advice, hoping to capitalize on market trends. But do these recommendations truly hold weight?

Before exploring the reliability of brokerage endorsements, it’s prudent to dissect what the heavy hitters on Wall Street opine about Vital Farms (VITL).

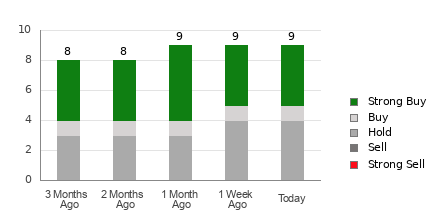

With an average brokerage recommendation (ABR) of 1.94, Vital Farms stands at the cusp between a Strong Buy and a Buy, based on inputs from nine brokerage firms. Of these, 44.4% lean towards Strong Buy, while 11.1% support a Buy rating.

Trends in Wall Street Recommendations for VITL

While the ABR may hint at a bullish outlook, prudence dictates not relying solely on this metric. Studies caution against using brokerage recommendations as a solitary guide for optimal stock picks.

The beneficial approach? Leverage this intel for cross-referencing your research or validating a proven market indicator, such as the Zacks Rank.

Unveiling the Essence of Zacks Rank

Distinct from ABR, the Zacks Rank employs a quantitative model hinged on predicting stock movements through earnings estimate revisions. This tool, graded from 1 (Strong Buy) to 5 (Strong Sell), attests to its market effectiveness.

Unlike ABR, where analysts’ biases can cloud judgment, the Zacks Rank hinges on concrete earnings projections. Research underscores the tangible link between earnings estimate revisions and stock price fluctuations.

Moreover, Zacks Rank’s timeliness stands out, swiftly adapting to evolving market dynamics while maintaining a balanced assessment across listed stocks.

Assessing Vital Farms’ Investment Potential

Vital Farms’ Zacks Consensus Estimate forecasts a 21.8% surge in earnings to $0.94 for the year. Resonating with analysts’ positive sentiment, this upbeat earnings outlook positions Vital Farms at a Zacks Rank #1 (Strong Buy).

As optimism swirls around the company’s earning projections, investors eye a promising trajectory in the stock movement.

On the brink of a potential upswing, Vital Farms remains an intriguing prospect in the market landscape, aligned with Zacks Rank’s bullish endorsement.